Is Now The Time To Put Addnode Group (STO:ANOD B) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Addnode Group (STO:ANOD B). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Addnode Group

How Quickly Is Addnode Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Addnode Group managed to grow EPS by 12% per year, over three years. That's a good rate of growth, if it can be sustained.

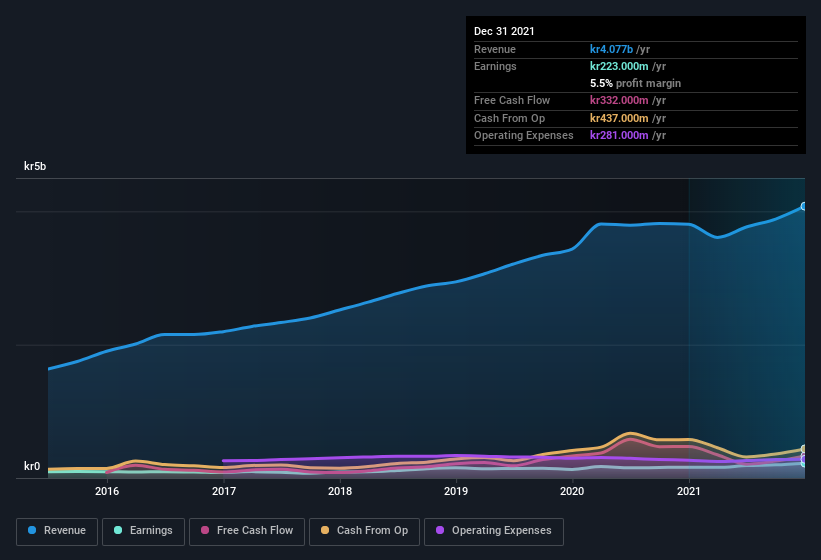

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Addnode Group maintained stable EBIT margins over the last year, all while growing revenue 7.1% to kr4.1b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Addnode Group's balance sheet strength, before getting too excited.

Are Addnode Group Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Addnode Group shares worth a considerable sum. Indeed, they hold kr235m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 1.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between kr9.5b and kr30b, like Addnode Group, the median CEO pay is around kr6.3m.

Addnode Group offered total compensation worth kr5.3m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Addnode Group Worth Keeping An Eye On?

One important encouraging feature of Addnode Group is that it is growing profits. Earnings growth might be the main game for Addnode Group, but the fun does not stop there. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Addnode Group shapes up to industry peers, when it comes to ROE.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ANOD B

Addnode Group

Offers software and services for the design, construction, product data information, project collaboration, and facility management in Sweden, Nordic countries, the United States, the United Kingdom, Germany, and internationally.

Solid track record with adequate balance sheet.