Only Four Days Left To Cash In On Nodebis Applications' (NGM:NODE) Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Nodebis Applications AB (publ) (NGM:NODE) is about to go ex-dividend in just four days. Typically, the ex-dividend date is two business days before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. This means that investors who purchase Nodebis Applications' shares on or after the 21st of May will not receive the dividend, which will be paid on the 23rd of May.

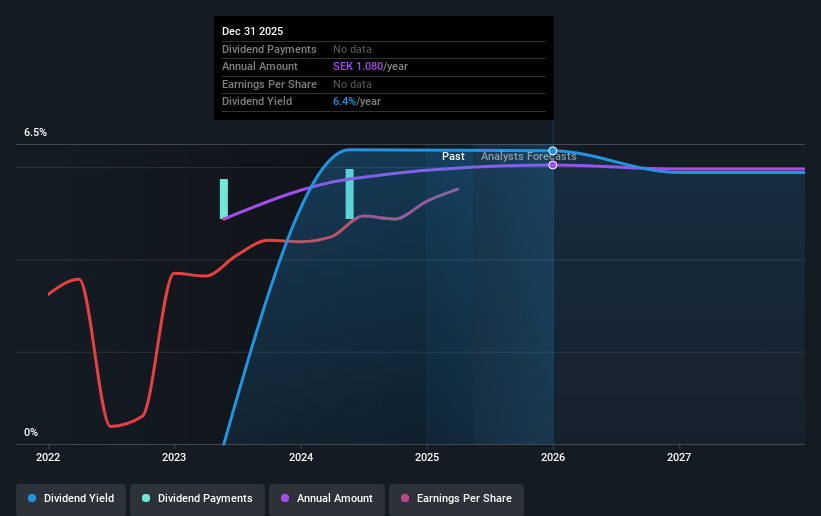

The company's upcoming dividend is kr01.00 a share, following on from the last 12 months, when the company distributed a total of kr1.00 per share to shareholders. Last year's total dividend payments show that Nodebis Applications has a trailing yield of 5.9% on the current share price of kr017.00. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Nodebis Applications can afford its dividend, and if the dividend could grow.

Our free stock report includes 4 warning signs investors should be aware of before investing in Nodebis Applications. Read for free now.Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Nodebis Applications paid out 168% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year it paid out 60% of its free cash flow as dividends, within the usual range for most companies.

It's good to see that while Nodebis Applications's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

View our latest analysis for Nodebis Applications

Click here to see how much of its profit Nodebis Applications paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That's why it's comforting to see Nodebis Applications's earnings have been skyrocketing, up 89% per annum for the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Nodebis Applications has delivered 12% dividend growth per year on average over the past two years. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

The Bottom Line

From a dividend perspective, should investors buy or avoid Nodebis Applications? Growing earnings per share and a normal cashflow payout ratio is an ok combination, but we're concerned that the company is paying out such a high percentage of its income as dividends. In summary, while it has some positive characteristics, we're not inclined to race out and buy Nodebis Applications today.

However if you're still interested in Nodebis Applications as a potential investment, you should definitely consider some of the risks involved with Nodebis Applications. Case in point: We've spotted 4 warning signs for Nodebis Applications you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Nodebis Applications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:NODE

Nodebis Applications

Provides digital support services in Sweden and the Nordic region.

Slight and fair value.

Market Insights

Community Narratives