- Spain

- /

- Healthcare Services

- /

- BME:CBAV

Clínica Baviera And 2 Promising European Small Caps With Strong Potential

Reviewed by Simply Wall St

As the European market experiences a modest upswing, buoyed by easing geopolitical tensions and potential economic stimulus in Germany, investors are increasingly eyeing small-cap stocks for their growth potential. In this environment, identifying promising companies with strong fundamentals and innovative business models can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| va-Q-tec | 43.54% | 9.84% | -34.33% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Clínica Baviera (BME:CBAV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Clínica Baviera, S.A. is a medical company that runs a network of ophthalmology clinics across Spain and Europe, with a market cap of €662.64 million.

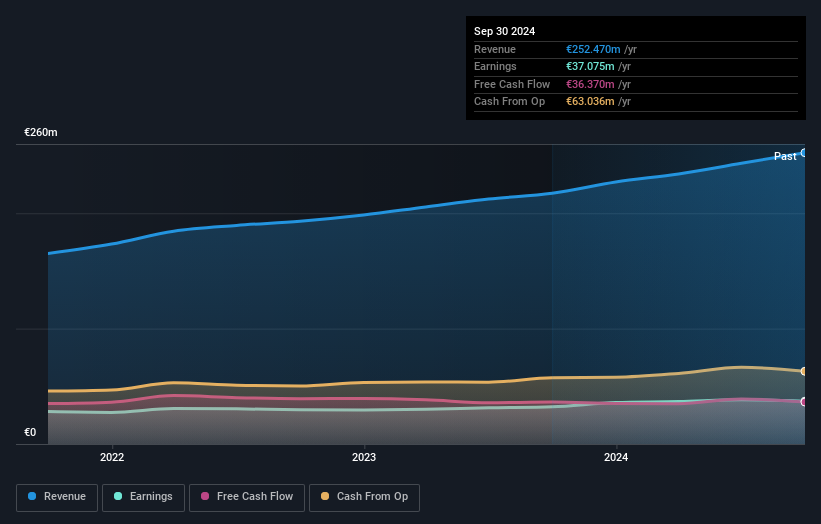

Operations: The company generates revenue primarily from its ophthalmology segment, amounting to €279.53 million.

Clínica Baviera, a nimble player in the healthcare sector, is trading at 19.6% below its estimated fair value. Over the past five years, earnings have grown impressively at 20.8% annually, showcasing robust performance and high-quality earnings. The company has successfully slashed its debt to equity ratio from 64.1% to just 5.7%, indicating prudent financial management with more cash than total debt on hand. Recent figures reveal a net income of €12.87 million for Q1 2025, up from €12.41 million last year, against sales of €80.22 million compared to €66.41 million previously.

- Delve into the full analysis health report here for a deeper understanding of Clínica Baviera.

Evaluate Clínica Baviera's historical performance by accessing our past performance report.

Haypp Group (OM:HAYPP)

Simply Wall St Value Rating: ★★★★★★

Overview: Haypp Group AB (publ) is an online retailer specializing in tobacco-free nicotine pouches and snus products, serving markets in Sweden, Norway, the rest of Europe, and the United States, with a market cap of approximately SEK4.13 billion.

Operations: Haypp Group generates revenue through three primary segments: Core (SEK2.68 billion), Growth (SEK946.56 million), and Emerging Market (SEK94.82 million). The financial focus is on optimizing these revenue streams to enhance profitability and shareholder value.

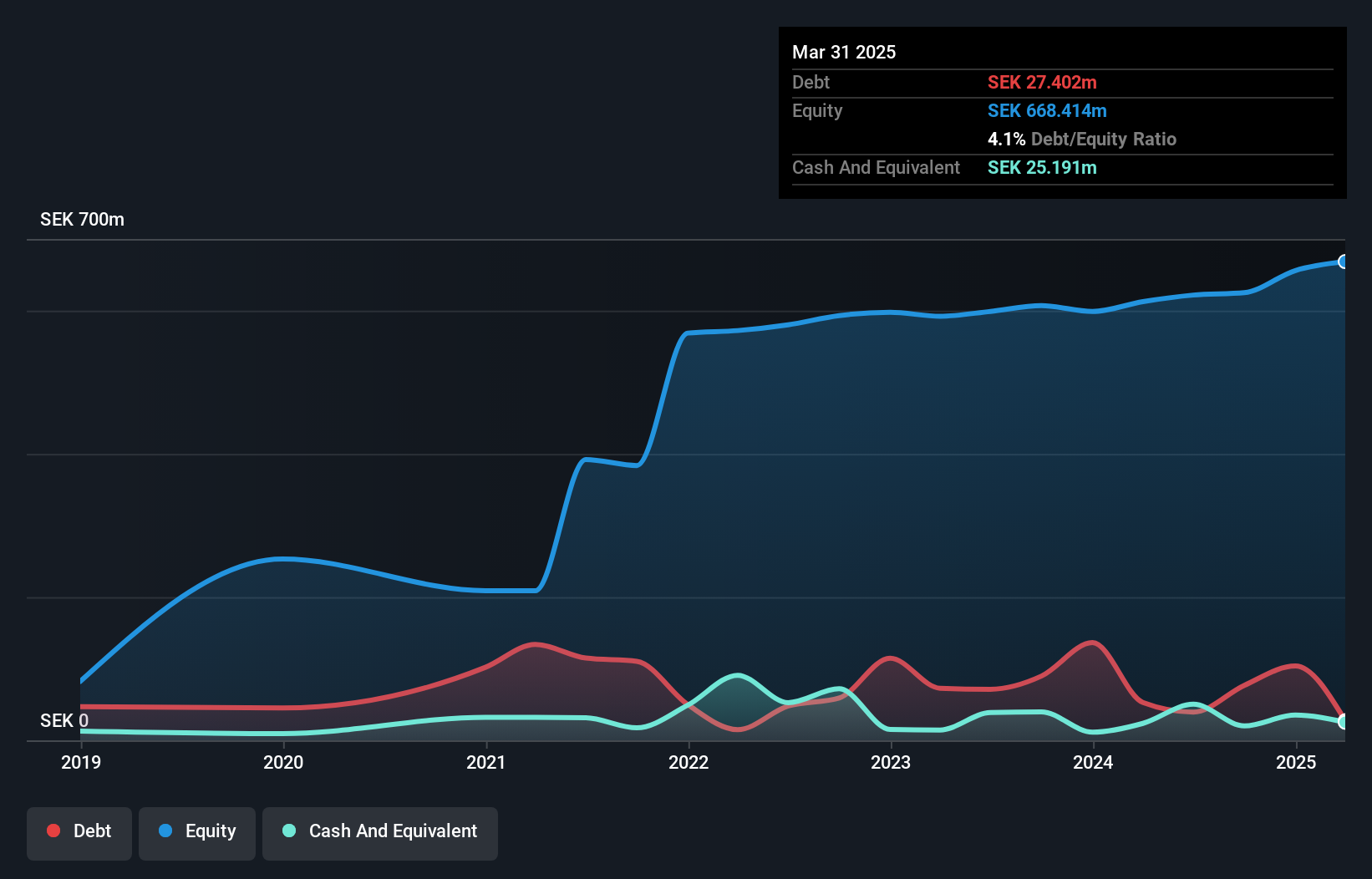

Haypp Group, a nimble player in the tobacco-free nicotine market, has seen its debt to equity ratio shrink significantly from 24.5% to just 4.1% over five years, reflecting strong financial discipline. Trading at nearly 60% below estimated fair value, it offers an intriguing valuation proposition. The company's earnings have soared by 280% in the past year, outpacing industry trends and signaling robust growth potential. Recent FDA approvals for flavored nicotine pouches could bolster U.S. sales while operational efficiencies like warehouse automation aim to boost margins further. However, supply issues with Zyn products and regulatory challenges may pose risks moving forward.

Nordrest Holding (OM:NREST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nordrest Holding AB (publ) is a foodservice company that operates in Sweden and internationally, with a market cap of SEK2.38 billion.

Operations: Nordrest Holding generates revenue primarily from its restaurant segment, which accounts for SEK2.01 billion.

