- United Kingdom

- /

- Retail REITs

- /

- LSE:NRR

3 Undervalued European Small Caps With Insider Activity

Reviewed by Simply Wall St

As European markets grapple with trade tariff concerns and monetary policy uncertainties, the STOXX Europe 600 Index recently dipped by 1.23%, reflecting a cautious sentiment among investors. Despite these challenges, small-cap stocks in Europe present intriguing opportunities, particularly when insider activity suggests confidence from those closest to the companies. In such an environment, identifying stocks that exhibit both potential for growth and strong insider involvement can be key to navigating market volatility effectively.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.3x | 4.9x | 23.96% | ★★★★★★ |

| Macfarlane Group | 10.4x | 0.6x | 41.22% | ★★★★★★ |

| 4imprint Group | 12.4x | 1.1x | 47.97% | ★★★★★★ |

| J D Wetherspoon | 14.4x | 0.3x | 38.56% | ★★★★★★ |

| Robert Walters | NA | 0.2x | 45.77% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 25.65% | ★★★★★☆ |

| Gamma Communications | 21.7x | 2.2x | 37.99% | ★★★★☆☆ |

| Nyab | 22.1x | 1.1x | 41.10% | ★★★★☆☆ |

| Franchise Brands | 39.0x | 2.0x | 25.90% | ★★★★☆☆ |

| Optima Health | NA | 1.6x | 42.25% | ★★★★☆☆ |

We'll examine a selection from our screener results.

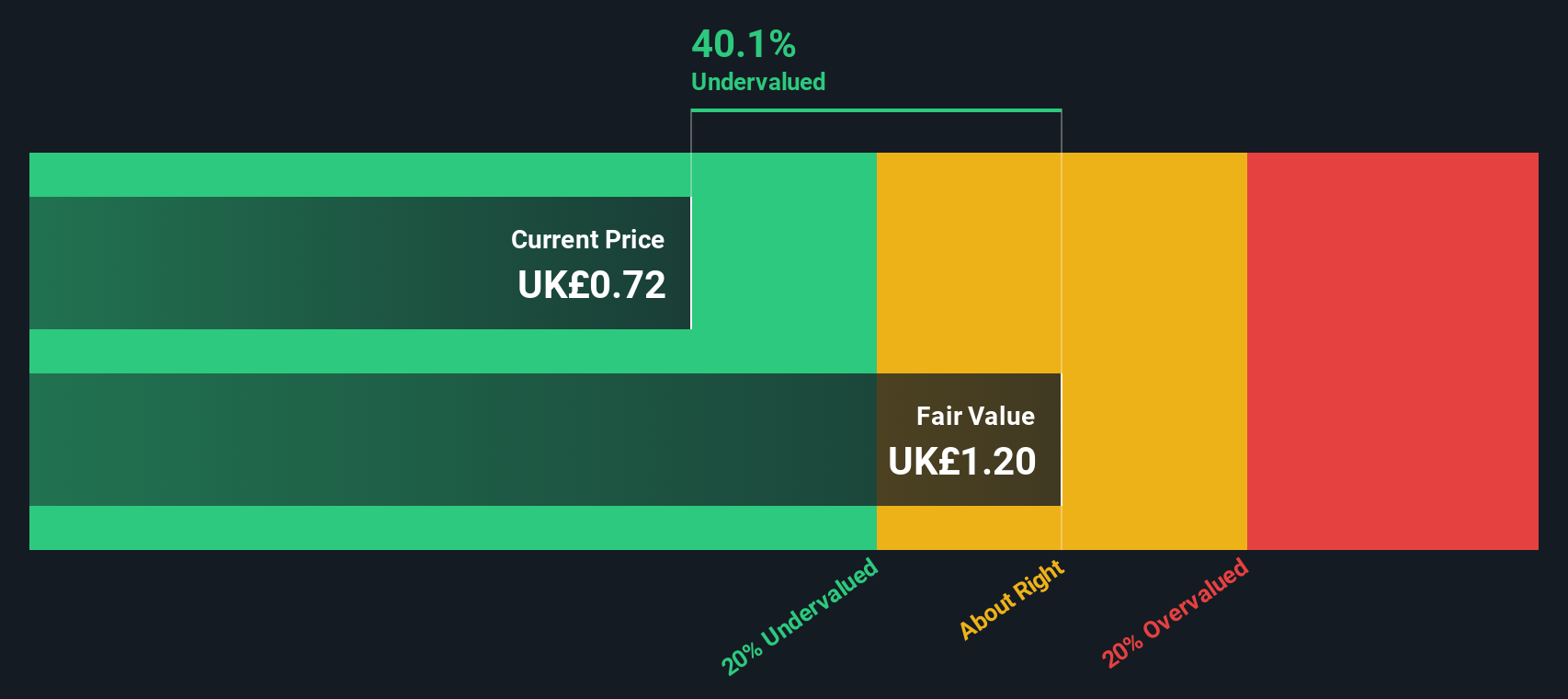

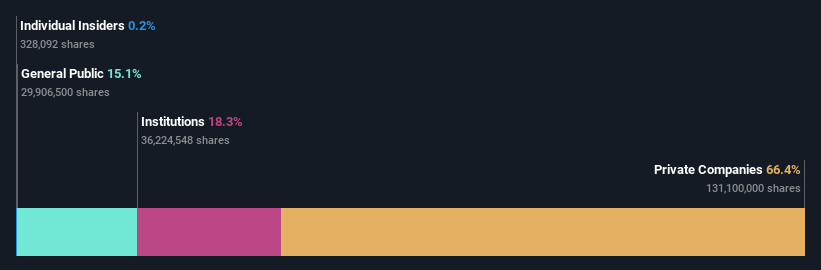

NewRiver REIT (LSE:NRR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NewRiver REIT is a UK-based real estate investment trust focused on acquiring, managing, and developing retail and leisure properties across the United Kingdom, with a market capitalization of approximately £0.27 billion.

Operations: NewRiver REIT's revenue streams are primarily driven by its gross profit, which has shown a notable trend with a recent gross profit margin of 71.32% as of September 2024. The company's cost structure includes significant general and administrative expenses, which were £13.7 million in the same period. Additionally, non-operating expenses have varied significantly over time, impacting net income results.

PE: 24.4x

NewRiver REIT, a smaller European stock, is tapping into new growth avenues. Recently partnering with Royal Mail to install parcel lockers across 60 shopping centres and retail parks, NewRiver aims to boost foot traffic and revenue. A new Sainsbury's lease at Cuckoo Bridge Retail Park highlights strategic leasing efforts, improving rental terms by 60%. Despite past shareholder dilution and reliance on external borrowing for funding, earnings are projected to grow by 48% annually.

- Get an in-depth perspective on NewRiver REIT's performance by reading our valuation report here.

Evaluate NewRiver REIT's historical performance by accessing our past performance report.

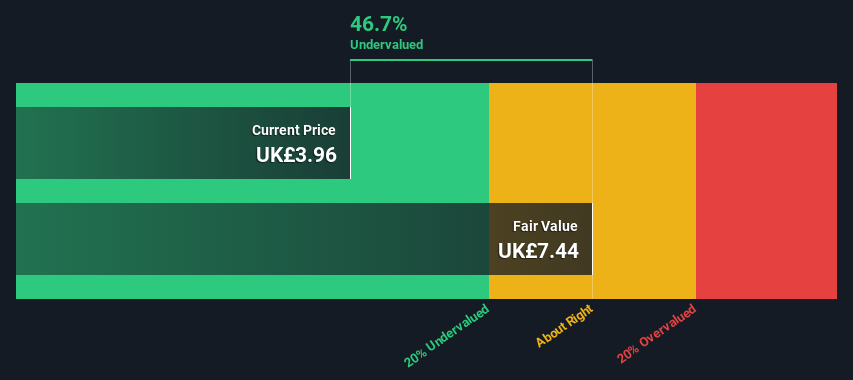

Vesuvius (LSE:VSVS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vesuvius is a global leader in molten metal flow engineering, providing products and services primarily for the steel and foundry industries, with a market capitalization of approximately £1.5 billion.

Operations: The company's revenue is primarily driven by its Steel - Flow Control and Advanced Refractories segments, contributing significantly to the overall total. Over recent periods, the gross profit margin has shown a trend of being around 27-28%. Operating expenses are a notable part of the cost structure, with general and administrative expenses consistently forming a substantial portion.

PE: 11.3x

Vesuvius, a smaller European stock, has caught attention with its strategic moves. The company recently completed a share repurchase of nearly 3 million shares for £15.5 million, indicating potential value recognition by the management. Insider confidence is evident as they have been actively purchasing shares over the past months. Despite relying on external borrowing for funding, Vesuvius is poised for growth with earnings projected to increase by 12% annually. A proposed dividend hike further enhances its appeal to investors seeking income alongside growth prospects.

- Delve into the full analysis valuation report here for a deeper understanding of Vesuvius.

Examine Vesuvius' past performance report to understand how it has performed in the past.

FastPartner (OM:FPAR A)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: FastPartner is a real estate company focused on property management across multiple regions, with a market capitalization of approximately SEK 10.65 billion.

Operations: The company generates revenue primarily through property management across three regions, with Region 1 contributing the largest portion. Over recent periods, the gross profit margin has shown a slight upward trend, reaching 71.45% by September 2023. Operating expenses have remained relatively stable around SEK 46 million to SEK 47 million in recent quarters. Non-operating expenses have fluctuated significantly, impacting net income margins which turned negative in several periods before returning to positive territory by December 2024.

PE: 17.0x

FastPartner, a European stock with a smaller market capitalization, recently reported improved financial results. For Q4 2024, sales reached SEK 566.2 million and net income was SEK 159.2 million, marking a substantial turnaround from the previous year's loss. Annual sales hit SEK 2.29 billion with net income of SEK 648 million. Insider confidence is evident as insiders purchased shares in February 2025, suggesting belief in future growth despite reliance on higher-risk external funding and insufficient earnings to cover interest payments fully.

- Navigate through the intricacies of FastPartner with our comprehensive valuation report here.

Understand FastPartner's track record by examining our Past report.

Summing It All Up

- Discover the full array of 57 Undervalued European Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewRiver REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:NRR

NewRiver REIT

NewRiver REIT plc ('NewRiver') is a leading Real Estate Investment Trust specialising in buying, managing and developing resilient retail assets throughout the UK.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives