Even though InfraCom Group (NGM:INFRA) has lost kr80m market cap in last 7 days, shareholders are still up 122% over 5 years

The InfraCom Group AB (publ) (NGM:INFRA) share price has had a bad week, falling 10%. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 106% the gain in that time. To some, the recent pullback wouldn't be surprising after such a fast rise. Of course, that doesn't necessarily mean it's cheap now. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 47% decline over the last twelve months.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

View our latest analysis for InfraCom Group

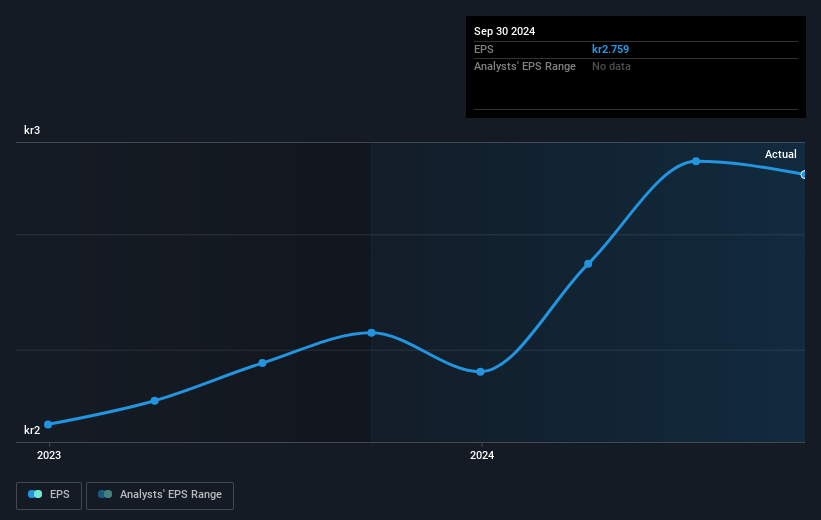

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, InfraCom Group became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that InfraCom Group has improved its bottom line lately, but is it going to grow revenue? Check if analysts think InfraCom Group will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for InfraCom Group the TSR over the last 5 years was 122%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 16% in the last year, InfraCom Group shareholders lost 46% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand InfraCom Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with InfraCom Group , and understanding them should be part of your investment process.

But note: InfraCom Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:INFRA

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives