- Sweden

- /

- Specialty Stores

- /

- OM:LYKO A

Anna Persson Is The Chief Logistics & Purchasing Officer of Lyko Group AB (publ) (STO:LYKO A) And They Just Picked Up 3.9% More Shares

Whilst it may not be a huge deal, we thought it was good to see that the Lyko Group AB (publ) (STO:LYKO A) Chief Logistics & Purchasing Officer, Anna Persson, recently bought kr75k worth of stock, for kr300 per share. Although the purchase is not a big one, increasing their shareholding by only 3.9%, it can be interpreted as a good sign.

View our latest analysis for Lyko Group

Lyko Group Insider Transactions Over The Last Year

The insider Frans Gunnar Lyko made the biggest insider purchase in the last 12 months. That single transaction was for kr941k worth of shares at a price of kr314 each. So it's clear an insider wanted to buy, even at a higher price than the current share price (being kr294). It's very possible they regret the purchase, but it's more likely they are bullish about the company. To us, it's very important to consider the price insiders pay for shares. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

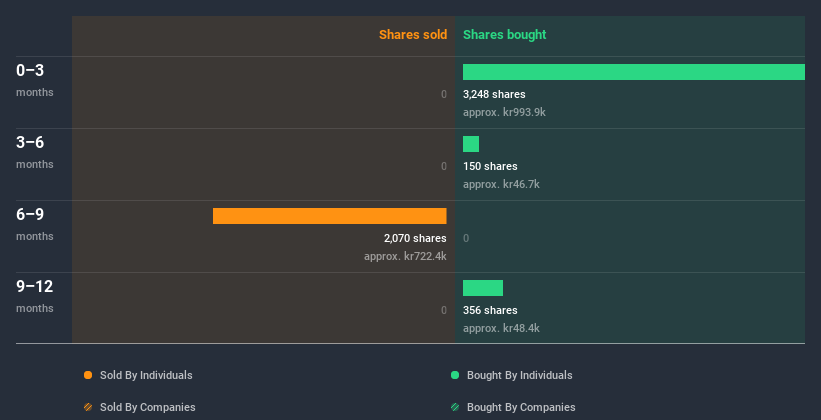

Over the last year, we can see that insiders have bought 3.75k shares worth kr1.1m. But they sold 2.07k shares for kr722k. Overall, Lyko Group insiders were net buyers during the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Does Lyko Group Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. It's great to see that Lyko Group insiders own 50% of the company, worth about kr2.3b. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Lyko Group Insiders?

It is good to see recent purchasing. We also take confidence from the longer term picture of insider transactions. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about Lyko Group. One for the watchlist, at least! I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow for free.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Lyko Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:LYKO A

Lyko Group

Sells a range of hair care and beauty products in the Nordic markets.

Reasonable growth potential and fair value.

Market Insights

Community Narratives