The Solidx AB (publ) (NGM:SOLIDX) share price has fared very poorly over the last month, falling by a substantial 34%. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

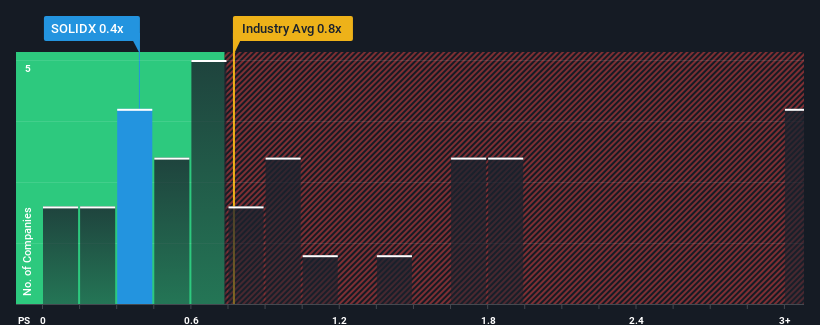

Even after such a large drop in price, it's still not a stretch to say that Solidx's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the IT industry in Sweden, where the median P/S ratio is around 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Solidx

What Does Solidx's Recent Performance Look Like?

Recent times have been quite advantageous for Solidx as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Solidx's earnings, revenue and cash flow.How Is Solidx's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Solidx's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. The strong recent performance means it was also able to grow revenue by 180% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to decline by 7.7% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's peculiar that Solidx's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From Solidx's P/S?

Solidx's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Solidx revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

Before you settle on your opinion, we've discovered 3 warning signs for Solidx that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:SOLIDX

Low and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)