- Sweden

- /

- Metals and Mining

- /

- OM:GRNG

Exploring Gränges And 2 Other Undiscovered Swedish Gems

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and economic uncertainties, the Swedish market remains a fertile ground for investors seeking opportunities beyond the mainstream. Amidst this backdrop, identifying stocks with strong fundamentals and growth potential becomes crucial, making Gränges and two other lesser-known Swedish companies intriguing prospects for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Gränges (OM:GRNG)

Simply Wall St Value Rating: ★★★★★★

Overview: Gränges AB (publ) is a company that focuses on the development, production, and distribution of rolled aluminum products for thermal management systems, specialty packaging, and niche applications across Europe, Asia, and the Americas with a market capitalization of approximately SEK12.60 billion.

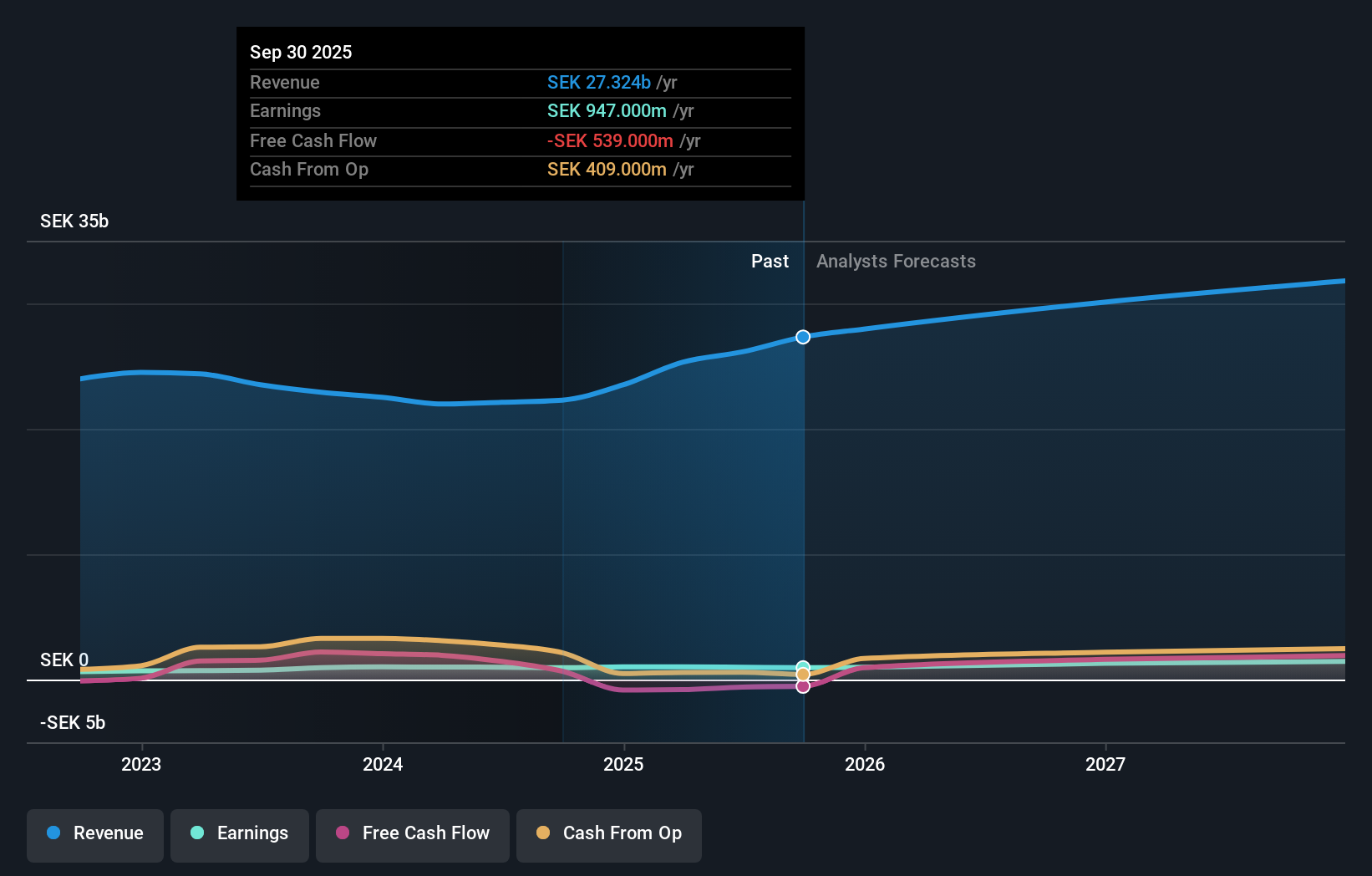

Operations: Gränges generates revenue primarily from its Gränges Eurasia and Gränges Americas segments, contributing SEK12.26 billion and SEK10.84 billion, respectively. The company has a net profit margin trend that could be analyzed further for investment insights.

Gränges, a Swedish player in the metals and mining sector, has seen its debt to equity ratio improve from 86.5% to 42.3% over five years, indicating better financial health. Despite a slight dip in net income for recent quarters (SEK 314 million vs SEK 316 million), its earnings growth of 31.1% outpaced industry averages. Trading at an attractive value, Gränges' EBIT covers interest payments comfortably at 6.5x, suggesting robust earnings quality and potential for future growth.

- Navigate through the intricacies of Gränges with our comprehensive health report here.

Gain insights into Gränges' past trends and performance with our Past report.

Investment AB Öresund (OM:ORES)

Simply Wall St Value Rating: ★★★★★★

Overview: Investment AB Öresund (publ) is an investment company focused on asset management activities in Sweden, with a market capitalization of approximately SEK5.23 billion.

Operations: Investment AB Öresund generates revenue primarily through its asset management activities in Sweden. The company has a market capitalization of approximately SEK5.23 billion.

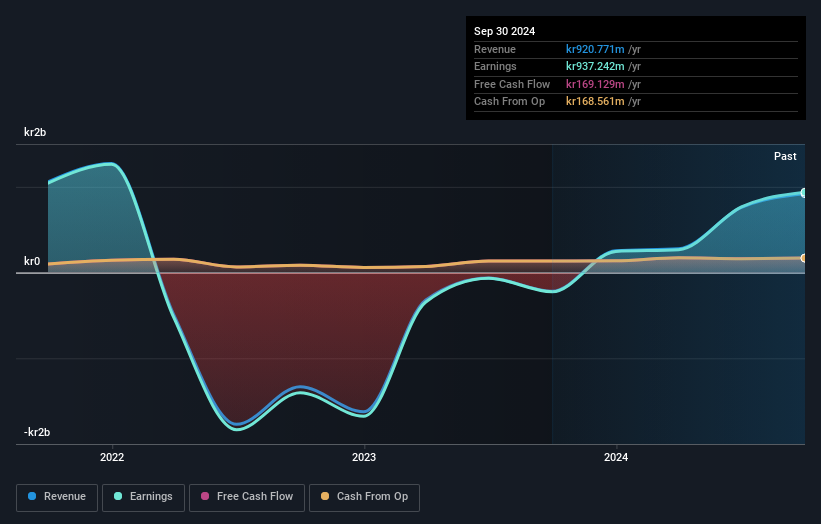

Öresund, a nimble player in the Swedish financial landscape, showcases intriguing dynamics. Despite recent third-quarter challenges with negative revenue of SEK 5.1 million and a net loss of SEK 7.4 million, its nine-month performance shines with revenue hitting SEK 483 million and net income reaching SEK 488.4 million. The company is debt-free and boasts high-quality earnings, while its price-to-earnings ratio of 5.6x suggests it trades at an attractive valuation compared to the Swedish market average of 23.5x.

- Click to explore a detailed breakdown of our findings in Investment AB Öresund's health report.

Assess Investment AB Öresund's past performance with our detailed historical performance reports.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK12.67 billion.

Operations: The company generates revenue primarily from its operations in Sweden, Norway, and other markets, with Sweden contributing SEK6.43 billion to the total revenue. The gross profit margin is 45%, reflecting the company's ability to manage costs effectively across its different geographical segments.

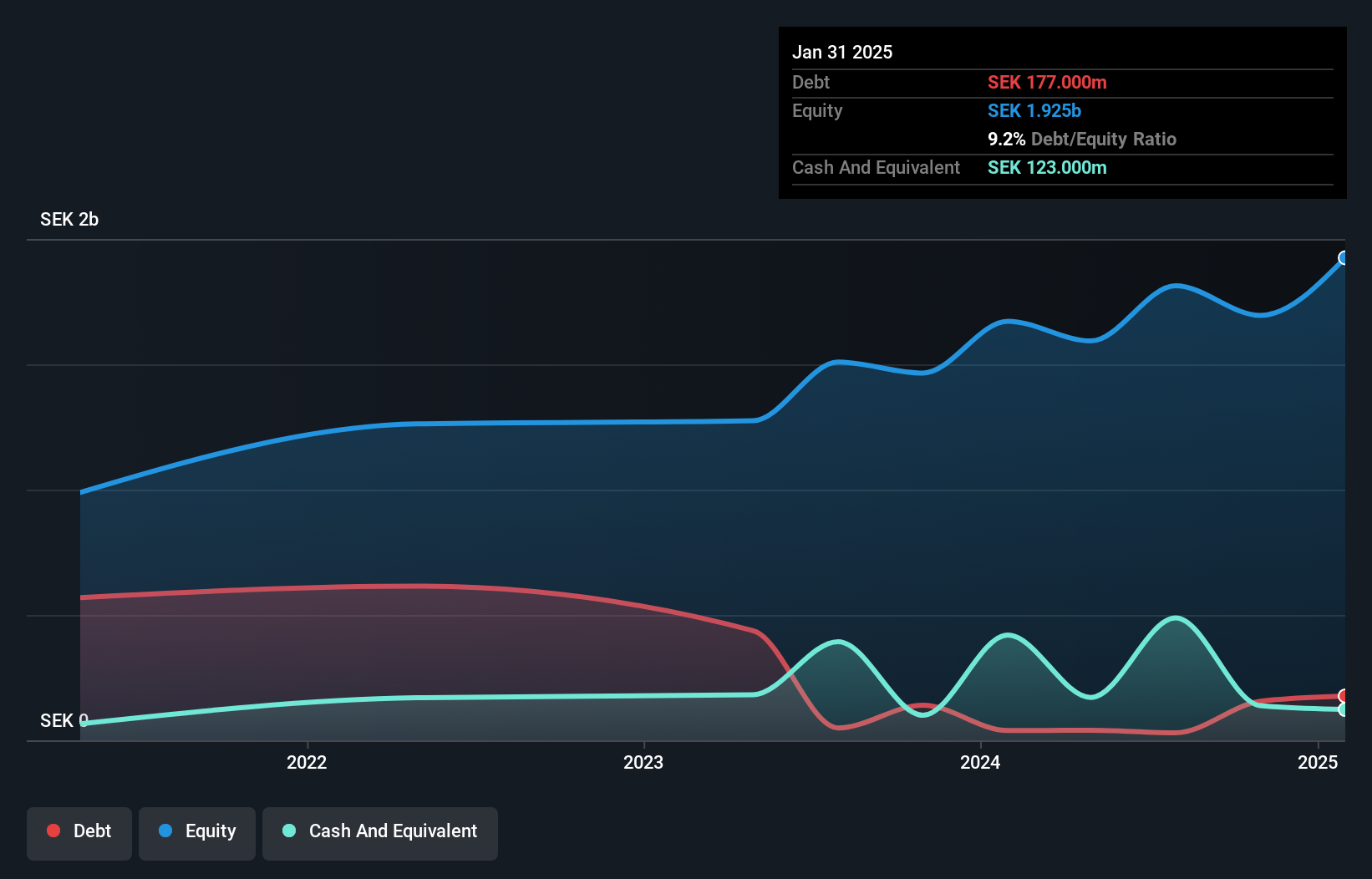

Rusta, a notable player in the retail sector, is making waves with its strategic expansion and robust financial performance. Recent earnings show a net income of SEK 231 million for Q1 2024, up from SEK 189 million last year, reflecting strong growth. The company reported sales of SEK 3.07 billion compared to SEK 2.96 billion previously. With interest payments well covered by EBIT at a ratio of 3.5x and trading significantly below estimated fair value by about 68%, Rusta's financial health appears solid. Its recent store openings in Sweden and Norway underscore an aggressive expansion plan that aligns with its long-term growth strategy, further supported by a dividend increase to SEK 1.15 per share for the fiscal year ending in September 2024.

- Dive into the specifics of Rusta here with our thorough health report.

Gain insights into Rusta's historical performance by reviewing our past performance report.

Where To Now?

- Click this link to deep-dive into the 56 companies within our Swedish Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GRNG

Gränges

Engages in the development, production, and distribution of rolled aluminum products for thermal management systems, specialty packaging, and niche applications in Europe, Asia, and the Americas.

Flawless balance sheet, good value and pays a dividend.