- Sweden

- /

- Real Estate

- /

- OM:PRISMA

Prisma Properties (OM:PRISMA) One-Off Gain Prompts Rethink on Recent Profit Quality

Reviewed by Simply Wall St

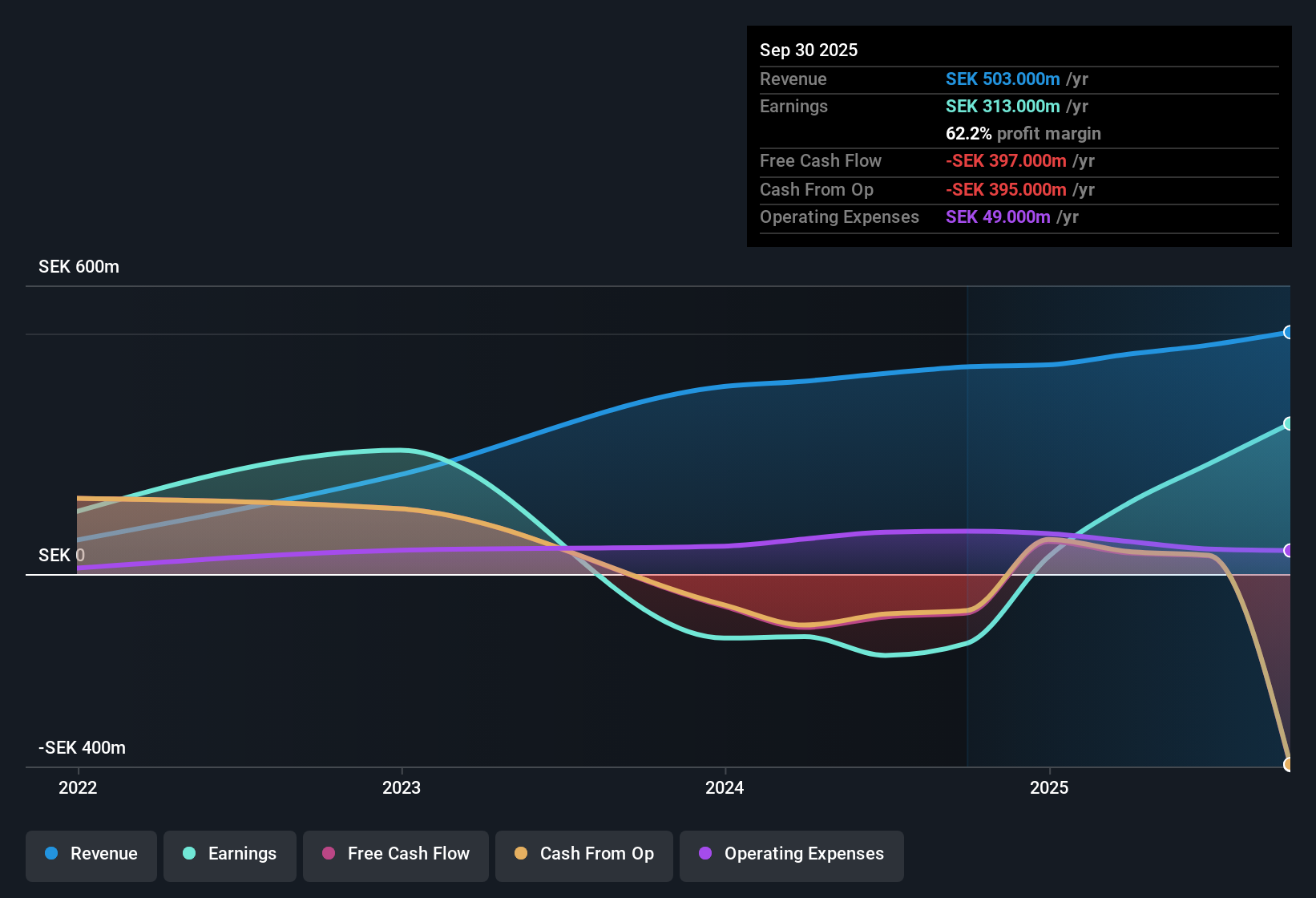

Prisma Properties (OM:PRISMA) saw its revenue forecast to climb 15.8% per year, while earnings are expected to grow 18.7% annually. This is well ahead of the Swedish market’s 3.8% revenue growth outlook. Over the past five years, Prisma’s earnings rose at a rate of 7.5% per year, and in the last 12 months up to September 30, 2025, the company posted a notable one-off gain of SEK180.0 million that could influence reported EPS quality. Investors are eyeing the company’s strong growth profile, though the presence of this significant non-recurring item means some caution is warranted when interpreting headline figures.

See our full analysis for Prisma Properties.Next, we’re putting these earnings numbers under the microscope alongside the popular narratives tracked by the community, to see which ones hold up and which ones may be in for a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off SEK180.0m Gain Alters Profit Quality Picture

- Prisma’s most recent annual profit includes a substantial non-recurring gain of SEK180.0 million, which is material enough to influence how investors interpret the underlying business strength.

- What stands out is that, even as forecasts show an 18.7% earnings growth rate, this one-off gain means reported profit may look healthier than the ongoing underlying trend.

- Critics highlight that non-recurring items can mask the true earning power of the company, especially as this gain was singled out in the latest results.

- Bears argue this distorts headline figures and urge caution for those assessing Prisma’s current performance on reported numbers alone.

P/E Discount Points To Relative Value

- With a Price-to-Earnings Ratio of 13.3x, Prisma trades below the Swedish real estate average of 16.1x and peer average of 14.2x, which underscores a valuation gap that could appeal to value-focused investors.

- From a fundamental perspective, lower P/E multiples often reflect either lower growth prospects or additional perceived risks.

- It is notable that Prisma’s forecasted earnings growth outpaces the market, so this discount may not be fully justified by the company’s growth profile alone.

- This pricing could present an opportunity if the concerns about financial position or non-recurring gains prove less material over time.

Profitability Turns Positive Despite Cautions

- After several years of building momentum, Prisma reported profitability in the past year, with past five-year annual earnings growth running at 7.5% per year.

- Despite this steady improvement, bulls who point to accelerating earnings must grapple with risks flagged in company filings.

- The company’s newly positive bottom line is buoyed by the large SEK180.0 million gain, which tempers celebration until core operating profit increases on a more recurring basis.

- Bears highlight this as a reminder to track not just growth rates but also the quality and sustainability of earnings over time.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Prisma Properties's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Prisma’s recent profit is boosted by a one-off gain, raising concerns about the consistency and quality of its underlying earnings growth.

If you would rather focus on companies with more reliable, steady expansion, check out stable growth stocks screener (2101 results) to discover options with proven results across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PRISMA

Prisma Properties

Owns, develops, and leases properties in Sweden, Denmark, and Norway.

Moderate growth potential and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)