- Italy

- /

- Diversified Financial

- /

- BIT:BFF

3 European Stocks That May Be Priced Below Their Estimated Value In May 2025

Reviewed by Simply Wall St

As European markets continue to navigate mixed signals amid hopes for easing trade tensions and recent monetary policy adjustments, the pan-European STOXX Europe 600 Index has shown resilience, rising for a fourth consecutive week. In this environment of cautious optimism, identifying stocks that may be priced below their estimated value requires careful consideration of their fundamentals and potential for growth despite broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Benefit Systems (WSE:BFT) | PLN3480.00 | PLN6957.37 | 50% |

| adidas (XTRA:ADS) | €223.60 | €443.59 | 49.6% |

| Lectra (ENXTPA:LSS) | €24.35 | €47.74 | 49% |

| Arcure (ENXTPA:ALCUR) | €4.64 | €9.28 | 50% |

| Tesmec (BIT:TES) | €0.0567 | €0.11 | 49.5% |

| Boreo Oyj (HLSE:BOREO) | €15.80 | €31.18 | 49.3% |

| Montana Aerospace (SWX:AERO) | CHF20.15 | CHF39.80 | 49.4% |

| MilDef Group (OM:MILDEF) | SEK222.00 | SEK443.08 | 49.9% |

| illimity Bank (BIT:ILTY) | €3.652 | €7.23 | 49.5% |

| Bactiguard Holding (OM:BACTI B) | SEK31.10 | SEK61.56 | 49.5% |

Let's explore several standout options from the results in the screener.

BFF Bank (BIT:BFF)

Overview: BFF Bank S.p.A. operates in non-recourse factoring and credit management for public administration bodies and private hospitals across several European countries, with a market cap of €1.65 billion.

Operations: BFF Bank S.p.A. generates revenue through non-recourse factoring and credit management services provided to public administration entities and private hospitals in various European nations, including Italy, Croatia, the Czech Republic, France, Greece, Poland, Portugal, Slovakia, and Spain.

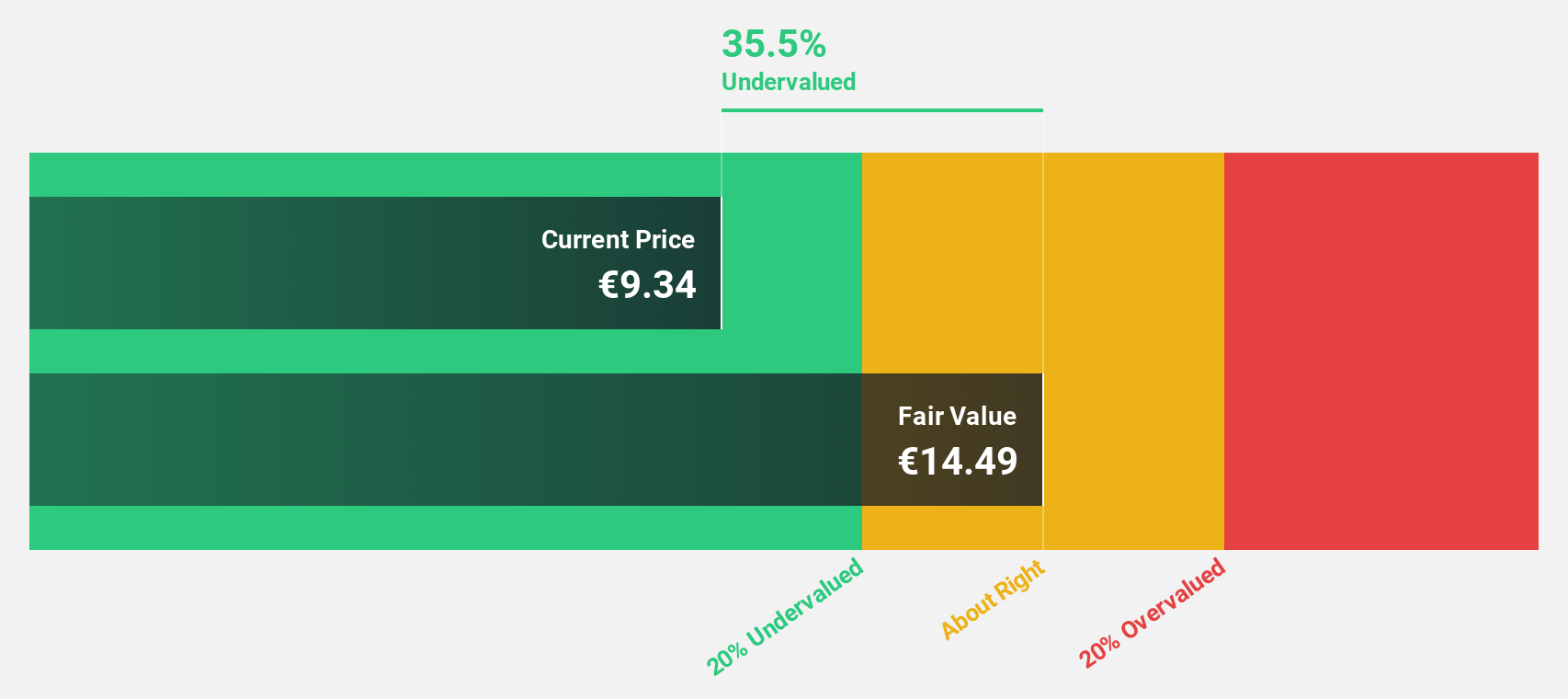

Estimated Discount To Fair Value: 37%

BFF Bank is trading at €8.76, significantly below its estimated fair value of €13.91, highlighting its undervaluation based on discounted cash flows. Despite a high debt level and an unstable dividend track record, BFF's earnings grew 30.3% last year and are forecast to grow annually by 7.5%, outpacing the Italian market's growth rate of 7.4%. The bank reported a net income of €35.4 million for Q1 2025, reinforcing its strong financial position relative to peers.

- Our growth report here indicates BFF Bank may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of BFF Bank.

Elopak (OB:ELO)

Overview: Elopak ASA is a company that manufactures and supplies paper-based packaging solutions for liquid food across Europe, the Middle East, Africa, Asia, the Americas, and internationally with a market cap of NOK12.24 billion.

Operations: Elopak generates revenue from its paper-based packaging solutions for liquid food across various regions, including Europe, the Middle East, Africa, Asia, and the Americas.

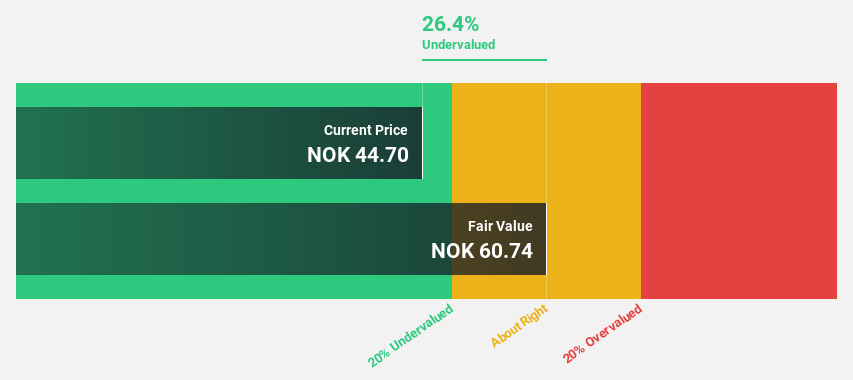

Estimated Discount To Fair Value: 25.1%

Elopak is trading at NOK45.55, over 20% below its fair value estimate of NOK60.81, indicating undervaluation based on discounted cash flows despite a high debt level and recent insider selling. Its revenue growth forecast of 5.2% annually surpasses the Norwegian market's 2.1%, while earnings are expected to grow at 12.7%, outpacing the market's 7.6%. Recent Q1 results showed increased sales but a decline in net income to EUR16.92 million from EUR21.5 million last year.

- The growth report we've compiled suggests that Elopak's future prospects could be on the up.

- Get an in-depth perspective on Elopak's balance sheet by reading our health report here.

Sveafastigheter (OM:SVEAF)

Overview: Sveafastigheter AB (publ) is a real estate company that owns, manages, and builds residential properties in Sweden, with a market cap of SEK7.20 billion.

Operations: Sveafastigheter AB (publ) generates revenue primarily through the ownership, management, and development of residential properties across Sweden.

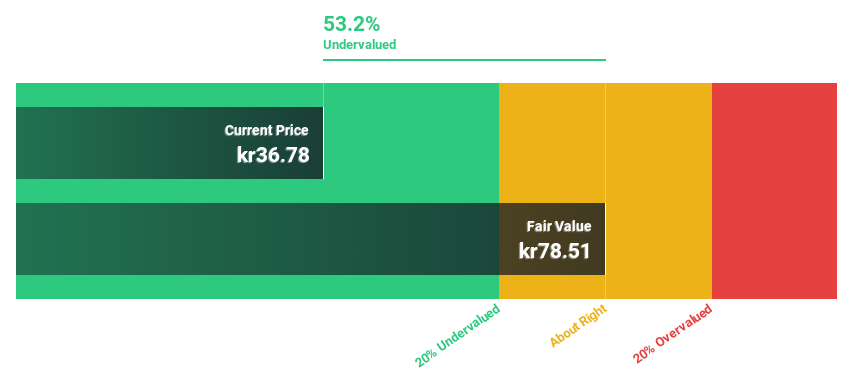

Estimated Discount To Fair Value: 24.6%

Sveafastigheter, trading at SEK36, is more than 20% below its estimated fair value of SEK47.76, highlighting potential undervaluation based on cash flows. Recent Q1 results showed sales increased to SEK 376 million from SEK 312 million a year ago, with net income improving to SEK 39 million from a previous loss. Despite slower forecasted revenue growth of 3.5% annually compared to the Swedish market's 4.2%, earnings are expected to grow significantly over the next three years.

- Insights from our recent growth report point to a promising forecast for Sveafastigheter's business outlook.

- Navigate through the intricacies of Sveafastigheter with our comprehensive financial health report here.

Taking Advantage

- Click through to start exploring the rest of the 177 Undervalued European Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BFF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BFF

BFF Bank

Engages in non-recourse factoring and credit management activities towards public administration bodies and private hospitals in Italy, Croatia, the Czech Republic, France, Greece, Poland, Portugal, Slovakia, and Spain.

Outstanding track record and undervalued.

Market Insights

Community Narratives