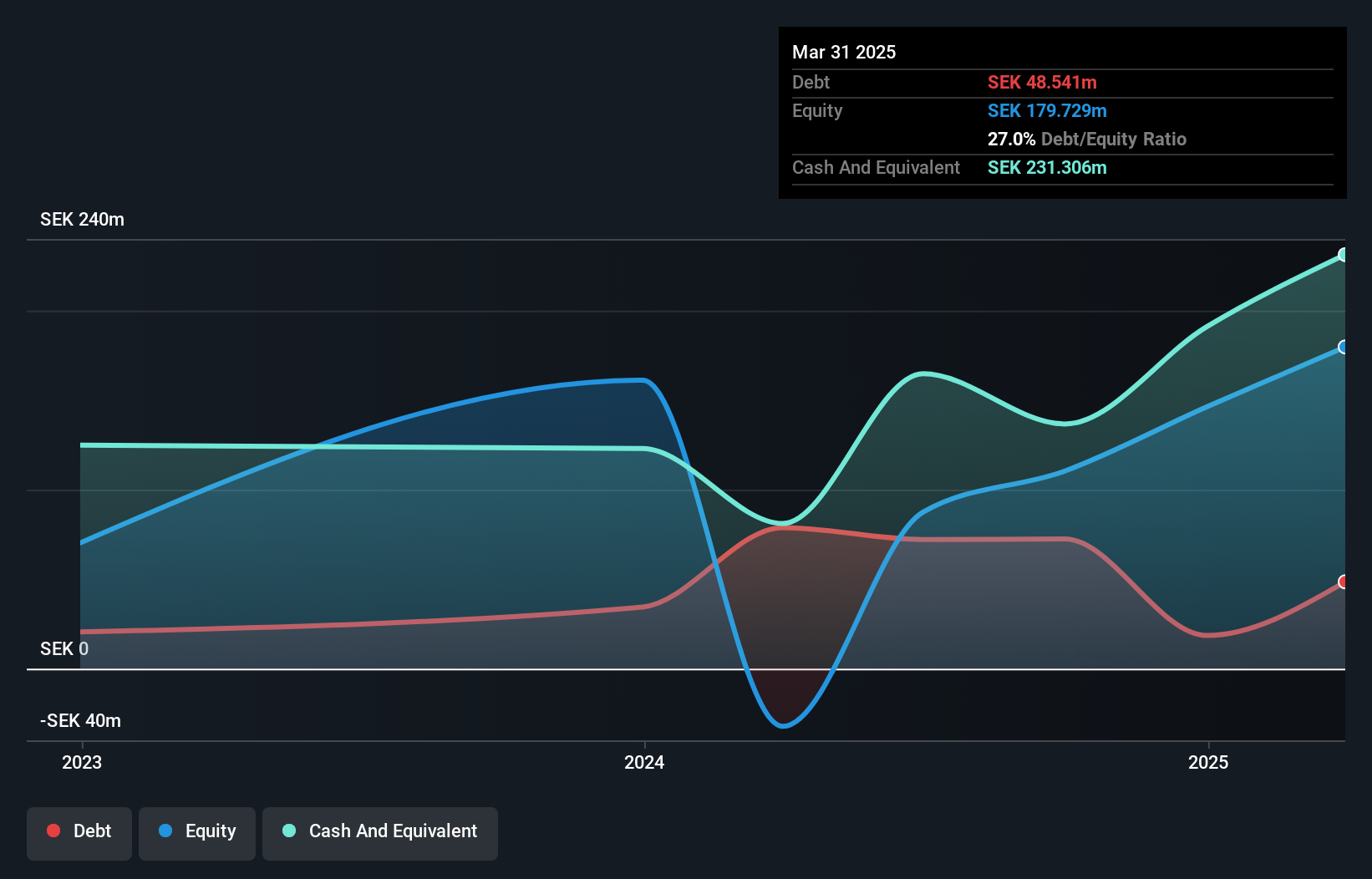

Nordrest Holding, a compact player in the hospitality sector, showcases strong financial health with earnings growth of 32.3% last year, outpacing the industry average of 16%. Its price-to-earnings ratio stands at 19.1x, offering better value compared to Sweden's market average of 23.2x. The company reported first-quarter sales of SEK 533.91 million and net income rose to SEK 33.46 million from SEK 28.72 million a year prior, despite a dip in basic earnings per share from SEK 2.85 to SEK 2.69. With more cash than debt and positive free cash flow, Nordrest seems poised for continued stability and growth prospects in its niche market.

- Take a closer look at Nordrest Holding's potential here in our health report.

Assess Nordrest Holding's past performance with our detailed historical performance reports.

Next Steps

- Access the full spectrum of 324 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CBAV

Clínica Baviera

A medical company, operates a network of ophthalmology clinics in Spain and Europe.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives