- Sweden

- /

- Real Estate

- /

- OM:FPAR A

Exploring 3 Promising Undervalued Small Caps With Insider Activity In Global

Reviewed by Simply Wall St

In recent weeks, global markets have shown a mixed performance, with the S&P 500 and Nasdaq Composite reaching new highs driven by strong corporate earnings, while small-cap stocks like those in the Russell 2000 have also seen positive movement. Amidst this backdrop of consumer strength and manageable inflation levels, investors are increasingly attentive to small-cap opportunities that may be overlooked yet exhibit potential through insider activity. Identifying promising stocks often involves looking at those with solid fundamentals and insider confidence, which can signal alignment between management interests and shareholder value.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Daiwa House Logistics Trust | 11.5x | 7.0x | 20.34% | ★★★★★☆ |

| Lion Rock Group | 5.2x | 0.4x | 49.16% | ★★★★☆☆ |

| Sagicor Financial | 10.1x | 0.4x | -168.30% | ★★★★☆☆ |

| CVS Group | 44.3x | 1.3x | 40.07% | ★★★★☆☆ |

| Seeing Machines | NA | 2.8x | 45.78% | ★★★★☆☆ |

| A.G. BARR | 19.9x | 1.9x | 45.02% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.8x | 0.5x | -129.04% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.6x | 1.8x | 12.88% | ★★★☆☆☆ |

| Chinasoft International | 24.6x | 0.7x | 10.59% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 11.8x | 0.7x | 2.55% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Stelrad Group (LSE:SRAD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Stelrad Group specializes in the manufacture and distribution of radiators, with a market capitalization of approximately £0.17 billion.

Operations: The primary revenue stream for the company is from the manufacture and distribution of radiators, with recent figures showing revenue at £290.58 million. The cost of goods sold (COGS) was £201.62 million, resulting in a gross profit of £88.96 million and a gross profit margin of 30.61%. Operating expenses are significant, with sales and marketing being a notable component at £41.73 million, contributing to an overall operating expense total of £59.34 million. Net income stands at £16.52 million, reflecting a net income margin of 5.68%.

PE: 13.3x

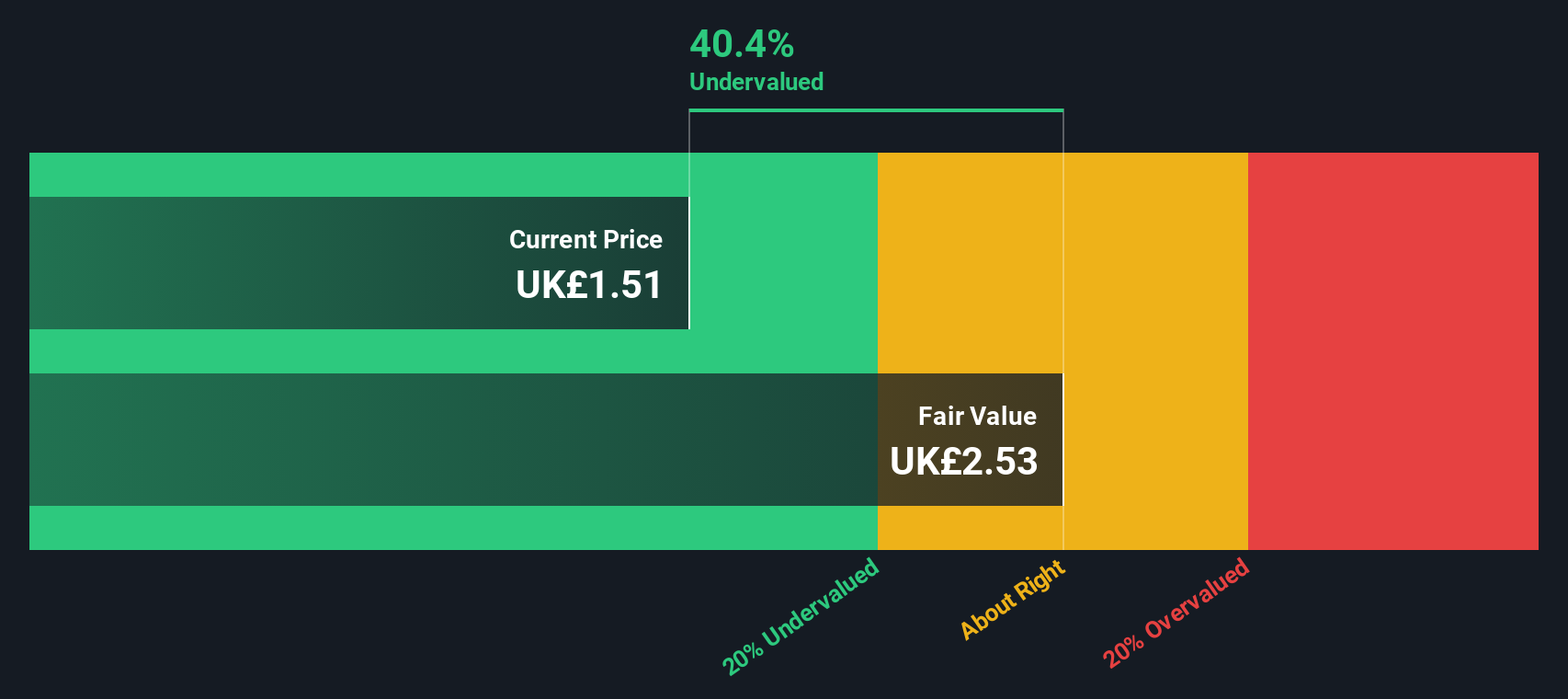

Stelrad Group, a smaller company in its sector, recently declared a final dividend of 4.81 pence per share for 2024, reflecting financial stability despite relying on external borrowing. With earnings projected to grow nearly 10% annually, this growth potential indicates value not fully recognized by the market. Insider confidence is evident with recent share purchases by key figures in the past months. As they prepare to release Q1 results soon, investors might find opportunities amidst their strategic positioning and industry dynamics.

- Click here to discover the nuances of Stelrad Group with our detailed analytical valuation report.

Review our historical performance report to gain insights into Stelrad Group's's past performance.

FastPartner (OM:FPAR A)

Simply Wall St Value Rating: ★★★☆☆☆

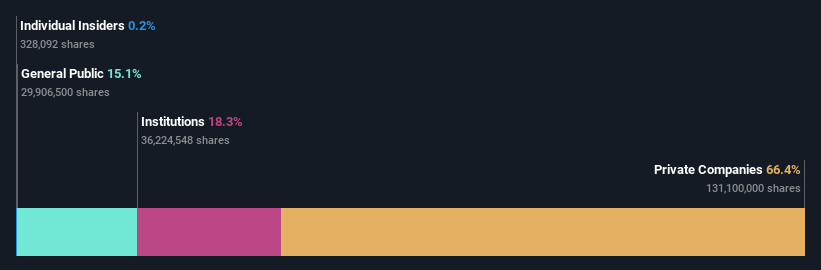

Overview: FastPartner is a Swedish real estate company specializing in property management across multiple regions, with a market capitalization of approximately SEK 11.41 billion.

Operations: FastPartner generates revenue primarily from property management across three regions, with Region 1 contributing the highest portion. The company has experienced fluctuations in its net income margin, reaching a peak of 1.84% in December 2019 and declining to -0.88% by June 2023. Gross profit margins have shown relative stability, hovering around the low to mid-70s percentile range over recent periods. Operating expenses have remained consistent, with general and administrative expenses being a significant component.

PE: 17.5x

FastPartner, a company in the smaller market segment, recently reported a decline in Q1 2025 net income to SEK 141.6 million from SEK 203.3 million the previous year, while sales slightly decreased to SEK 571.5 million. Despite these challenges, insider confidence is evident with recent share purchases over the past three months, signaling belief in future growth prospects. The company relies entirely on external borrowing for funding and anticipates earnings growth of around 24% annually, presenting potential opportunities amidst financial risks.

Chinasoft International (SEHK:354)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chinasoft International is a leading IT services provider offering technology professional services and internet information technology solutions, with a market cap of HK$13.44 billion.

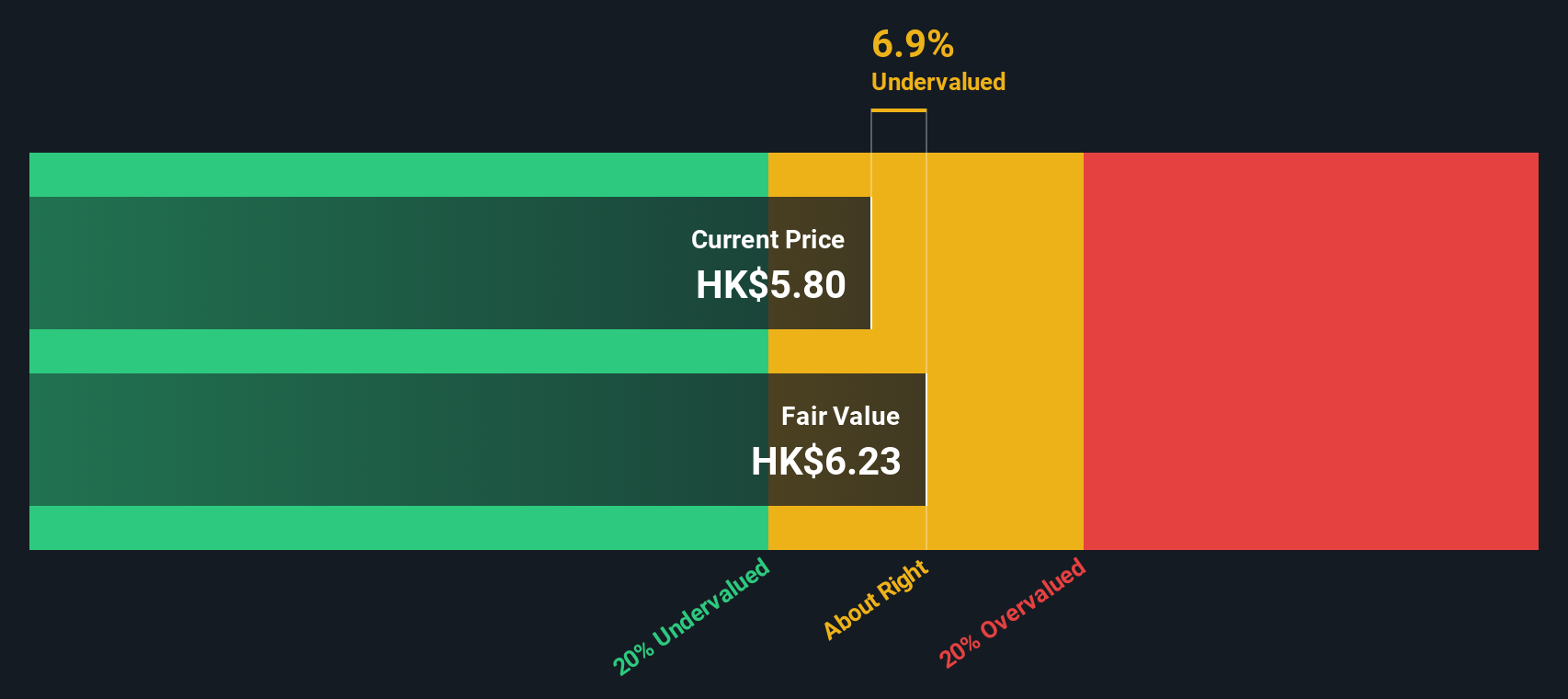

Operations: The company's primary revenue streams are from its Technology Professional Services Group and Internet Information Technology Services Group, with the former generating significantly higher revenue. Over recent periods, the gross profit margin has shown a decreasing trend, reaching 22.07% by the end of 2024. Operating expenses have been substantial, with notable allocations towards sales and marketing as well as research and development efforts.

PE: 24.6x

Chinasoft International, a smaller company in the tech industry, showcases potential with its strategic alliances and innovative product launches. Recently, they partnered with Beijing SiliconFlow to enhance AI solutions for digital transformation across various sectors. Additionally, insiders showed confidence by purchasing shares between May and June 2025. Despite relying on external borrowing for funding, Chinasoft's focus on AI platforms and HarmonyOS integration could drive future growth opportunities within key industries like energy and finance.

- Take a closer look at Chinasoft International's potential here in our valuation report.

Evaluate Chinasoft International's historical performance by accessing our past performance report.

Next Steps

- Embark on your investment journey to our 121 Undervalued Global Small Caps With Insider Buying selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FPAR A

FastPartner

A real estate company, owns, develops, and manages residential and commercial properties in Sweden.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives