- Germany

- /

- Medical Equipment

- /

- DB:PHH2

Paul Hartmann Leads 3 Undiscovered Gems in Europe

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the pan-European STOXX Europe 600 Index climbing 2.35% and major single-country indexes also showing gains, investors are increasingly interested in uncovering lesser-known opportunities within this dynamic region. In light of these favorable market conditions, identifying stocks that exhibit strong fundamentals and resilience to economic fluctuations can be particularly rewarding for those seeking potential growth in Europe's diverse landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Paul Hartmann AG is a company that produces and distributes medical and care products across various regions including Germany, Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market capitalization of approximately €774.28 million.

Operations: Paul Hartmann AG generates revenue primarily from four segments: Wound Care (€619.14 million), Infection Management (€523.34 million), Incontinence Management (€773.61 million), and Complementary divisions of the group (€510.39 million).

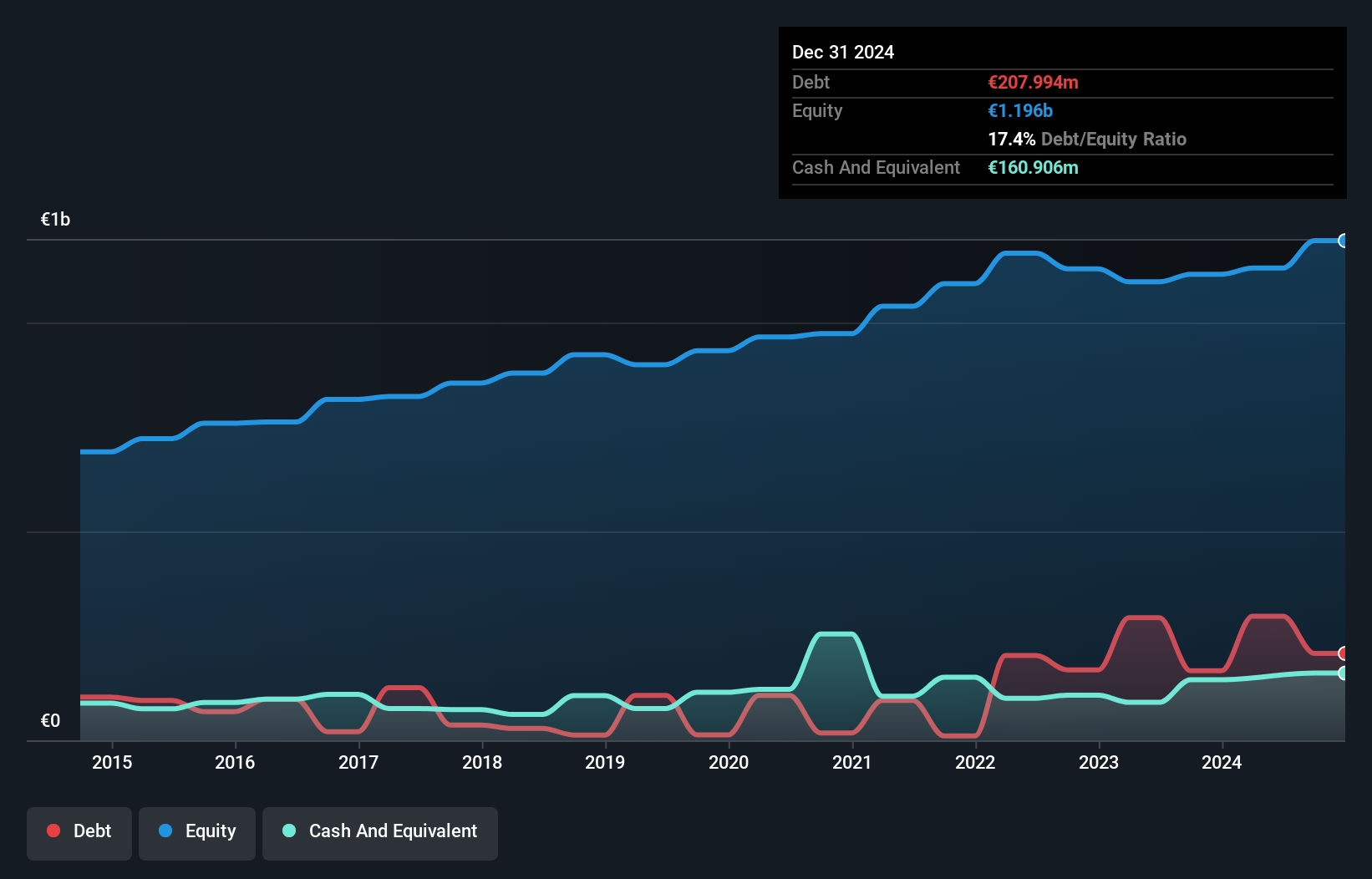

Hartmann, a nimble player in the medical equipment sector, has shown impressive earnings growth of 36.9% over the past year, outpacing its industry peers. Despite a satisfactory net debt to equity ratio of 19%, its debt level has climbed from 11.1% to 32.7% in five years, suggesting increased leverage. The company's price-to-earnings ratio stands at an attractive 9.5x compared to the German market's average of 17.9x, indicating potential undervaluation. Although free cash flow is negative, Hartmann's high-quality earnings and strong interest coverage with EBIT at 7.2 times interest payments highlight financial robustness amidst challenges.

- Navigate through the intricacies of Paul Hartmann with our comprehensive health report here.

Assess Paul Hartmann's past performance with our detailed historical performance reports.

Sipef (ENXTBR:SIP)

Simply Wall St Value Rating: ★★★★★★

Overview: Sipef NV operates as an agro-industrial company with a market capitalization of €852.14 million.

Operations: Sipef generates revenue primarily from its palm segment, contributing $443.03 million, followed by bananas at $43.98 million.

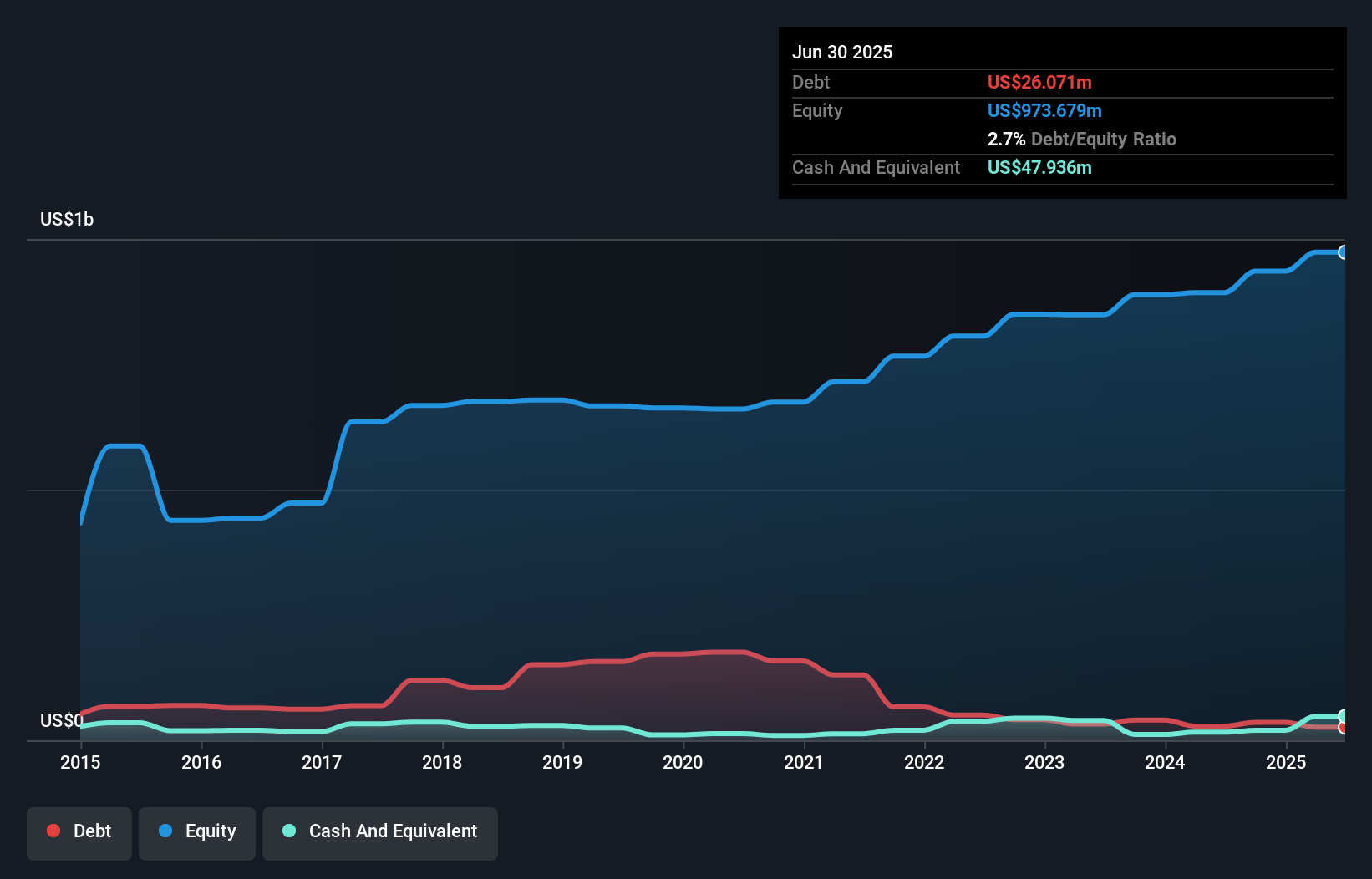

Sipef, a notable player in the European market, has seen its debt to equity ratio tumble from 26.6% to 2.7% over five years, showcasing financial prudence. This company trades at 66.5% below its estimated fair value, suggesting potential undervaluation in the market. Over the past year, earnings soared by 48%, outpacing the broader food industry growth of 30%. With interest payments comfortably covered by EBIT at a staggering 153 times and more cash than total debt on hand, Sipef seems robustly positioned despite forecasts indicating a modest earnings decline of 0.4% annually over three years.

- Take a closer look at Sipef's potential here in our health report.

Understand Sipef's track record by examining our Past report.

Nelly Group (OM:NELLY)

Simply Wall St Value Rating: ★★★★★★

Overview: Nelly Group AB (publ) is a fashion company that operates in Sweden, the rest of the Nordics, and internationally, with a market capitalization of approximately SEK2.91 billion.

Operations: Nelly Group generates revenue primarily from its fashion operations, with reported sales of SEK1.21 billion. The company's financial performance can be analyzed through its net profit margin trends over recent periods, which provide insights into profitability levels.

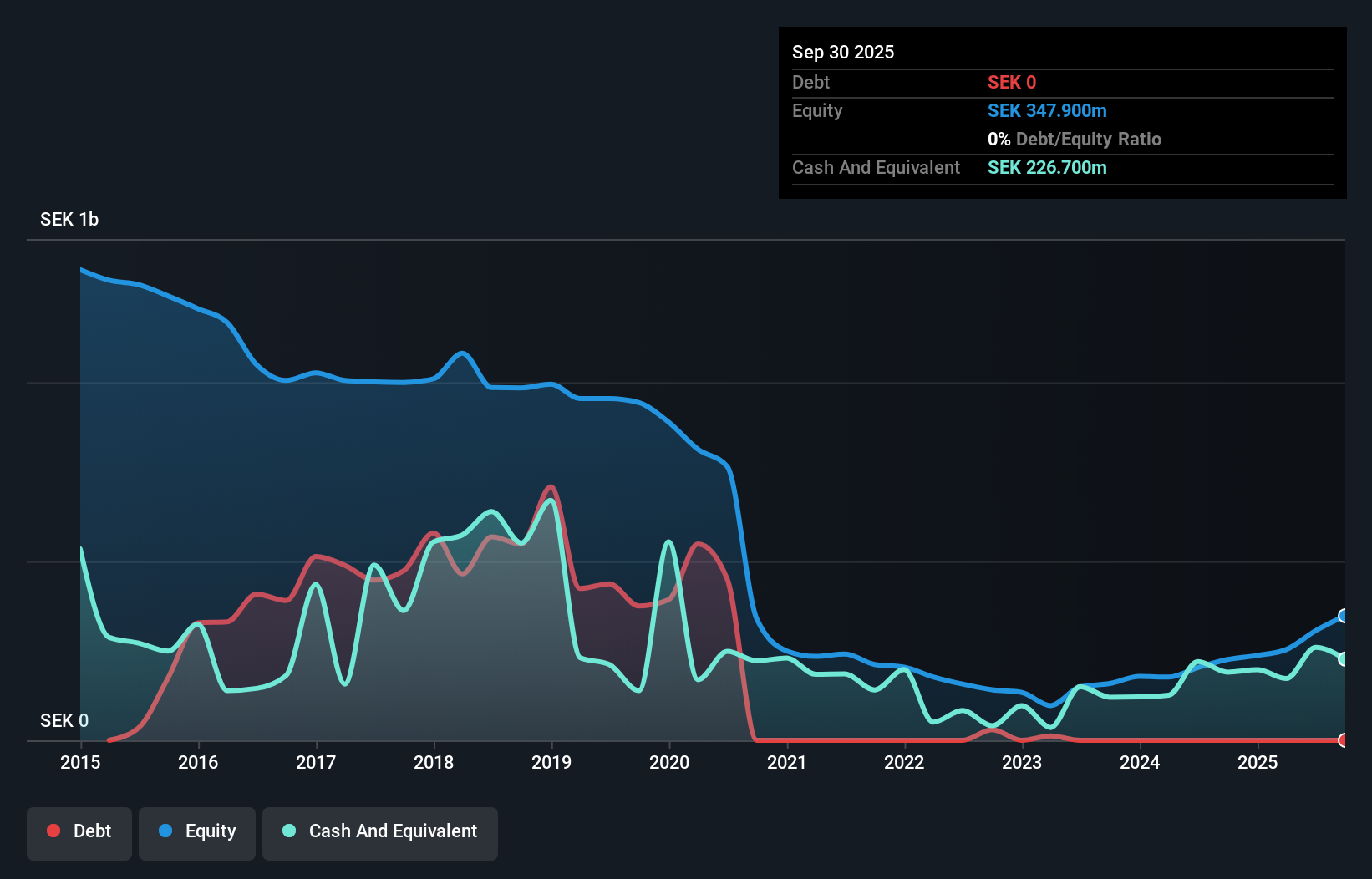

Nelly Group, a nimble player in the European market, has shown impressive growth with earnings soaring by 119.5% over the past year, outpacing industry standards. The company reported third-quarter sales of SEK 283.7 million and net income of SEK 41.5 million, marking a notable increase from last year's figures of SEK 239.6 million and SEK 22.3 million respectively. With a price-to-earnings ratio at an attractive 19.8x compared to the Swedish market's average of 22x, Nelly operates debt-free and is free cash flow positive, offering a solid foundation for potential investors seeking value in this sector.

- Click here and access our complete health analysis report to understand the dynamics of Nelly Group.

Seize The Opportunity

- Get an in-depth perspective on all 313 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:PHH2

Paul Hartmann

Manufactures and sells medical and care products in Germany, the rest of Europe, the Middle East, Africa, Asia and Pacific region, and the Americas.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026