Is Crunchfish (STO:CFISH) In A Good Position To Invest In Growth?

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Crunchfish (STO:CFISH) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Crunchfish

When Might Crunchfish Run Out Of Money?

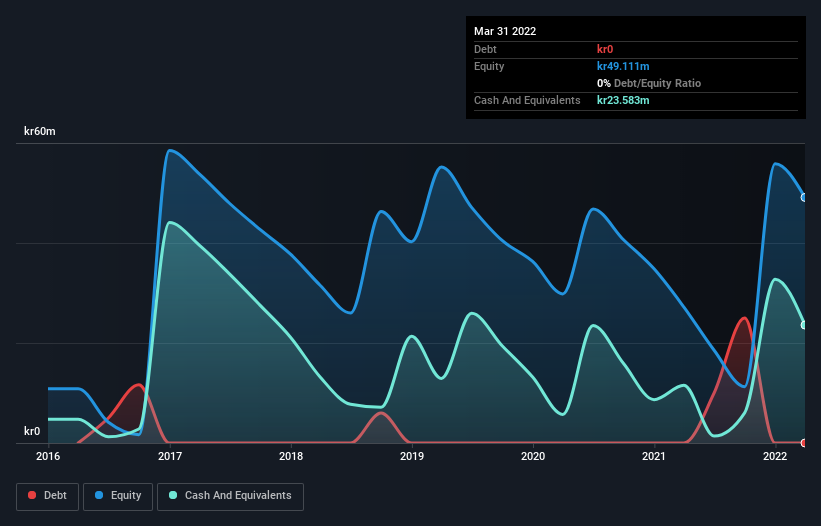

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In March 2022, Crunchfish had kr24m in cash, and was debt-free. In the last year, its cash burn was kr37m. Therefore, from March 2022 it had roughly 8 months of cash runway. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. You can see how its cash balance has changed over time in the image below.

How Well Is Crunchfish Growing?

Crunchfish boosted investment sharply in the last year, with cash burn ramping by 61%. While that's concerning on it's own, the fact that operating revenue was actually down 21% over the same period makes us positively tremulous. Considering both these metrics, we're a little concerned about how the company is developing. In reality, this article only makes a short study of the company's growth data. You can take a look at how Crunchfish has developed its business over time by checking this visualization of its revenue and earnings history.

Can Crunchfish Raise More Cash Easily?

Crunchfish revenue is declining and its cash burn is increasing, so many may be considering its need to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Crunchfish has a market capitalisation of kr433m and burnt through kr37m last year, which is 8.5% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Crunchfish's Cash Burn?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Crunchfish's cash burn relative to its market cap was relatively promising. Summing up, we think the Crunchfish's cash burn is a risk, based on the factors we mentioned in this article. On another note, Crunchfish has 6 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Of course Crunchfish may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CFISH

Medium-low risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026