- Sweden

- /

- Specialty Stores

- /

- OM:BHG

3 Top Undervalued Small Caps In The European Market With Insider Action

Reviewed by Simply Wall St

As the European market navigates a period of mixed performance, with the pan-European STOXX Europe 600 Index remaining relatively flat amidst ongoing trade discussions and economic adjustments, small-cap stocks present intriguing opportunities for investors. In this environment, identifying stocks that exhibit strong fundamentals and potential for growth can be particularly rewarding, especially when insider activity suggests confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Kitwave Group | 13.0x | 0.3x | 45.16% | ★★★★★☆ |

| Instabank | 10.2x | 2.9x | 24.22% | ★★★★★☆ |

| Yubico | 32.7x | 4.7x | 11.32% | ★★★★☆☆ |

| Hoist Finance | 8.9x | 1.8x | 18.02% | ★★★★☆☆ |

| CVS Group | 45.1x | 1.3x | 38.97% | ★★★★☆☆ |

| Seeing Machines | NA | 2.9x | 45.04% | ★★★★☆☆ |

| A.G. BARR | 19.5x | 1.8x | 46.10% | ★★★☆☆☆ |

| NOTE | 21.1x | 1.4x | -8.45% | ★★★☆☆☆ |

| FastPartner | 17.0x | 4.4x | -35.94% | ★★★☆☆☆ |

| Karnov Group | 233.1x | 5.0x | 27.51% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

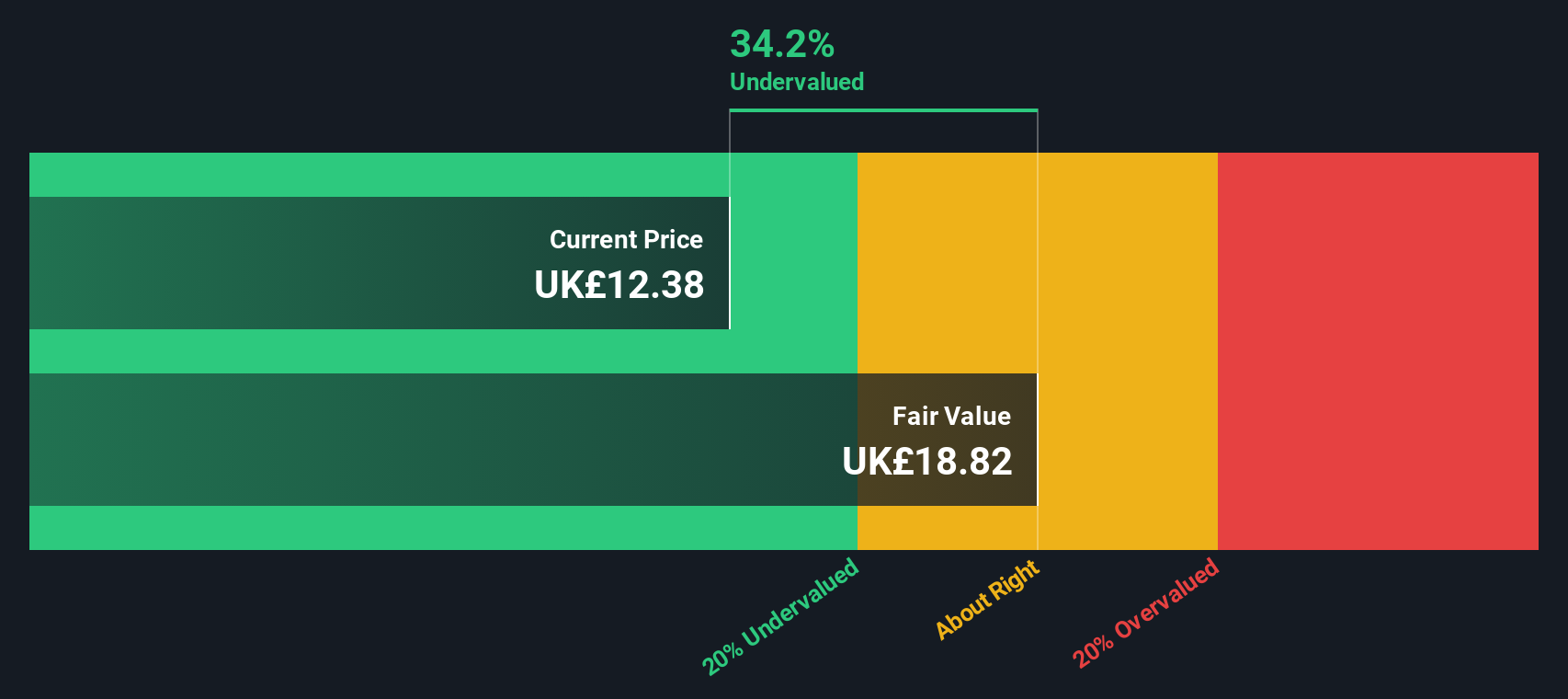

CVS Group (AIM:CVSG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CVS Group operates in the veterinary services industry, providing services through its veterinary practices, laboratories, crematoria, and online retail business, with a market capitalization of approximately £1.32 billion.

Operations: The primary revenue streams are Veterinary Practices, Laboratories, and Online Retail Business. The gross profit margin has shown variability over time, with a recent figure of 44.23%. Operating expenses have been significant, particularly in General & Administrative costs.

PE: 45.1x

CVS Group, a European small-cap company, is currently trading at levels that suggest it might be undervalued. Despite a decline in profit margins from 7.3% to 2.9% over the past year, there's insider confidence reflected in recent share purchases within the last six months. Earnings are projected to grow by 19% annually, although interest payments aren't fully covered by earnings due to reliance on external borrowing for funding. This financial structure presents both opportunities and challenges for future growth potential.

- Navigate through the intricacies of CVS Group with our comprehensive valuation report here.

Explore historical data to track CVS Group's performance over time in our Past section.

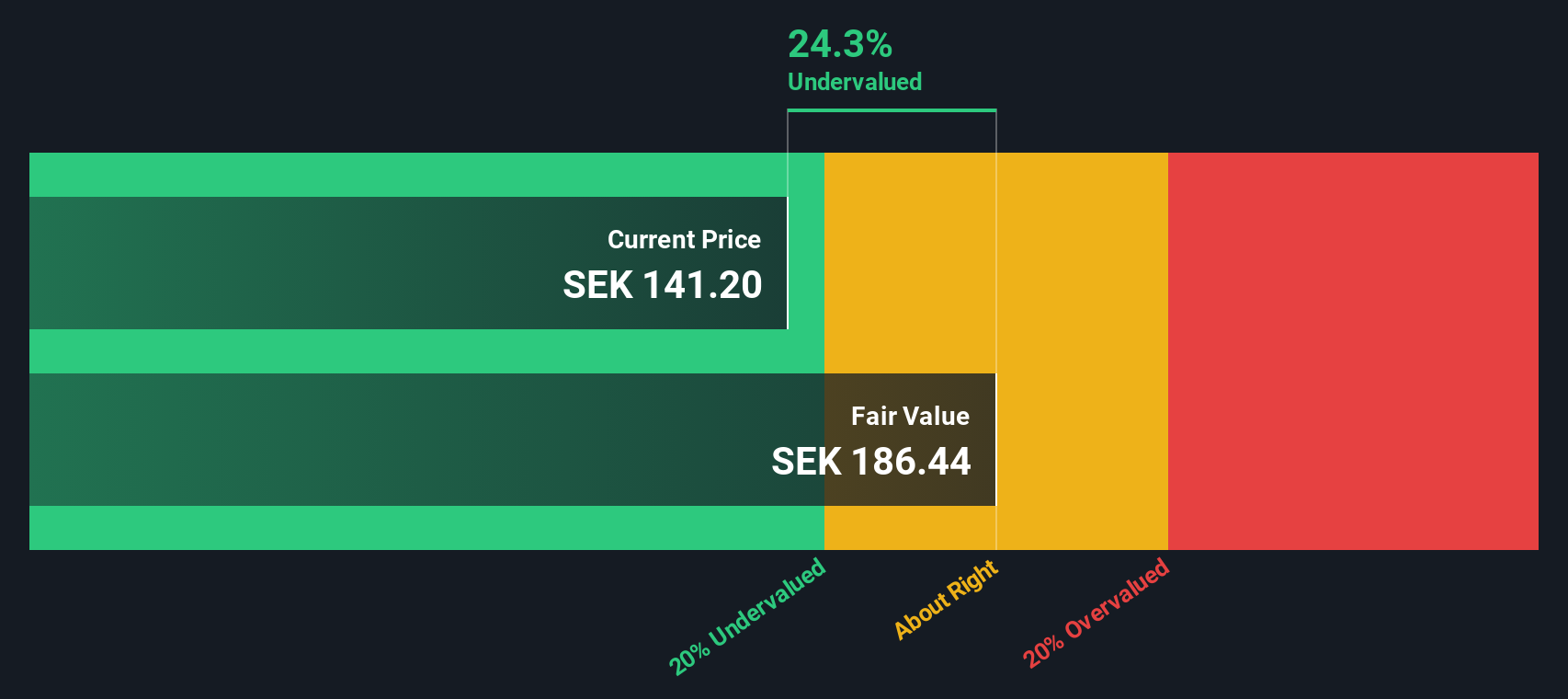

Alimak Group (OM:ALIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alimak Group specializes in providing vertical access solutions, including elevators and platforms for industrial and construction sectors, with a market cap of approximately SEK 5.18 billion.

Operations: Alimak Group generates revenue primarily through its sales, with a notable gross profit margin trend peaking at 40.81% by mid-2025. The company's cost structure is significantly influenced by the cost of goods sold (COGS), which has shown an upward trajectory over time. Operating expenses, including sales and marketing, research and development, and general administrative costs, also play a crucial role in determining profitability. Net income margins have demonstrated variability but reached 10.11% in mid-2025, indicating improved efficiency in managing expenses relative to revenue growth.

PE: 23.1x

Alimak Group, a small European company, recently reported improved earnings with net income for Q2 2025 at SEK 184 million, up from SEK 143 million the previous year. Despite stable sales figures around SEK 1.7 billion for both quarters, the company's basic earnings per share rose to SEK 1.74 from SEK 1.35 year-on-year. Insider confidence is evident as Sven Törnkvist increased their stake by purchasing an additional 4,000 shares in June for approximately A$451,440. With earnings projected to grow annually by over 10%, Alimak's prospects appear promising despite its reliance on external borrowing as a funding source.

- Get an in-depth perspective on Alimak Group's performance by reading our valuation report here.

Examine Alimak Group's past performance report to understand how it has performed in the past.

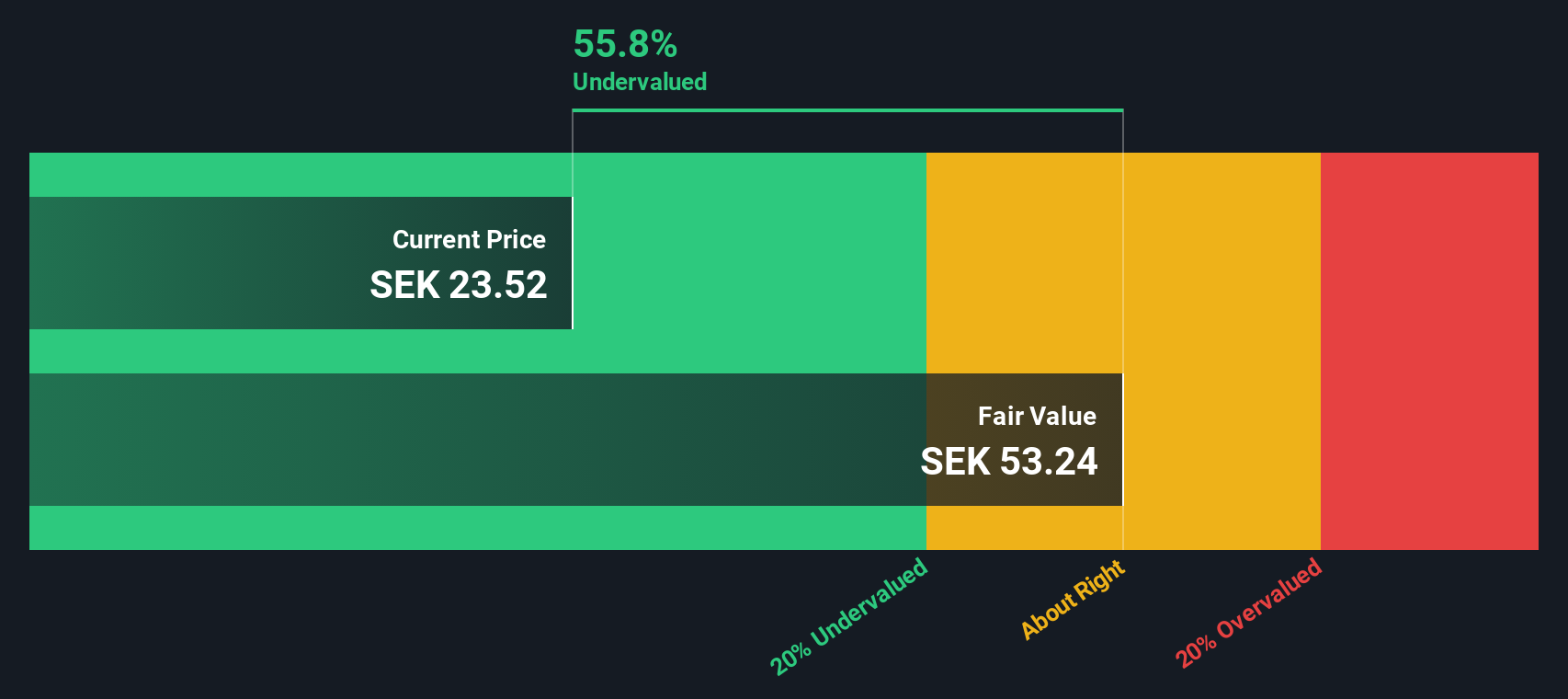

BHG Group (OM:BHG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BHG Group is a leading Nordic online retailer specializing in home improvement and furniture, with a market capitalization of approximately SEK 3.5 billion.

Operations: BHG Group generates revenue primarily through sales, with recent figures showing SEK 10.25 billion for the quarter ending June 2025. The company's gross profit margin was noted at 17.12% during this period, indicating a focus on managing cost of goods sold relative to revenue. Operating expenses include significant allocations for general and administrative purposes, totaling SEK 1.09 billion in the same quarter.

PE: -11.1x

BHG Group, a European small cap, has shown promising financial recovery with net income reaching SEK 75.6 million in Q2 2025, reversing a loss from the previous year. Earnings per share improved to SEK 0.42 from a loss of SEK 0.57. Notably, insider confidence is evident as Martin Leo purchased shares worth over SEK 1 million recently, reflecting potential optimism about future growth prospects despite reliance on external borrowing for funding and anticipated earnings growth of nearly 88% annually.

- Take a closer look at BHG Group's potential here in our valuation report.

Understand BHG Group's track record by examining our Past report.

Key Takeaways

- Navigate through the entire inventory of 53 Undervalued European Small Caps With Insider Buying here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BHG

BHG Group

Operates as a consumer e-commerce company in Sweden, Finland, Denmark, Norway, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives