Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Lyko Group (STO:LYKO A). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Lyko Group

How Fast Is Lyko Group Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Lyko Group's EPS went from kr0.74 to kr3.09 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

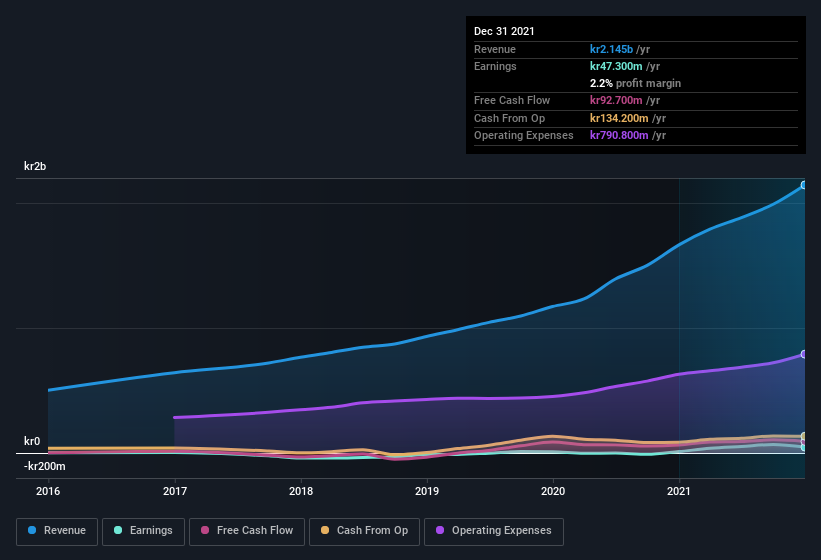

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Lyko Group's EBIT margins were flat over the last year, revenue grew by a solid 29% to kr2.1b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Lyko Group's future profits.

Are Lyko Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Lyko Group insiders spent kr1.1m on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. Zooming in, we can see that the biggest insider purchase was by Chief Logistics & Purchasing Officer Anna Persson for kr750k worth of shares, at about kr268 per share.

On top of the insider buying, we can also see that Lyko Group insiders own a large chunk of the company. Actually, with 50% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about kr1.7b riding on the stock, at current prices. That's nothing to sneeze at!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Rickard Lyko, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Lyko Group with market caps between kr1.9b and kr7.5b is about kr5.4m.

Lyko Group offered total compensation worth kr2.9m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Lyko Group Deserve A Spot On Your Watchlist?

Lyko Group's earnings per share have taken off like a rocket aimed right at the moon. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Lyko Group belongs on the top of your watchlist. It is worth noting though that we have found 1 warning sign for Lyko Group that you need to take into consideration.

The good news is that Lyko Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LYKO A

Lyko Group

Produces and sells various hair care and beauty products in the Nordic markets.

Solid track record with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026