We Think Cint Group (STO:CINT) Can Easily Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Cint Group (STO:CINT) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Cint Group

How Long Is Cint Group's Cash Runway?

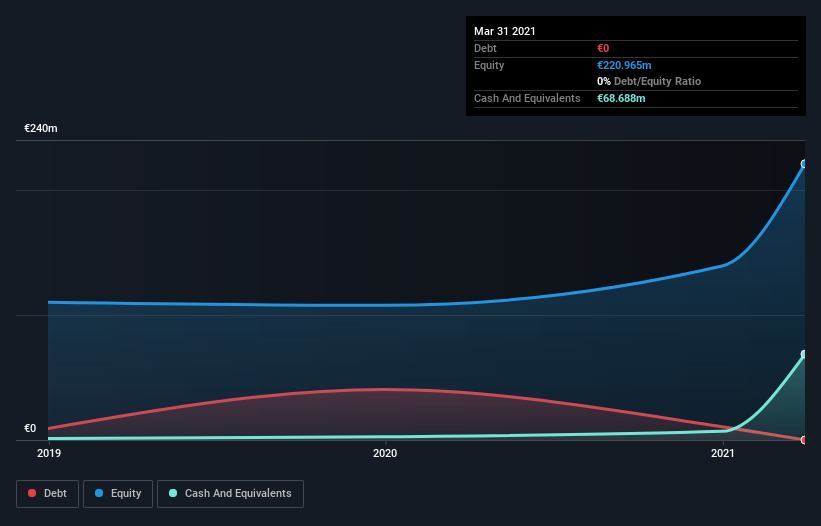

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In March 2021, Cint Group had €69m in cash, and was debt-free. In the last year, its cash burn was €2.7m. So it had a very long cash runway of many years from March 2021. Notably, however, analysts think that Cint Group will break even (at a free cash flow level) before then. If that happens, then the length of its cash runway, today, would become a moot point. The image below shows how its cash balance has been changing over the last few years.

How Well Is Cint Group Growing?

It was fairly positive to see that Cint Group reduced its cash burn by 47% during the last year. On top of that, operating revenue was up 46%, making for a heartening combination It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Cint Group Raise Cash?

We are certainly impressed with the progress Cint Group has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Cint Group has a market capitalisation of €1.3b and burnt through €2.7m last year, which is 0.2% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Cint Group's Cash Burn?

As you can probably tell by now, we're not too worried about Cint Group's cash burn. For example, we think its cash runway suggests that the company is on a good path. But it's fair to say that its cash burn reduction was also very reassuring. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. We think it's very important to consider the cash burn for loss making companies, but other considerations such as the amount the CEO is paid can also enhance your understanding of the business. You can click here to see what Cint Group's CEO gets paid each year.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Cint Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:CINT

Cint Group

Provides software solutions for digital insights and research technology worldwide.

Undervalued with excellent balance sheet.