Addnode Group (STO:ANOD B) Might Be Having Difficulty Using Its Capital Effectively

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after briefly looking over the numbers, we don't think Addnode Group (STO:ANOD B) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Addnode Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = kr506m ÷ (kr8.1b - kr3.8b) (Based on the trailing twelve months to June 2024).

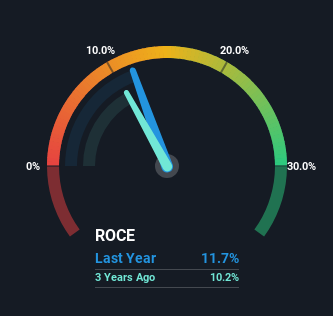

Thus, Addnode Group has an ROCE of 12%. In absolute terms, that's a pretty normal return, and it's somewhat close to the IT industry average of 13%.

View our latest analysis for Addnode Group

In the above chart we have measured Addnode Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Addnode Group .

How Are Returns Trending?

When we looked at the ROCE trend at Addnode Group, we didn't gain much confidence. Around five years ago the returns on capital were 15%, but since then they've fallen to 12%. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. If these investments prove successful, this can bode very well for long term stock performance.

Another thing to note, Addnode Group has a high ratio of current liabilities to total assets of 47%. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

Our Take On Addnode Group's ROCE

In summary, despite lower returns in the short term, we're encouraged to see that Addnode Group is reinvesting for growth and has higher sales as a result. And the stock has done incredibly well with a 195% return over the last five years, so long term investors are no doubt ecstatic with that result. So while the underlying trends could already be accounted for by investors, we still think this stock is worth looking into further.

If you'd like to know about the risks facing Addnode Group, we've discovered 1 warning sign that you should be aware of.

While Addnode Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ANOD B

Addnode Group

Offers software and services for the design, construction, product data information, project collaboration, and facility management in Sweden, Nordic countries, the United States, the United Kingdom, Germany, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Kratos Defense & Security Solutions (KTOS): Scaling "Attritable" Dominance in a New Era of Aerial Conflict.

BWX Technologies (BWXT): Powering the Nuclear Renaissance from Naval Depths to Medical Frontiers.

Merck & Co. (MRK): Scaling the "Post-Keytruda Hill" Through Diversified Blockbusters.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks