- United Kingdom

- /

- Electrical

- /

- AIM:VLX

European Insider Buying Insights Into 3 Undervalued Small Caps

Reviewed by Simply Wall St

In recent weeks, European markets have shown resilience, with the pan-European STOXX Europe 600 Index climbing 3.93% amid positive investor sentiment driven by delayed tariff implementations and signals of further interest rate cuts by the European Central Bank. This environment has sparked renewed interest in small-cap stocks, which often thrive during periods of economic optimism due to their growth potential and agility in adapting to changing market conditions. Identifying promising small-cap stocks involves assessing factors such as financial health, market positioning, and insider activity—elements that can indicate underlying value even when broader market trends are uncertain.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.5x | 0.5x | 43.46% | ★★★★★★ |

| Tristel | 27.2x | 3.8x | 28.07% | ★★★★★☆ |

| J D Wetherspoon | 11.4x | 0.3x | 35.47% | ★★★★★☆ |

| Savills | 23.8x | 0.5x | 42.83% | ★★★★☆☆ |

| Speedy Hire | NA | 0.2x | 3.37% | ★★★★☆☆ |

| Norcros | 24.4x | 0.6x | 27.90% | ★★★☆☆☆ |

| FRP Advisory Group | 12.6x | 2.2x | 8.69% | ★★★☆☆☆ |

| Italmobiliare | 10.9x | 1.4x | -259.01% | ★★★☆☆☆ |

| Arendals Fossekompani | 21.0x | 1.6x | 47.83% | ★★★☆☆☆ |

| FastPartner | 15.1x | 4.3x | -67.76% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Volex (AIM:VLX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Volex is a global manufacturer and supplier of complex assemblies for performance-critical applications, with a market cap of approximately £0.85 billion.

Operations: Volex's revenue has shown a consistent upward trajectory, reaching $1.03 billion by 2025. The company has experienced fluctuations in its gross profit margin, which was at 22.74% in the latest period analyzed. Operating expenses have been rising alongside revenue growth, with general and administrative expenses being a significant component of these costs. Net income margin reflects gradual improvement over time, indicating enhanced profitability despite increased non-operating expenses.

PE: 13.5x

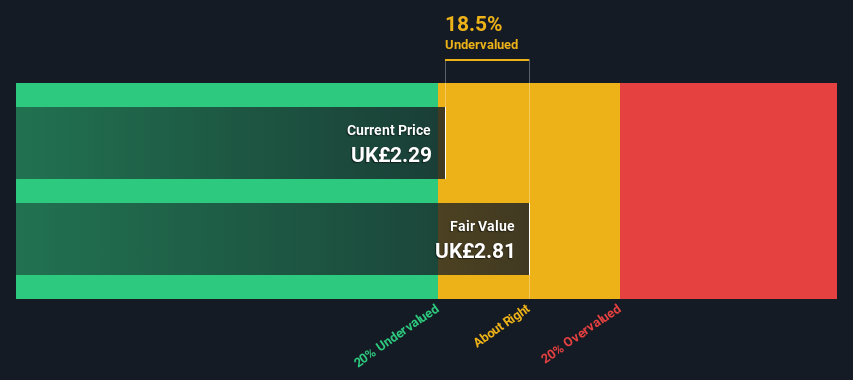

Volex, a European small-cap stock, is gaining attention for its potential value. Despite facing legal challenges from Credo Technology over patent issues, the company projects strong growth with expected 2025 revenue of at least $1.06 billion and operating profit surpassing market estimates at $100 million. Insider confidence is evident as Nathaniel Philip Victor Rothschild recently purchased 102,797 shares for approximately $225,825 in January 2025. However, Volex's reliance on external borrowing raises some financial risk concerns amidst its promising earnings forecast of 13% annual growth.

- Delve into the full analysis valuation report here for a deeper understanding of Volex.

Evaluate Volex's historical performance by accessing our past performance report.

C&C Group (LSE:CCR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: C&C Group is a beverage company that produces and distributes alcoholic drinks, including cider and beer, with a market capitalization of approximately €0.88 billion.

Operations: C&C Group's revenue has shown fluctuations, with a peak of €1.68 billion in 2023. The company's cost of goods sold (COGS) consistently represents a significant portion of revenue, impacting the gross profit margin which was 23.23% as of August 2024. Operating expenses have remained substantial, contributing to variations in net income across periods. Notably, non-operating expenses have also influenced net income outcomes significantly over time.

PE: -4.9x

C&C Group, a European beverage company, has caught attention with significant insider confidence. Ralph Findlay's purchase of 66,183 shares for approximately £99,003 in early 2025 highlights this confidence. Despite relying entirely on external borrowing for funding, which adds risk, the company's earnings are projected to grow by an impressive 88% annually. This potential growth offers intriguing prospects for investors considering smaller companies in Europe. Recent events include a special call and an anticipated earnings release on April 17th.

- Click to explore a detailed breakdown of our findings in C&C Group's valuation report.

Review our historical performance report to gain insights into C&C Group's's past performance.

Diös Fastigheter (OM:DIOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diös Fastigheter is a Swedish real estate company focused on owning and managing properties across several regions including Umeå, Gävle, Luleå, Dalarna, Sundsvall, Skellefteå, and Östersund/Åre with a market capitalization of approximately SEK 8.26 billion.

Operations: Diös Fastigheter generates revenue through its various regional segments, with significant contributions from locations like Luleå and Dalarna. Over the observed periods, the company has experienced fluctuations in net income margin, showing a notable change from 1.24% in March 2022 to -0.09% in June 2024. The gross profit margin has shown an upward trend reaching 69.07% by September 2024. Operating expenses have remained relatively stable around SEK 85 million to SEK 100 million throughout recent periods, impacting overall profitability alongside non-operating expenses which have varied significantly over time.

PE: 13.4x

Diös Fastigheter, a notable player in the European property market, has recently made strategic moves to enhance its portfolio. Acquiring centrally located properties in Sundsvall and Umea, while divesting non-core assets in Lulea, reflects their focus on growth and optimization. Insider confidence is evident with recent board changes approved at the AGM on April 7, 2025. With a dividend of SEK 2.20 per share for 2024 and improved earnings of SEK 691 million from a previous loss, Diös demonstrates resilience amidst financial challenges.

Summing It All Up

- Gain an insight into the universe of 63 Undervalued European Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VLX

Volex

Manufactures and sells power and data cables in North America, Europe, and Asia.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives