- Sweden

- /

- Specialty Stores

- /

- OM:BHG

Analysts Are Updating Their BHG Group AB (publ) (STO:BHG) Estimates After Its Second-Quarter Results

Shareholders in BHG Group AB (publ) (STO:BHG) had a terrible week, as shares crashed 22% to kr14.76 in the week since its latest second-quarter results. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on BHG Group after the latest results.

View our latest analysis for BHG Group

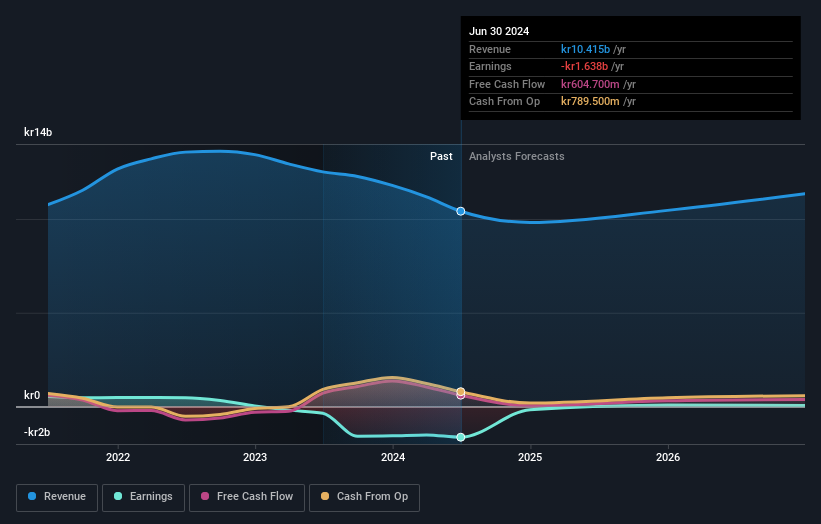

After the latest results, the consensus from BHG Group's twin analysts is for revenues of kr9.81b in 2024, which would reflect a small 5.8% decline in revenue compared to the last year of performance. Losses are predicted to fall substantially, shrinking 90% to kr0.95. Before this latest report, the consensus had been expecting revenues of kr10.2b and kr0.25 per share in losses. So it's pretty clear the analysts have mixed opinions on BHG Group after this update; revenues were downgraded and per-share losses expected to increase.

There was no major change to the consensus price target of kr19.00, signalling that the business is performing roughly in line with expectations, despite lower earnings per share forecasts.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the BHG Group's past performance and to peers in the same industry. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 11% by the end of 2024. This indicates a significant reduction from annual growth of 14% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 3.9% annually for the foreseeable future. It's pretty clear that BHG Group's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at BHG Group. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. The consensus price target held steady at kr19.00, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on BHG Group. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

And what about risks? Every company has them, and we've spotted 1 warning sign for BHG Group you should know about.

Valuation is complex, but we're here to simplify it.

Discover if BHG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BHG

BHG Group

Operates as a consumer e-commerce company in Sweden, Finland, Denmark, Norway, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives