It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Zinzino (STO:ZZ B). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Zinzino

Zinzino's Improving Profits

In the last three years Zinzino's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Zinzino's EPS shot up from kr2.33 to kr3.20; a result that's bound to keep shareholders happy. That's a fantastic gain of 37%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Zinzino's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Zinzino shareholders can take confidence from the fact that EBIT margins are up from 6.1% to 8.5%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

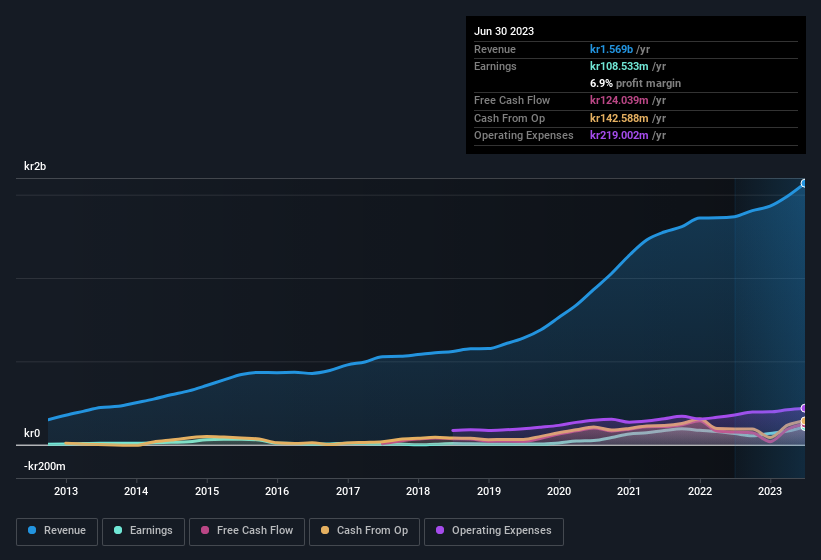

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Zinzino isn't a huge company, given its market capitalisation of kr1.4b. That makes it extra important to check on its balance sheet strength.

Are Zinzino Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the last 12 months Zinzino insiders spent kr1.7m more buying shares than they received from selling them. On balance, that's a good sign. We also note that it was the company insider, Örjan Saele, who made the biggest single acquisition, paying kr1.2m for shares at about kr42.50 each.

The good news, alongside the insider buying, for Zinzino bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have kr399m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 28% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Zinzino Deserve A Spot On Your Watchlist?

For growth investors, Zinzino's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. Astute investors will want to keep this stock on watch. However, before you get too excited we've discovered 1 warning sign for Zinzino that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Zinzino isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zinzino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ZZ B

Zinzino

A direct sales company, provides dietary supplements and skincare products in Sweden and internationally.

Flawless balance sheet established dividend payer.