- Sweden

- /

- Real Estate

- /

- OM:SAGA A

Swedish Exchange Growth Companies With Minimum 28% Insider Ownership

Reviewed by Simply Wall St

As global markets show signs of resilience, with indices like the S&P 500 reaching new highs, investors are keenly observing trends and shifts across various regions. In Sweden, growth companies with high insider ownership are garnering attention as potentially stable investments in a fluctuating economic landscape.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.9% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Biovica International (OM:BIOVIC B) | 12.7% | 73.8% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 43.4% |

| SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Here we highlight a subset of our preferred stocks from the screener.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) focuses on developing biological drugs for central nervous system disorders in Sweden, with a market capitalization of SEK 19.70 billion.

Operations: The company generates SEK 252.21 million in revenue from its biotechnology segment.

Insider Ownership: 35.1%

BioArctic, a Swedish biopharmaceutical company, recently gained approval in South Korea for Leqembi®, marking significant progress in Alzheimer's treatment. Despite a challenging Q1 with revenues down to SEK 29.64 million from SEK 393.43 million and a shift from profit to a loss of SEK 57.56 million, analysts remain optimistic about its potential growth. The stock is currently seen as undervalued, trading 67.1% below its estimated fair value with expectations of substantial revenue growth (40.8% per year) and profitability within three years. Additionally, insider transactions have not shown significant buying activity recently.

- Get an in-depth perspective on BioArctic's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that BioArctic's current price could be quite moderate.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company active in Sweden, Finland, France, Benelux, Spain, Germany, and other European regions with a market capitalization of approximately SEK 93.07 billion.

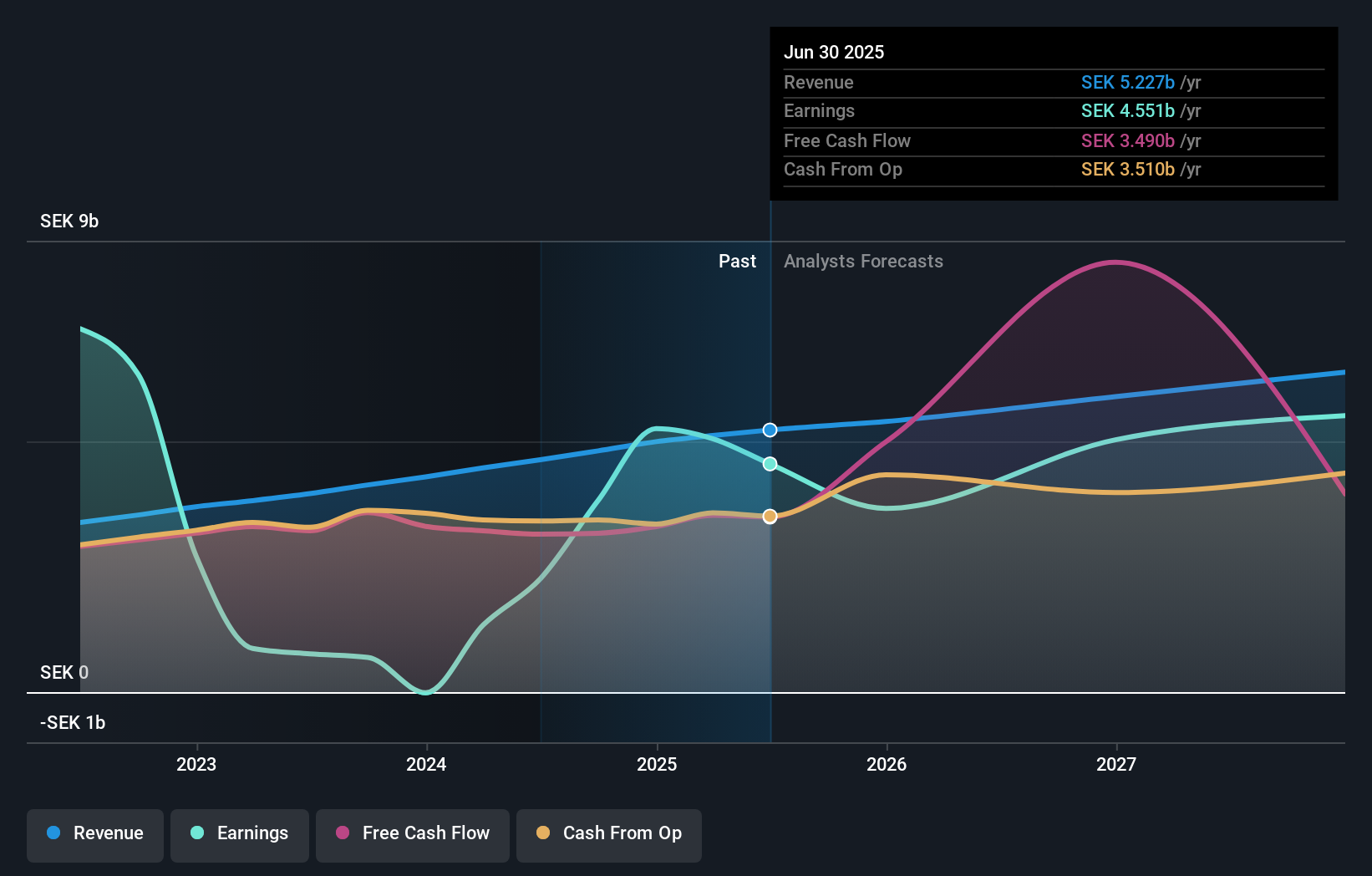

Operations: The company generates its revenue primarily through real estate rentals, amounting to SEK 4.47 billion.

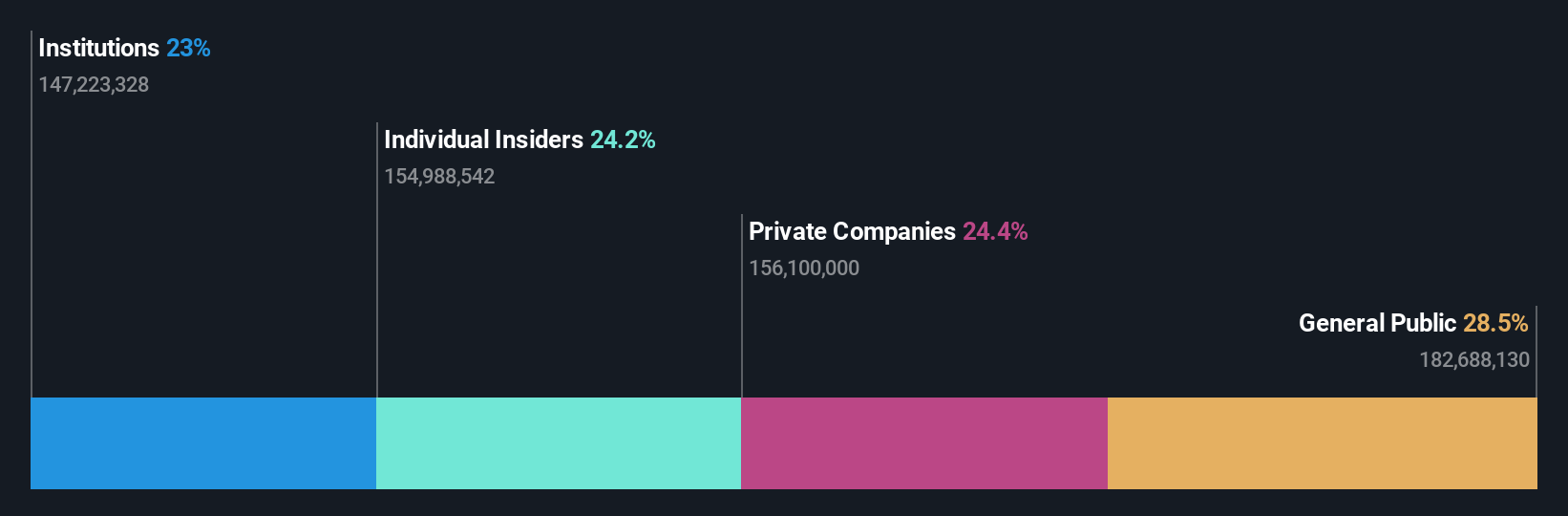

Insider Ownership: 28.3%

AB Sagax, a Swedish company, has shown robust growth with a 53.3% increase in earnings over the past year. Despite shareholder dilution and debt not well covered by operating cash flow, earnings are forecasted to grow at 33.4% annually, outpacing the Swedish market's 13.9%. Recent financial activities include issuing €500 million in green bonds to support corporate initiatives under its Green Finance Framework and approving dividends for its shareholders, reflecting confidence in ongoing financial health and commitment to growth.

- Click here and access our complete growth analysis report to understand the dynamics of AB Sagax.

- Our expertly prepared valuation report AB Sagax implies its share price may be too high.

Wallenstam (OM:WALL B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a Swedish property company with a market capitalization of approximately SEK 32.43 billion.

Operations: The company generates its revenue primarily from two key cities, with SEK 1.89 billion from Gothenburg and SEK 0.92 billion from Stockholm.

Insider Ownership: 35%

Wallenstam, a Swedish growth company with high insider ownership, has seen substantial insider buying over the past three months without any significant selling. Despite a challenging financial position where interest payments are poorly covered by earnings, Wallenstam's recent performance shows promise. In Q1 2024, net income surged to SEK 333 million from SEK 48 million year-over-year, with revenue also increasing. However, the forecasted Return on Equity remains low at 4.6%, suggesting cautious optimism is warranted for potential investors.

- Click here to discover the nuances of Wallenstam with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Wallenstam shares in the market.

Turning Ideas Into Actions

- Discover the full array of 85 Fast Growing Swedish Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAGA A

AB Sagax

Operates as a property company in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives