- Sweden

- /

- Specialty Stores

- /

- OM:BHG

BHG Group (OM:BHG) Losses Worsen 57.6% Yearly, Challenging Turnaround Hopes Despite Growth Forecast

Reviewed by Simply Wall St

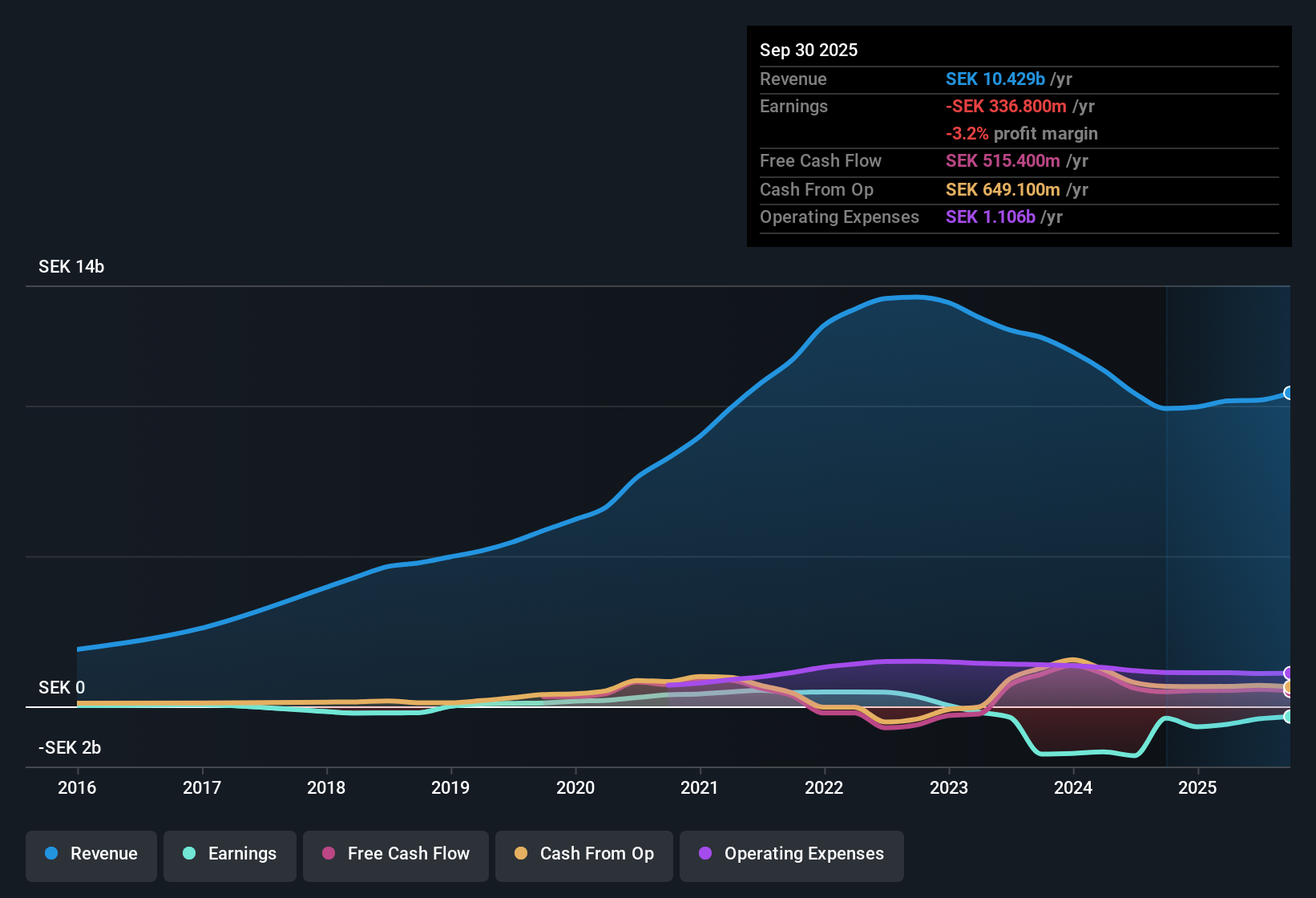

BHG Group (OM:BHG) remains in the red, with annual losses worsening at 57.6% per year over the last five years. In spite of unprofitable results and a lack of past earnings quality, the company is forecast to grow revenue by 6.1% per year, surpassing the Swedish market's expected 3.9% annual growth. Investors might be watching the potential for a profitability turnaround, supported by forecasts for 91.25% per year earnings growth and a share price (SEK28.34) that sits well below the estimated fair value (SEK45.81). Current data signals minimal risk and highlights the appeal of a low valuation.

See our full analysis for BHG Group.The next section puts these results in context. We will see how the latest numbers compare to the key narratives investors are following right now.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Mount as Turnaround Remains Elusive

- Annual losses have accelerated at 57.6% per year over the past five years, with no improvement in past earnings quality.

- Despite management's efforts to drive growth, what stands out is that persistent net losses raise the bar for a successful turnaround, especially since the company has not reported any periods of profitability yet.

- The expectation of a future pivot to profit is notable, but ongoing losses challenge even bullish hopes of a near-term inflection point.

- The company’s narrative of an operational comeback is still unproven in the numbers. Recent optimism remains somewhat speculative until profitability is actually delivered.

Peer-Defying Revenue Outlook

- Revenue is forecast to grow by 6.1% per year, significantly outpacing the Swedish market’s 3.9% per year. This gives BHG a rare growth advantage among local rivals.

- The prevailing view is that this expected revenue expansion supports BHG’s positioning as a potential outlier, especially given most peers expect slower top-line growth.

- With Swedish specialty retail only looking at 3.9% growth, bulls may point to BHG’s 6.1% pace as a strong base for future gains.

- The challenge is that revenue acceleration alone has not yet translated into bottom-line improvement, so investors may still hesitate to give full credit for this forecast until it materializes.

Price-To-Sales Discount Sets the Stage

- BHG trades at a Price-To-Sales Ratio of 0.5x, well below both its peer average of 1.7x and the Swedish industry average of 0.7x. This suggests the market assigns a steep discount to its shares despite growth prospects.

- This lower valuation heavily supports arguments for upside, as the share price (SEK28.34) remains meaningfully below DCF fair value (SEK45.38), tempting value-focused investors who believe the company’s growth forecasts can be delivered.

- Bulls may see this discount as unwarranted if revenue and earnings momentum confirms the turnaround path. In such a scenario, a rerating toward peers could drive gains.

- Skeptics, however, will note that the discount reflects persistent unprofitability and uncertainty about profitable execution, and not just market oversight.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BHG Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

BHG Group’s persistent losses and absence of sustained profitability indicate that its turnaround is still unproven, which leaves investors exposed to financial setbacks.

If steadier results matter to you, use stable growth stocks screener (2098 results) to focus on companies delivering consistent revenue and earnings growth, regardless of the market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BHG

BHG Group

Operates as a consumer e-commerce company in Sweden, Finland, Denmark, Norway, rest of Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives