- Sweden

- /

- Real Estate

- /

- OM:PLAZ B

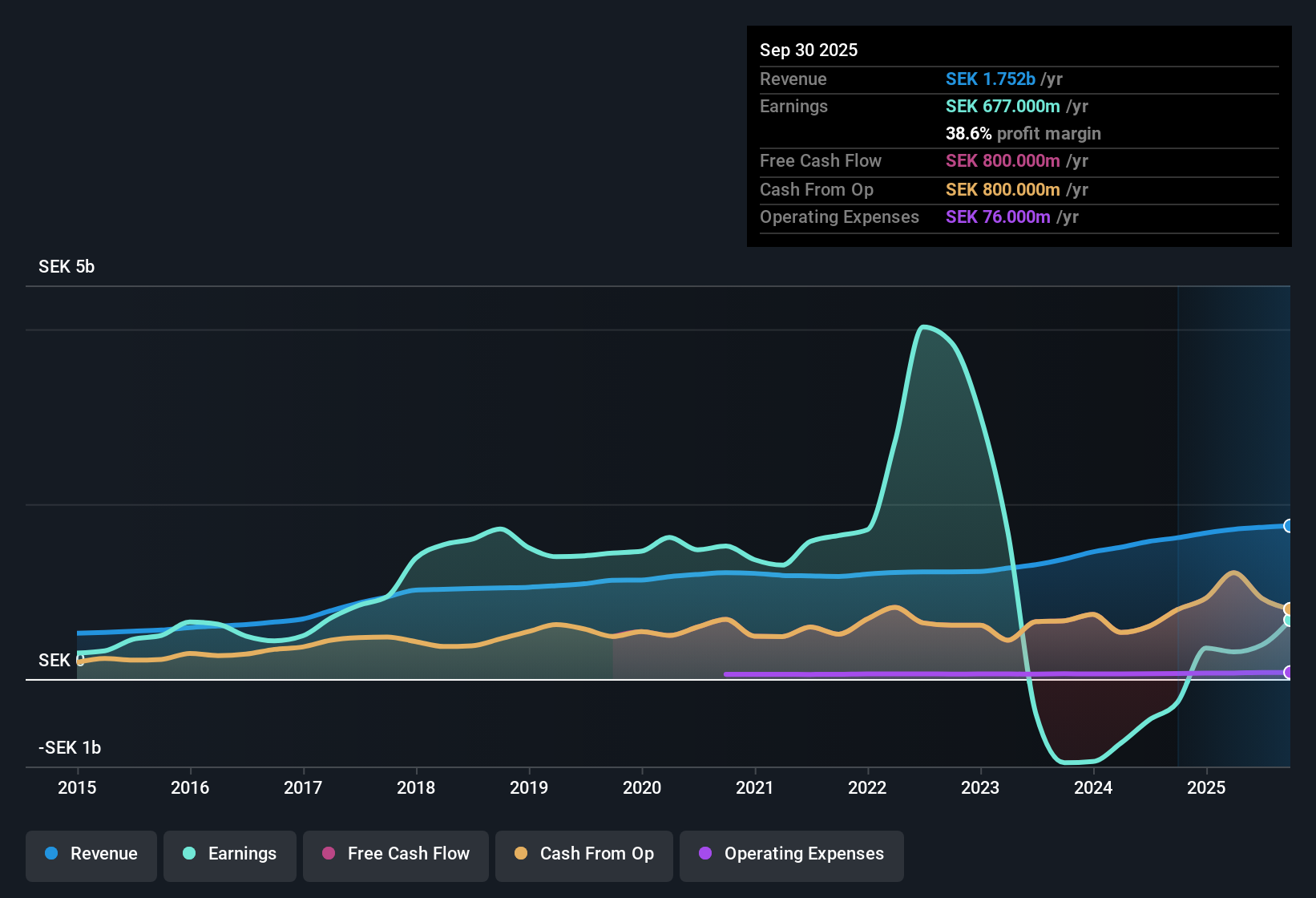

Platzer Fastigheter (OM:PLAZ B) Returns to Profitability, Challenging Prolonged Earnings Decline Narrative

Reviewed by Simply Wall St

Platzer Fastigheter Holding (OM:PLAZ B) has swung back into profitability over the last year, reversing a trend of declining earnings that saw a 34.7% annual drop over the previous five years. Looking ahead, analysts forecast earnings to grow at a robust 31.5% per year, more than double the Swedish market’s expected growth of 16.4%, even as revenue growth is projected to remain modest at 1.3% annually. With shares currently trading below their estimated fair value, the company’s combination of rising profits and an attractive valuation could pique investor interest.

See our full analysis for Platzer Fastigheter Holding.Next, we will see how the numbers measure up against the market’s current narratives for Platzer Fastigheter Holding. Some long-held views might be confirmed, while others could be upended.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Bounces Back to Positive

- Platzer Fastigheter Holding shifted from declining earnings over the past five years to a return to profitability, as shown by a positive net profit margin emerging in the latest year.

- Notably, the recent profit recovery contrasts with several years of sharp earnings declines. This signals a potential fundamental change, which differs from the cautious outlook that expects continued sector headwinds due to rising borrowing costs and pressured asset values.

- The 34.7% annual decline in earnings over five years suggested an entrenched slump. However, the latest turnaround challenges the bearish scenario of persistent sector pain.

- While macro concerns remain, the company’s ability to restore profitability despite low forecast revenue growth (1.3% annually) points to resilience that is often discounted in broader sector-level pessimism.

Financial Position: Risk Remains Center Stage

- The company’s financial position is identified as a major risk in recent filings, even as earnings momentum improves.

- Bears point out that, despite improved profit numbers, balance sheet vulnerability could limit upside if refinancing costs rise or property values weaken further.

- Recent profit gains do not erase balance sheet concerns, especially given exposure to sector-wide debt and refinancing risk amid a backdrop of more expensive borrowing.

- The muted revenue growth forecast, just 1.3% per year compared to the Swedish market’s 4.9%, leaves little room to absorb shocks if sector pressures intensify.

Valuation: Premium to Industry, Discount to Fair Value

- Shares currently trade at SEK70.6, with a 21.7x P/E ratio. This is above the Swedish real estate industry average of 16.8x, yet below the estimated DCF fair value of SEK79.21 and well below the price target of 90.00.

- Market watchers note that this valuation gap complicates a straightforward value argument, since premium earnings multiples can coexist with perceived mispricing, especially when the share price trails both sector targets and DCF-based estimates.

- Even as high-quality recent earnings and a discounted share price offer appeal, the P/E premium suggests investors remain cautious, likely reflecting the risk profile outlined above.

- The substantial gap to fair value (SEK70.6 vs SEK79.21 DCF estimate and 90.00 price target) suggests upside if growth and balance sheet stability persist. However, sector sensitivity may keep multiples in check in the near term.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Platzer Fastigheter Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite improving profits, Platzer Fastigheter Holding remains exposed to sector-wide debt and refinancing risk. Its balance sheet could be vulnerable if market pressures intensify.

If you want to focus on companies with stronger finances and healthier liquidity, start your search with solid balance sheet and fundamentals stocks screener to identify businesses better equipped to withstand financial shocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PLAZ B

Platzer Fastigheter Holding

Operates as a commercial real estate company in Sweden.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives