As the pan-European STOXX Europe 600 Index recently ended a two-week losing streak with modest gains, driven by optimism around potential government spending increases, the European tech sector remains in focus amid ongoing trade tensions and central bank policy shifts. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and resilience to economic uncertainties, which can position them well for future opportunities in a fluctuating market landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| CD Projekt | 30.55% | 39.06% | ★★★★★★ |

| Xbrane Biopharma | 39.92% | 95.35% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Devyser Diagnostics | 26.50% | 94.65% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

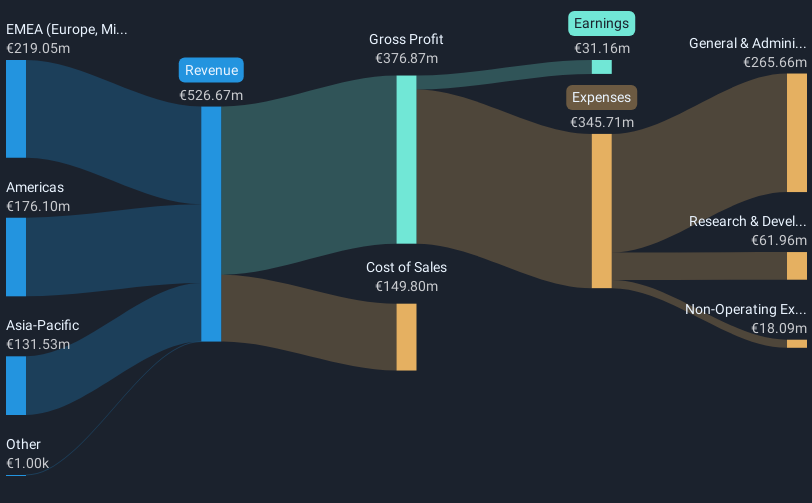

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture industries across Europe, the Americas, and the Asia Pacific with a market cap of approximately €1.05 billion.

Operations: The company generates revenue from its industrial intelligence solutions primarily across three regions: EMEA (€219.05 million), the Americas (€176.10 million), and Asia-Pacific (€131.53 million).

Lectra, a European tech firm, is navigating a complex landscape with mixed financial signals. Despite a modest annual revenue growth forecast at 6%, which slightly edges out the French market's 5.9%, its earnings are set to surge by an impressive 23.1% annually, outpacing the local market average of 13%. This growth is underpinned by substantial R&D investments aimed at innovation and maintaining competitive edge in digital cutting technologies—a sector where Lectra has carved out a significant niche. Recent strategic moves include proposing an increased dividend of €0.40 per share and projecting revenues between €550 million to €600 million for 2025, signaling confidence in future performance despite past earnings fluctuations and boardroom shake-ups which saw changes following leadership disputes. These elements position Lectra as a resilient player amidst evolving industry dynamics, though it operates in an increasingly competitive environment where staying ahead requires constant technological advancements and strategic foresight.

- Navigate through the intricacies of Lectra with our comprehensive health report here.

Understand Lectra's track record by examining our Past report.

Cint Group (OM:CINT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cint Group AB (publ) offers software solutions for digital insights and research technology on a global scale, with a market capitalization of SEK2.68 billion.

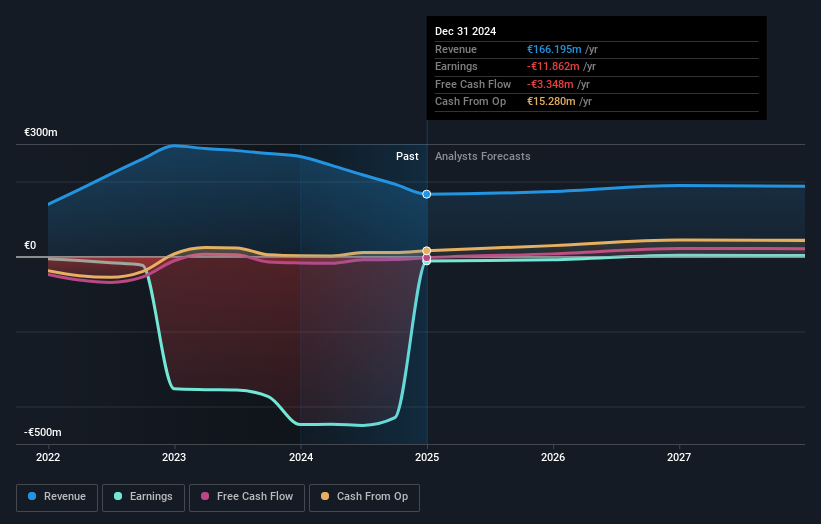

Operations: Cint Group generates revenue primarily through its Cint Exchange and Media Measurement segments, contributing €116.82 million and €49.37 million respectively. The company's focus is on providing digital insights and research technology solutions worldwide.

Cint Group, amidst a transformative period, recently completed a substantial follow-on equity offering of SEK 584 million, underscoring its strategic initiatives to stabilize and expand. Despite a challenging past with significant net losses—EUR 11.86 million in the last year—the company has pivoted towards profitability with an impressive forecasted annual earnings growth of 107.65%. This turnaround is supported by an R&D focus that aligns with industry demands for innovative software solutions, positioning Cint to potentially outperform the modest Swedish market revenue growth expectation of 0.8% per year. The recent recovery in net income from a heavy loss reflects effective management strategies and operational adjustments, setting a foundation for future growth in the competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Cint Group.

Assess Cint Group's past performance with our detailed historical performance reports.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

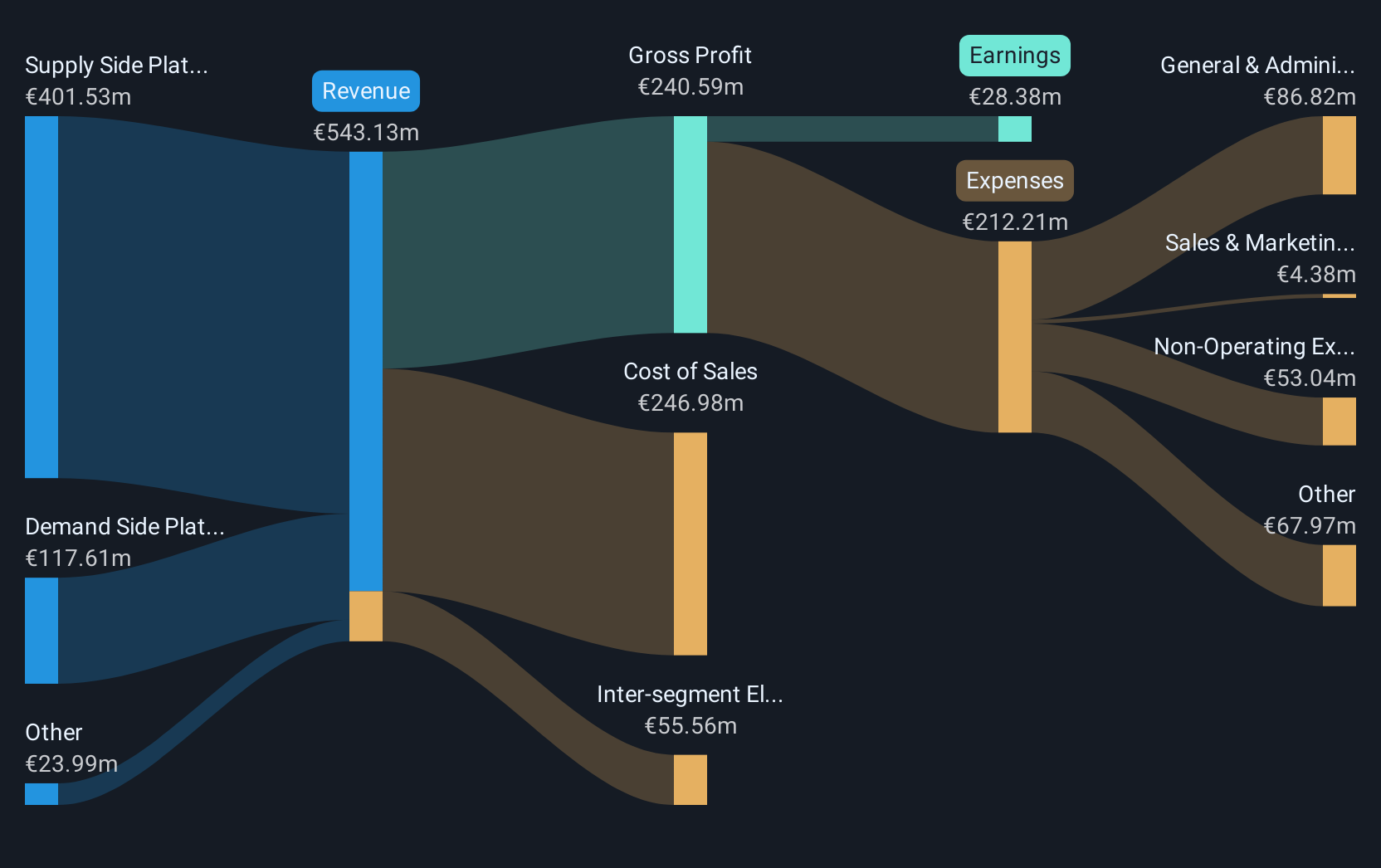

Overview: Verve Group SE operates a software platform facilitating the automated buying and selling of digital advertising space across North America and Europe, with a market capitalization of €638.24 million.

Operations: The company generates revenue primarily through its Demand Side Platforms (DSP) and Supply Side Platforms (SSP), with SSP contributing significantly more at €390.27 million compared to DSP's €100.55 million.

Verve Group SE, amidst a dynamic advertising market in the U.S., forecasts significant double-digit organic growth for 2025, bolstered by its innovative ID-less solutions. The company's recent financials underscore this trajectory; Q4 sales surged to EUR 150.06 million from EUR 104.7 million year-over-year, with annual sales climbing to EUR 461.94 million from EUR 347.94 million. Despite a dip in annual net income to EUR 28.8 million from EUR 46.73 million, the robust sales growth and strategic focus on emerging tech trends suggest strong future prospects in high-growth sectors.

- Click here to discover the nuances of Verve Group with our detailed analytical health report.

Explore historical data to track Verve Group's performance over time in our Past section.

Make It Happen

- Access the full spectrum of 243 European High Growth Tech and AI Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Verve Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:M8G

Verve Group

A digital media company, engages in the provision of ad-software solutions in North America and Europe.

Moderate and good value.

Similar Companies

Market Insights

Community Narratives