- Sweden

- /

- Retail Distributors

- /

- OM:ZZ B

If EPS Growth Is Important To You, Zinzino (STO:ZZ B) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Zinzino (STO:ZZ B). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Zinzino with the means to add long-term value to shareholders.

See our latest analysis for Zinzino

How Fast Is Zinzino Growing Its Earnings Per Share?

Zinzino has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Zinzino has grown its trailing twelve month EPS from kr2.16 to kr2.33, in the last year. That's a fair increase of 8.0%.

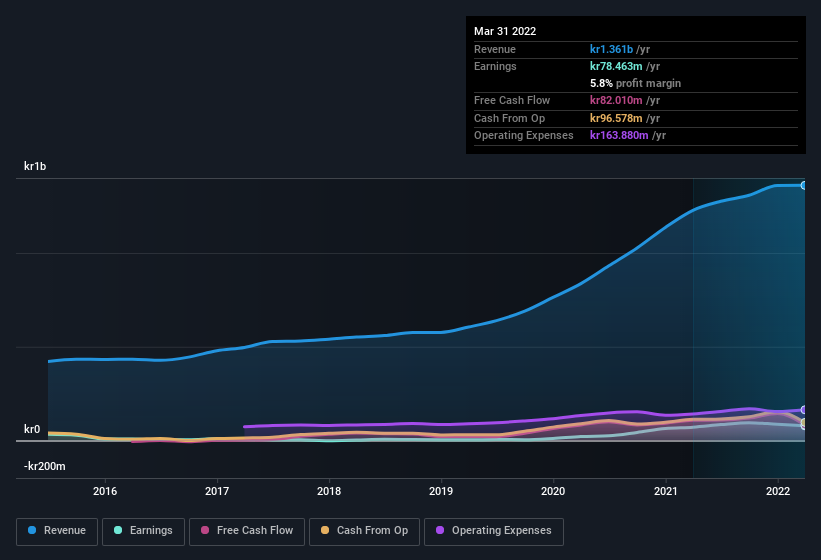

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Zinzino's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Zinzino maintained stable EBIT margins over the last year, all while growing revenue 11% to kr1.4b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Zinzino is no giant, with a market capitalisation of kr1.1b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Zinzino Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Zinzino insiders own a significant number of shares certainly is appealing. In fact, they own 46% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have kr523m invested in the business, at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Zinzino Worth Keeping An Eye On?

One positive for Zinzino is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. Even so, be aware that Zinzino is showing 2 warning signs in our investment analysis , you should know about...

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zinzino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ZZ B

Zinzino

A direct sales company, provides dietary supplements and skincare products in Sweden and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives