Positive Sentiment Still Eludes Time People Group AB (publ) (NGM:TPGR) Following 33% Share Price Slump

Time People Group AB (publ) (NGM:TPGR) shares have had a horrible month, losing 33% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

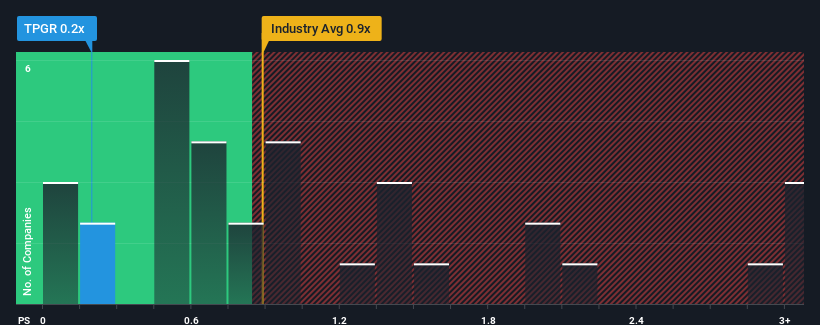

Since its price has dipped substantially, it would be understandable if you think Time People Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Sweden's IT industry have P/S ratios above 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Time People Group

How Has Time People Group Performed Recently?

As an illustration, revenue has deteriorated at Time People Group over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Time People Group's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Time People Group?

The only time you'd be truly comfortable seeing a P/S as low as Time People Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. Regardless, revenue has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 5.6% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Time People Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Time People Group's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Upon analysing the past data, we see it is unexpected that Time People Group is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Before you take the next step, you should know about the 4 warning signs for Time People Group that we have uncovered.

If these risks are making you reconsider your opinion on Time People Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Time People Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:TPGR

Time People Group

Provides consulting services in IT and change management in Sweden.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026