- Sweden

- /

- Specialty Stores

- /

- OM:CLAS B

Undiscovered Gems In Europe To Explore This June 2025

Reviewed by Simply Wall St

As European markets navigate a landscape of easing inflation and potential interest rate cuts by the European Central Bank, investors are keenly observing how these macroeconomic shifts might influence small-cap stocks. With Germany's unemployment rising faster than expected and business sentiment weakening in the UK services sector, identifying promising opportunities in this environment requires a focus on companies that demonstrate resilience and adaptability amid fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Ferrari Group (ENXTAM:FERGR)

Simply Wall St Value Rating: ★★★★★☆

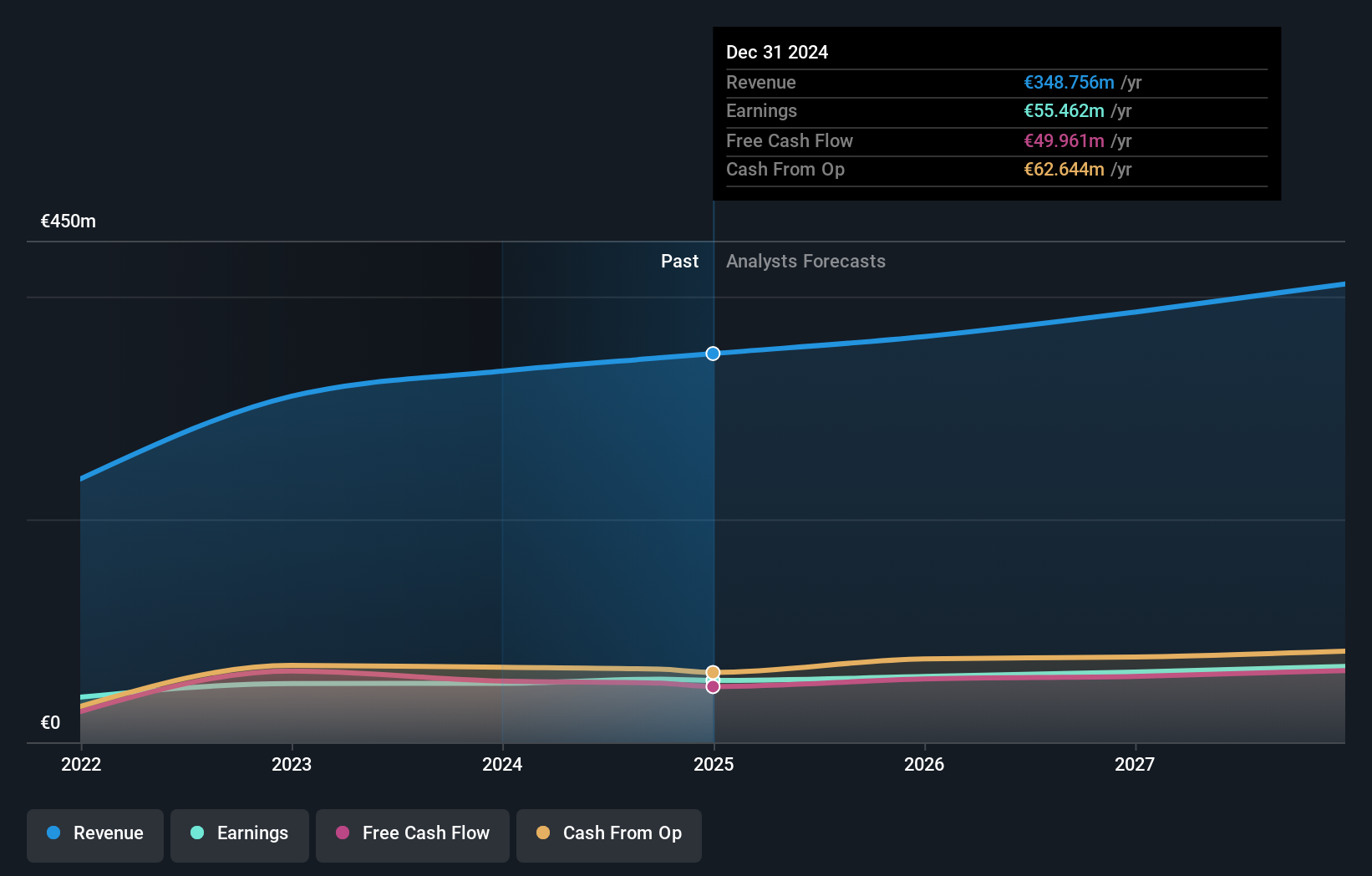

Overview: Ferrari Group PLC specializes in shipping, integrated logistics, and value-added services for jewelry and precious goods across Europe, Asia, North America, Brazil, and Africa with a market cap of €776.96 million.

Operations: Ferrari Group generates revenue primarily from its business services segment, which amounts to €344.94 million. The company has a market capitalization of €776.96 million.

Ferrari Group, a promising entity in Europe, is trading at 48.6% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings grew by 7.2%, outpacing the Logistics industry's -2.9%. The company boasts high-quality earnings and remains profitable with a positive free cash flow of US$53.12 million as of June 2025. With more cash than total debt and interest payments covered by profits, financial health seems robust. Looking ahead, earnings are forecasted to grow annually at 6.52%, hinting at continued momentum in performance and value realization for investors.

- Unlock comprehensive insights into our analysis of Ferrari Group stock in this health report.

Review our historical performance report to gain insights into Ferrari Group's's past performance.

BW Offshore (OB:BWO)

Simply Wall St Value Rating: ★★★★★☆

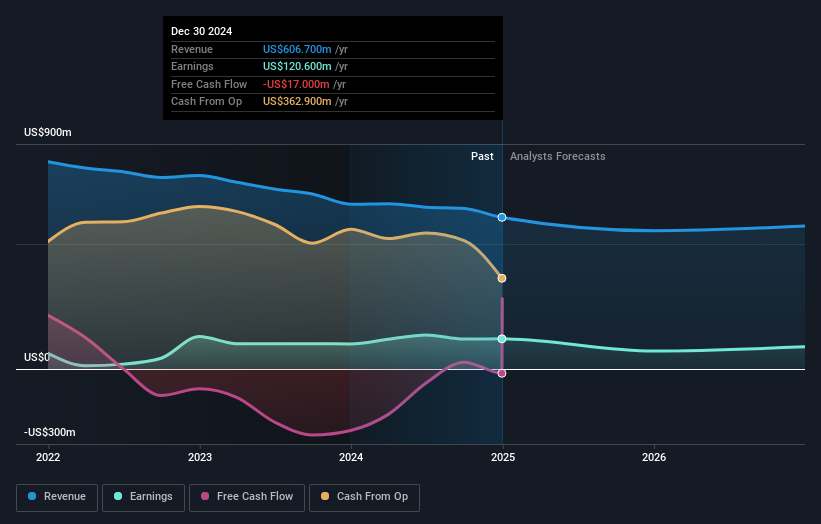

Overview: BW Offshore Limited specializes in the engineering of offshore production solutions across multiple regions, including the Americas, Europe, Africa, Asia, and the Pacific, with a market capitalization of NOK6.15 billion.

Operations: BW Offshore generates revenue primarily from its FPSO segment, amounting to $603.70 million, with a smaller contribution from Floating Wind at $3.10 million.

BW Offshore, a nimble player in the energy sector, has seen its earnings grow at an impressive 57% annually over five years. The company’s debt-to-equity ratio has dramatically improved from 85.5% to 18.6%, showcasing robust financial management. Its interest payments are comfortably covered by EBIT at a ratio of 6.4 times, indicating strong operational efficiency. Despite trading at a notable discount of about 34% below estimated fair value, BW Offshore faces hurdles such as dependency on key projects and rising financing costs that might affect profitability in the near term. Recent strategic moves into FPSO projects and floating wind energy signal promising growth avenues for the future.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

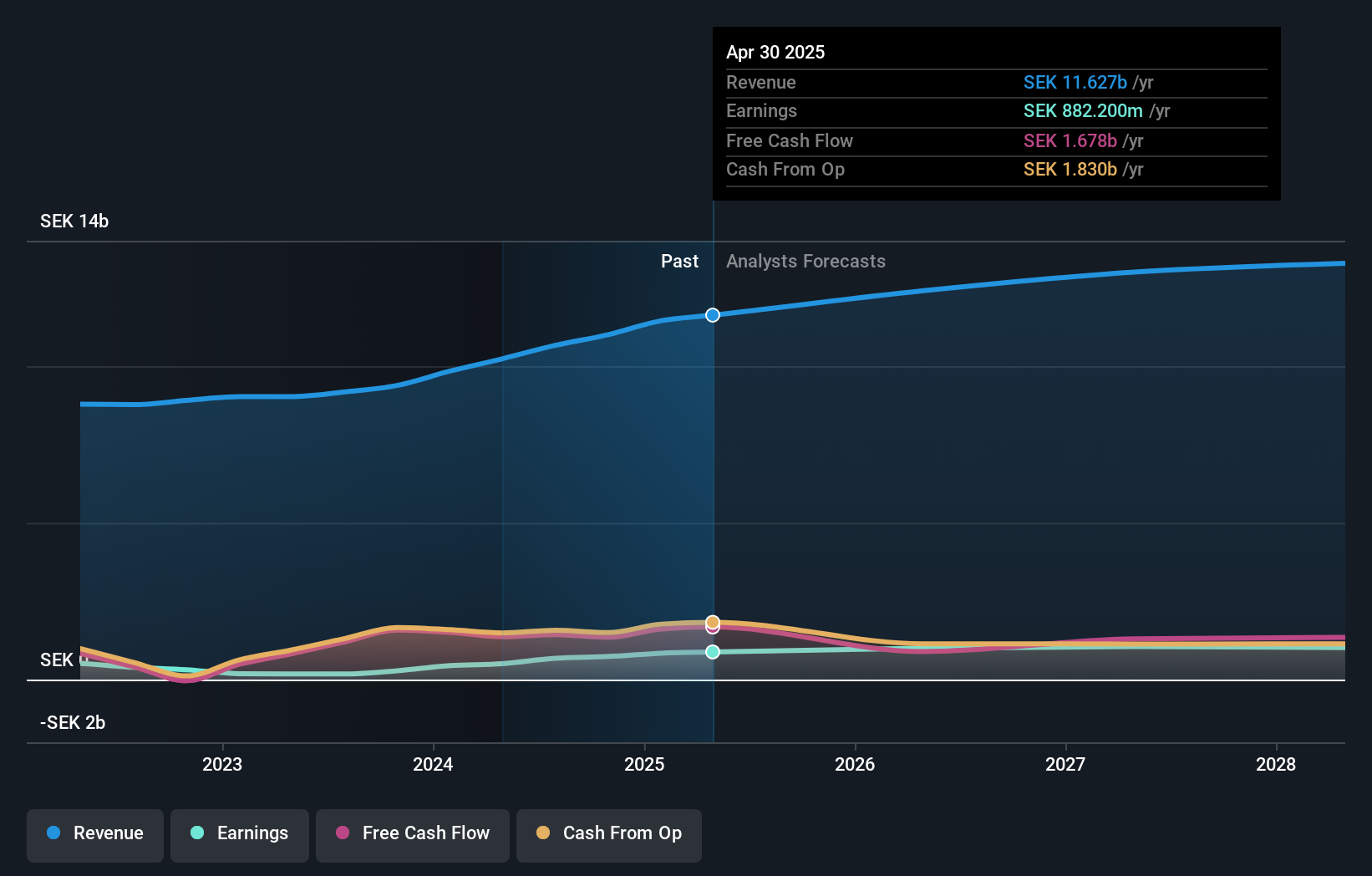

Overview: Clas Ohlson AB (publ) is a retail company that offers hardware, electrical, multimedia, home, and leisure products across Sweden, Norway, Finland, and other international markets with a market cap of approximately SEK17.53 billion.

Operations: Clas Ohlson generates revenue primarily from its retail specialty segment, which amounts to SEK11.45 billion. The company's financial performance is influenced by its cost structure and market presence in multiple regions.

Clas Ohlson, a nimble player in the European retail scene, has demonstrated impressive earnings growth of 89.5% over the past year, outpacing its industry peers significantly. Trading at 53.7% below its estimated fair value and completely debt-free for five years, it presents an intriguing valuation opportunity. Recent sales figures highlight a robust performance with SEK 11.63 billion in net sales for May 2024-April 2025, marking a solid increase from SEK 10.23 billion previously. The company's strategic shift to multi-niche retailing and collaborations like those with Husqvarna are likely to bolster future prospects despite potential challenges from currency effects and rising costs.

Make It Happen

- Dive into all 331 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CLAS B

Clas Ohlson

A retail company, sells building, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives