- Sweden

- /

- Specialty Stores

- /

- OM:FOI B

Take Care Before Diving Into The Deep End On Fenix Outdoor International AG (STO:FOI B)

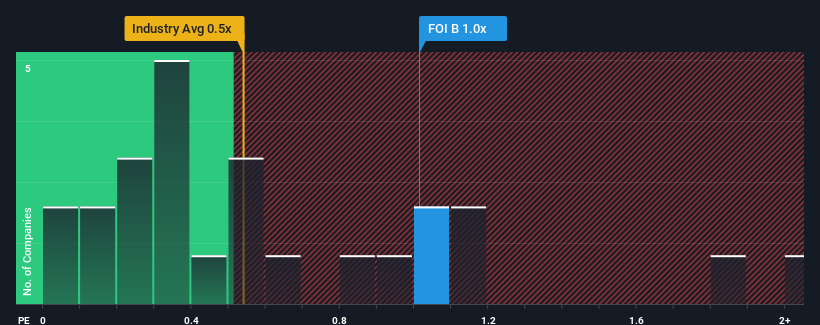

There wouldn't be many who think Fenix Outdoor International AG's (STO:FOI B) price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S for the Specialty Retail industry in Sweden is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Fenix Outdoor International

How Has Fenix Outdoor International Performed Recently?

While the industry has experienced revenue growth lately, Fenix Outdoor International's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Fenix Outdoor International will help you uncover what's on the horizon.How Is Fenix Outdoor International's Revenue Growth Trending?

In order to justify its P/S ratio, Fenix Outdoor International would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 1.2% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 33% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 2.5%, which is noticeably less attractive.

In light of this, it's curious that Fenix Outdoor International's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Fenix Outdoor International's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Fenix Outdoor International you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FOI B

Fenix Outdoor International

Develops, manufactures, and sells outdoor products worldwide.

Excellent balance sheet second-rate dividend payer.