- Sweden

- /

- Real Estate

- /

- OM:OP

Oscar Properties Holding AB (publ) (STO:OP) Stock Rockets 484% But Many Are Still Ignoring The Company

Those holding Oscar Properties Holding AB (publ) (STO:OP) shares would be relieved that the share price has rebounded 484% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 47% in the last twelve months.

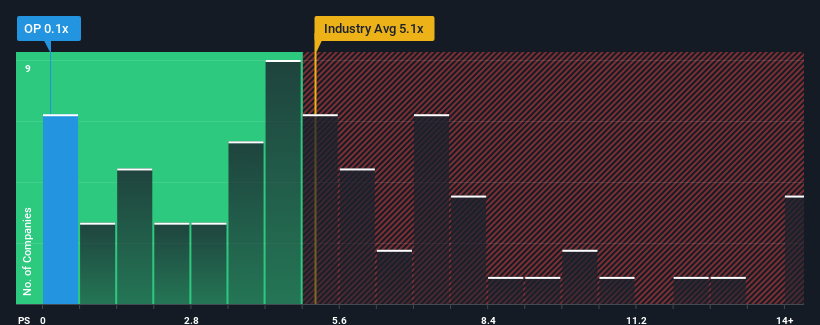

Even after such a large jump in price, Oscar Properties Holding may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Real Estate industry in Sweden have P/S ratios greater than 5.1x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Oscar Properties Holding

How Oscar Properties Holding Has Been Performing

While the industry has experienced revenue growth lately, Oscar Properties Holding's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Oscar Properties Holding's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Oscar Properties Holding's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 239% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 3.7%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Oscar Properties Holding's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Oscar Properties Holding's P/S

Shares in Oscar Properties Holding have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Oscar Properties Holding's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 6 warning signs for Oscar Properties Holding (5 shouldn't be ignored) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:OP

Oscar Properties Holding

Oscar Properties Holding AB (publ) purchases, develops, manages, and sells real estate properties in Stockholm.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives