- Sweden

- /

- Commercial Services

- /

- OM:ITAB

Undiscovered Gems in Sweden for October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising oil prices and geopolitical tensions, European indices have experienced notable declines, with the pan-European STOXX Europe 600 Index ending 1.80% lower amid cautious investor sentiment. In this environment, small-cap stocks in Sweden may present intriguing opportunities for investors seeking to uncover potential growth stories that align with resilient economic indicators and sectoral strengths. Identifying a good stock often involves looking for companies that demonstrate strong fundamentals and adaptability in challenging market conditions, making them well-positioned to capitalize on emerging trends despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Cloetta (OM:CLA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cloetta AB (publ) is a confectionery company with a market capitalization of approximately SEK7.20 billion.

Operations: Cloetta generates revenue primarily from packaged branded goods, amounting to SEK6.24 billion, and candy not packed in small bags, contributing SEK2.22 billion.

Cloetta, a notable player in Sweden's confectionery sector, has seen its debt to equity ratio improve from 69.4% to 45.9% over five years, indicating stronger financial health. The company reported a net income of SEK 82 million for Q2 2024, up from SEK 73 million the previous year. Earnings per share rose to SEK 0.29 from SEK 0.26 year-on-year. Despite insider selling and halted greenfield investments due to energy supply risks, Cloetta maintains robust earnings growth at nearly double the industry rate over the past year (29.8%).

- Click here and access our complete health analysis report to understand the dynamics of Cloetta.

Gain insights into Cloetta's past trends and performance with our Past report.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Value Rating: ★★★★★★

Overview: ITAB Shop Concept AB (publ) specializes in delivering solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of approximately SEK7.17 billion.

Operations: The primary revenue stream for ITAB Shop Concept AB comes from its Furniture & Fixtures segment, generating SEK6.39 billion.

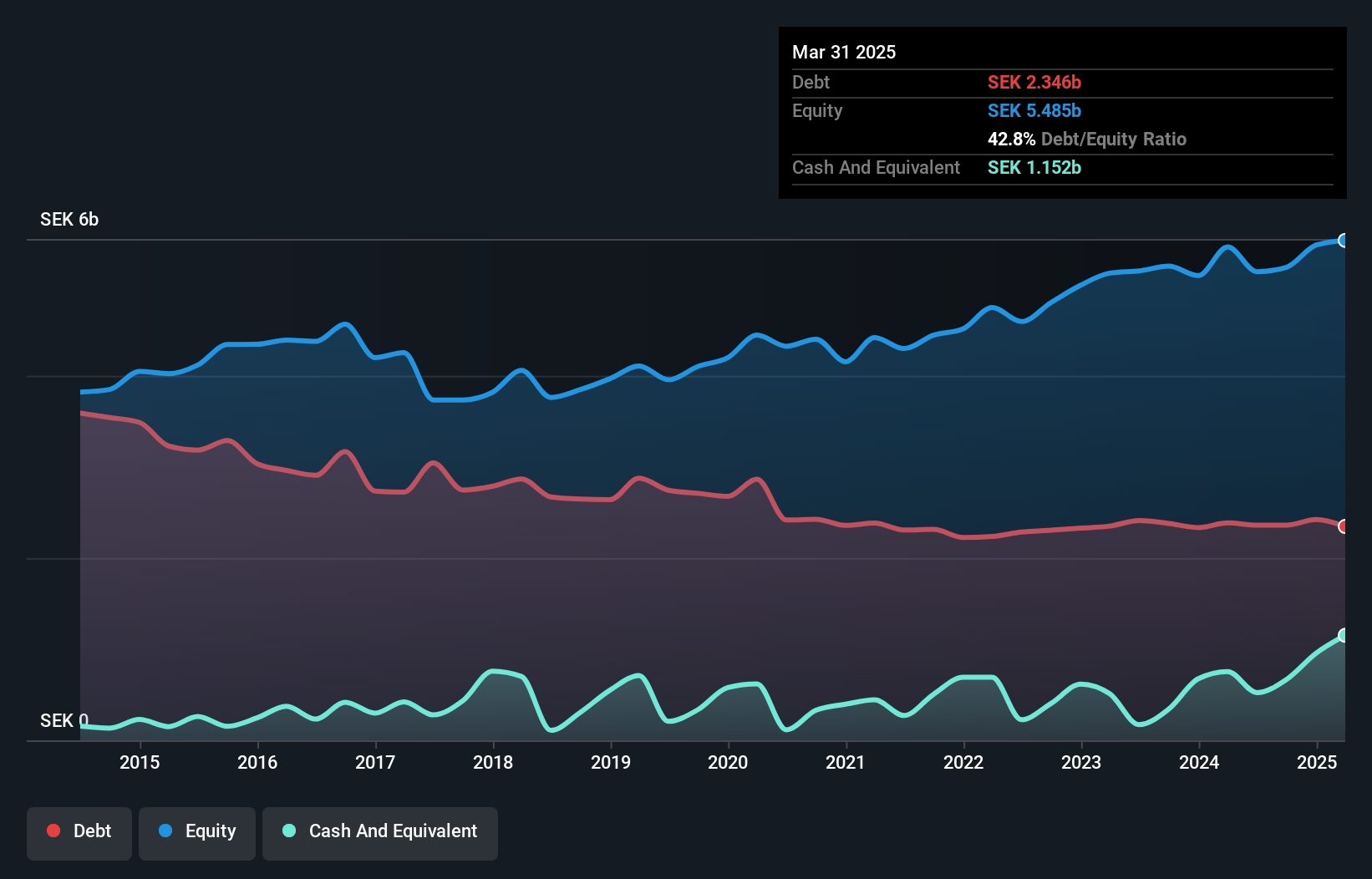

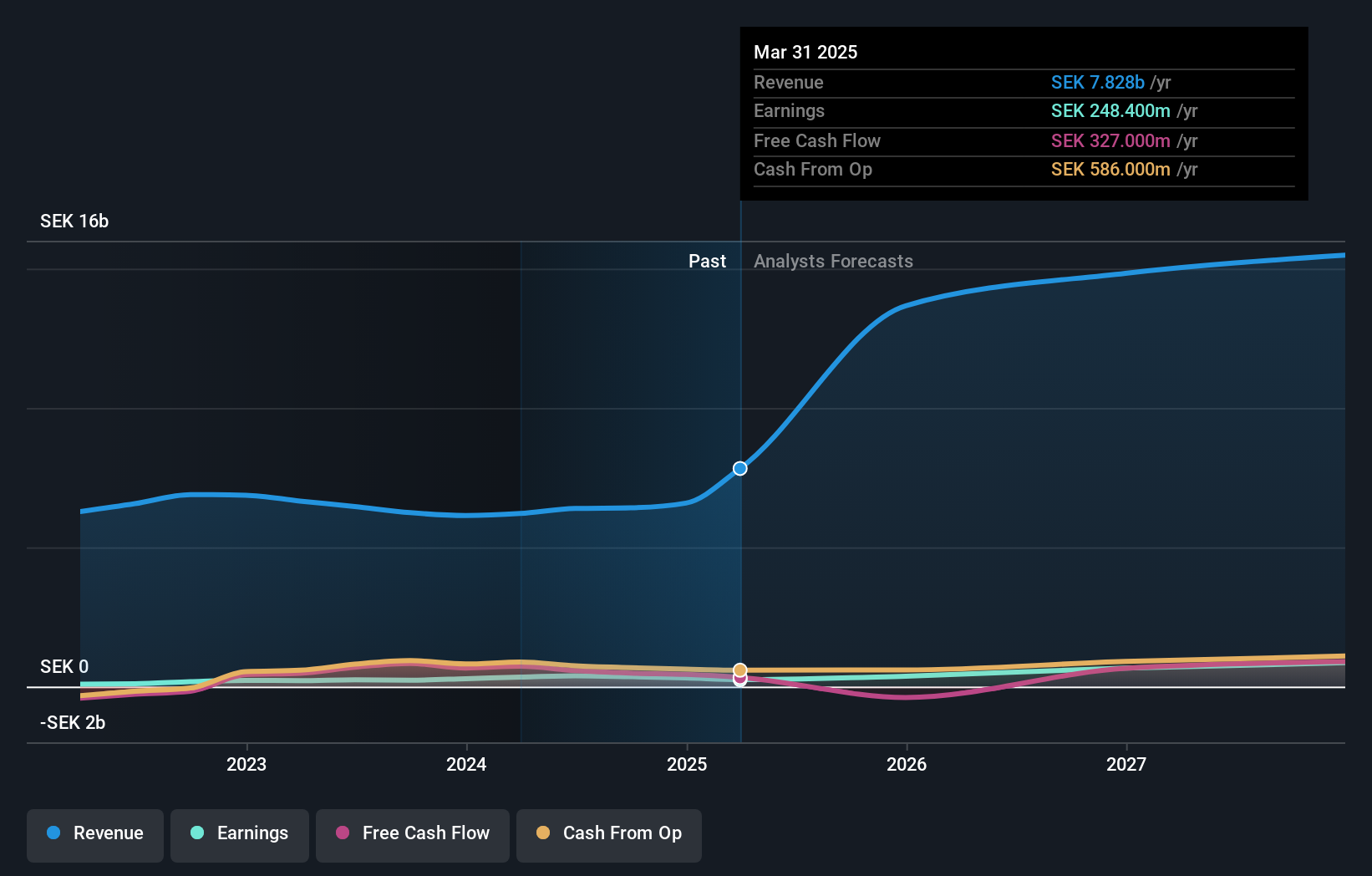

ITAB's recent performance highlights its potential as a promising player in the industry. With earnings growth of 56.7% over the past year, it has outpaced the commercial services sector's -2%. Trading at 9.4% below fair value and reducing its debt to equity ratio from 137.6% to 20% over five years, ITAB shows financial prudence. Recent framework agreements worth EUR 42 million further bolster its market presence across Europe and the UK, indicating robust strategic partnerships.

- Delve into the full analysis health report here for a deeper understanding of ITAB Shop Concept.

Evaluate ITAB Shop Concept's historical performance by accessing our past performance report.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK11.93 billion.

Operations: Rusta generates revenue primarily from its operations in Sweden, Norway, and other markets, with Sweden contributing SEK6.43 billion and Norway SEK2.39 billion.

Rusta, a prominent player in the retail sector, has been making waves with its robust earnings growth of 47.5% over the past year, outpacing the industry average. Trading at 70.3% below estimated fair value, Rusta seems to offer significant investment potential. Recent expansions include new stores in Sweden and Norway, bringing their total to 217 locations. The company reported Q1 sales of SEK 3 billion and net income of SEK 231 million, reflecting solid financial health and strategic growth initiatives.

- Take a closer look at Rusta's potential here in our health report.

Assess Rusta's past performance with our detailed historical performance reports.

Where To Now?

- Access the full spectrum of 55 Swedish Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ITAB

ITAB Shop Concept

Develops, manufactures, sells, and installs store concepts for retail chain stores.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives