As global markets navigate a period of mixed economic signals, with U.S. consumer confidence dipping and European stocks showing modest gains, investors are keenly observing how these developments might influence their portfolios. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams; they can be particularly appealing in times of market uncertainty when consistent returns are valued.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) offers solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK5.29 billion.

Operations: The revenue segment for ITAB Shop Concept AB (publ) is primarily derived from Furniture & Fixtures, totaling SEK6.42 billion.

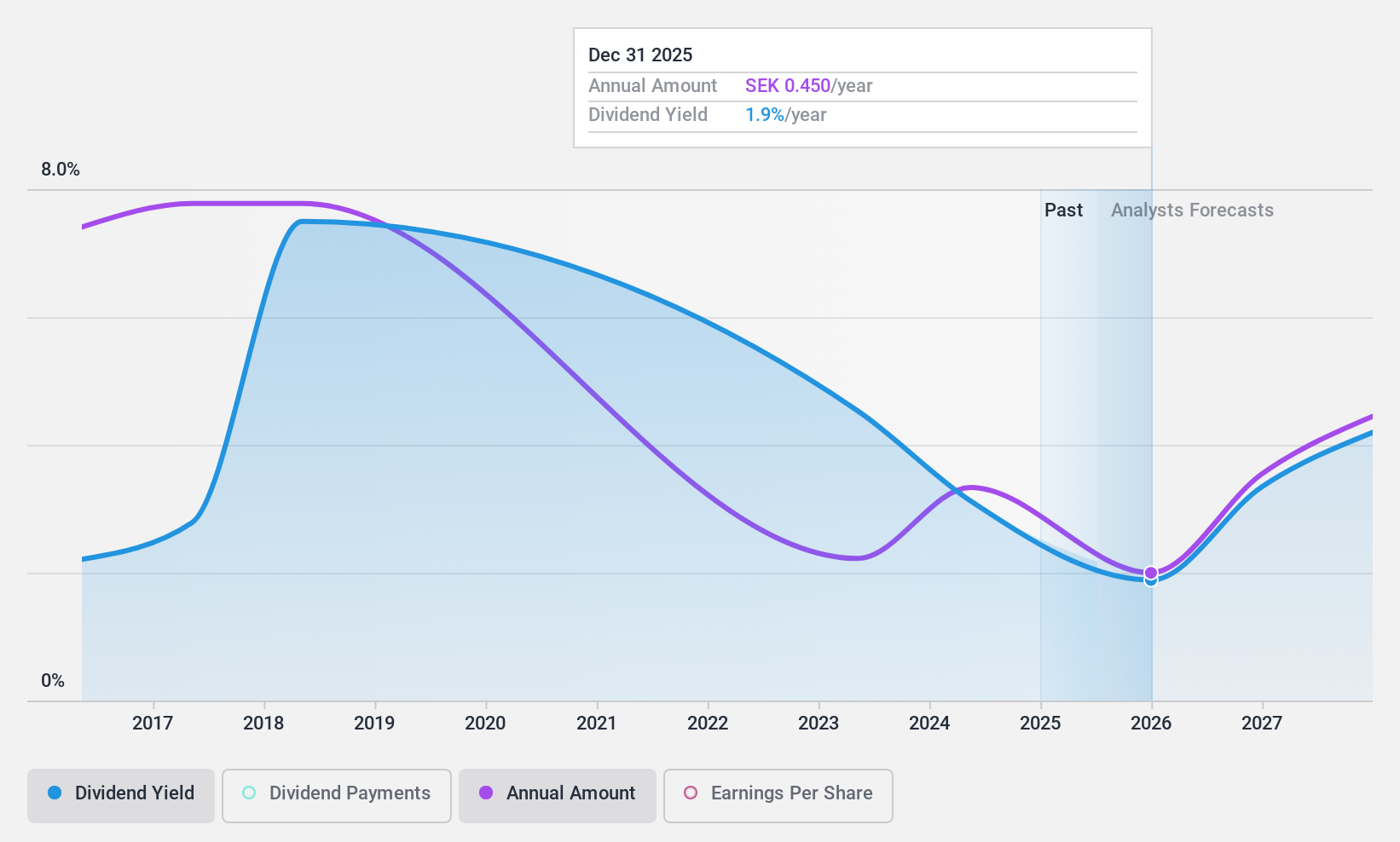

Dividend Yield: 3.5%

ITAB Shop Concept's dividend payments are well covered by earnings and cash flows, with payout ratios of 46.4% and 39.2%, respectively. However, the dividend yield of 3.47% is below the top tier in Sweden, and its track record has been volatile over the past decade. Recent earnings showed net income growth for nine months but a decline in Q3 compared to last year, highlighting potential concerns about stability despite overall profit growth.

- Click to explore a detailed breakdown of our findings in ITAB Shop Concept's dividend report.

- The valuation report we've compiled suggests that ITAB Shop Concept's current price could be quite moderate.

New Wave Group (OM:NEWA B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB (publ) is involved in designing, acquiring, and developing brands and products across corporate, sports, gifts, and home furnishings sectors in various regions including Sweden, the United States, Central Europe, Nordic countries, Southern Europe and internationally with a market cap of SEK12.89 billion.

Operations: New Wave Group AB generates revenue from its segments with SEK4.64 billion from Corporate, SEK3.92 billion from Sports & Leisure, and SEK874.90 million from Gifts & Home Furnishings.

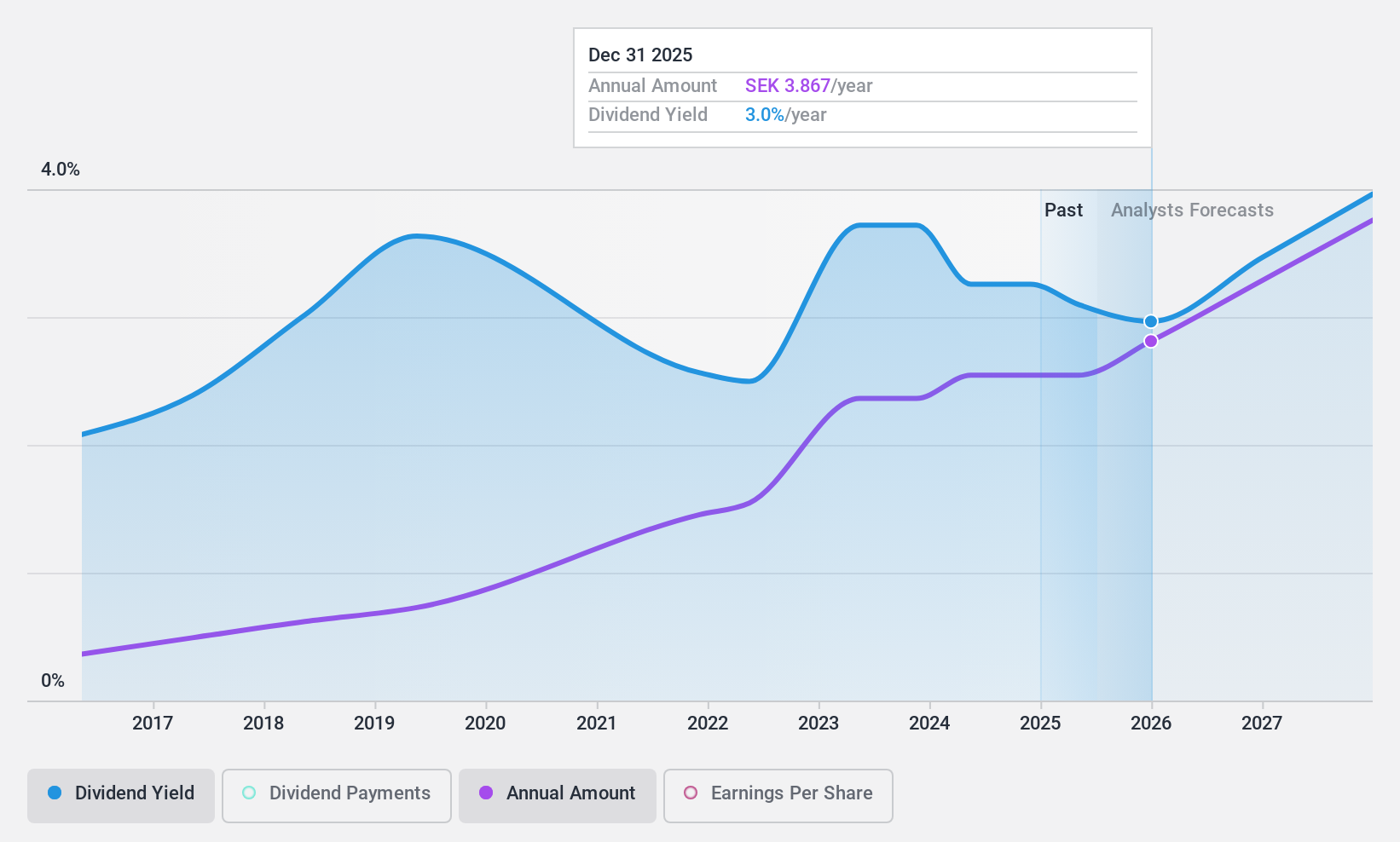

Dividend Yield: 3.5%

New Wave Group's dividends are sustainably covered by earnings and cash flows, with payout ratios of 51.5% and 36.2%, respectively, yet the yield of 3.53% is below Sweden's top tier. Despite a decade of growth, dividend reliability remains an issue due to volatility and recent insider selling raises concerns. Q3 earnings showed decreased net income (SEK 204.2 million) compared to last year, reflecting potential challenges in maintaining stable payouts amidst executive changes.

- Click here and access our complete dividend analysis report to understand the dynamics of New Wave Group.

- In light of our recent valuation report, it seems possible that New Wave Group is trading behind its estimated value.

Schloss Wachenheim (XTRA:SWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG is a company that produces and distributes sparkling and semi-sparkling wine products in Europe and internationally, with a market cap of €112.46 million.

Operations: Schloss Wachenheim AG generates revenue primarily from its Alcoholic Beverages segment, amounting to €441.21 million.

Dividend Yield: 4.1%

Schloss Wachenheim's dividend, yielding 4.08%, is lower than Germany's top tier and not well supported by free cash flow, with a high cash payout ratio of 106.6%. Despite stable and growing dividends over the past decade, recent earnings show a decline in net income to €0.634 million for Q1 2024 from €2.77 million last year, raising concerns about sustainability amidst trading significantly below fair value estimates.

- Delve into the full analysis dividend report here for a deeper understanding of Schloss Wachenheim.

- Our expertly prepared valuation report Schloss Wachenheim implies its share price may be lower than expected.

Key Takeaways

- Navigate through the entire inventory of 1958 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Wave Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEWA B

New Wave Group

Designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors in Sweden, the United States, Central Europe, rest of Nordiac countries, Southern Europe, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives