Investors Who Bought Eyeonid Group (NGM:EOID) Shares Three Years Ago Are Now Down 67%

Eyeonid Group AB (publ) (NGM:EOID) shareholders are doubtless heartened to see the share price bounce 31% in just one week. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 67% in the last three years. So the improvement may be a real relief to some. While many would remain nervous, there could be further gains if the business can put its best foot forward.

View our latest analysis for Eyeonid Group

Given that Eyeonid Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Eyeonid Group grew revenue at 65% per year. That's well above most other pre-profit companies. In contrast, the share price is down 31% compound, over three years - disappointing by most standards. This could mean hype has come out of the stock because the losses are concerning investors. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

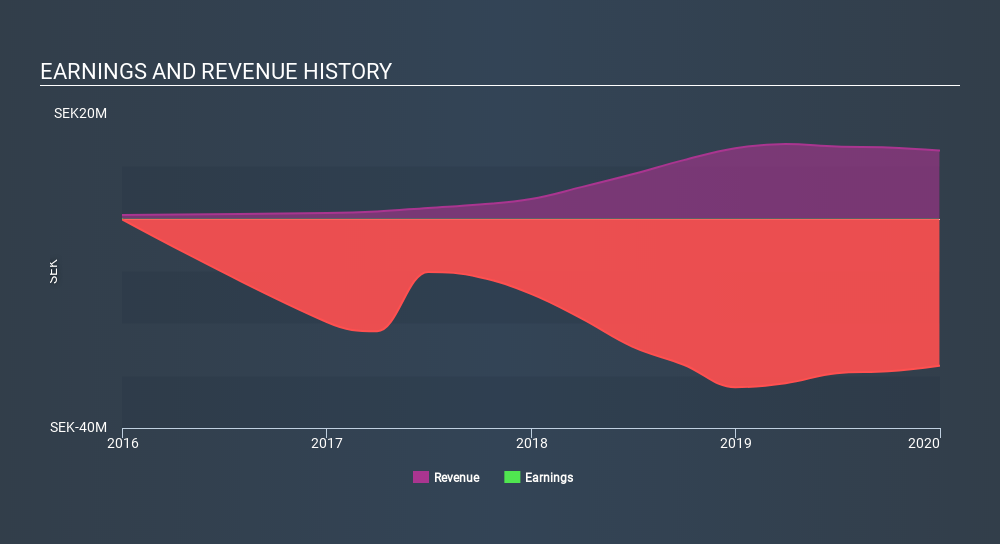

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Eyeonid Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Eyeonid Group shares, which performed worse than the market, costing holders 66%. The market shed around 11%, no doubt weighing on the stock price. Shareholders have lost 31% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 7 warning signs with Eyeonid Group (at least 4 which are potentially serious) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NGM:EYEW

Eye World

Develops software-as-a-service platform that offers identity protection solutions in Sweden and internationally.

Moderate with adequate balance sheet.

Market Insights

Community Narratives