- Sweden

- /

- Real Estate

- /

- OM:BALD B

Fastighets AB Balder (STO:BALD B) shareholders have endured a 29% loss from investing in the stock three years ago

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Fastighets AB Balder (publ) (STO:BALD B) shareholders have had that experience, with the share price dropping 29% in three years, versus a market decline of about 9.6%. The falls have accelerated recently, with the share price down 13% in the last three months. Of course, this share price action may well have been influenced by the 6.5% decline in the broader market, throughout the period.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for Fastighets AB Balder

Given that Fastighets AB Balder didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Fastighets AB Balder grew revenue at 9.6% per year. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 9% per year, for three years. So the market has definitely lost some love for the stock. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

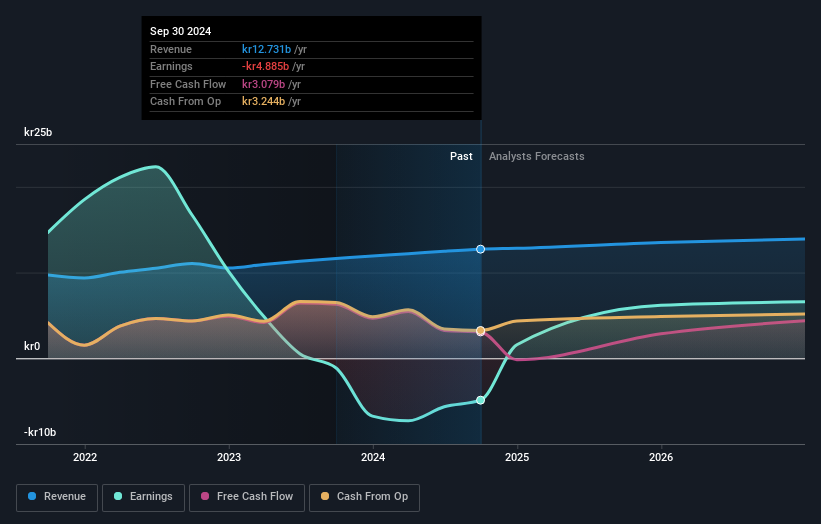

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Fastighets AB Balder's financial health with this free report on its balance sheet.

A Different Perspective

Fastighets AB Balder's TSR for the year was broadly in line with the market average, at 7.2%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 0.7%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Fastighets AB Balder (1 makes us a bit uncomfortable) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BALD B

Fastighets AB Balder

Develops, owns, and manages residential and commercial properties in Sweden, Denmark, Finland, Norway, Germany, and the United Kingdom.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives