- Sweden

- /

- Real Estate

- /

- OM:BALD B

Fastighets AB Balder (STO:BALD B) shareholders have earned a 2.1% CAGR over the last five years

Fastighets AB Balder (publ) (STO:BALD B) shareholders might be concerned after seeing the share price drop 15% in the last quarter. But at least the stock is up over the last five years. Unfortunately its return of 11% is below the market return of 76%.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

We've discovered 1 warning sign about Fastighets AB Balder. View them for free.There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

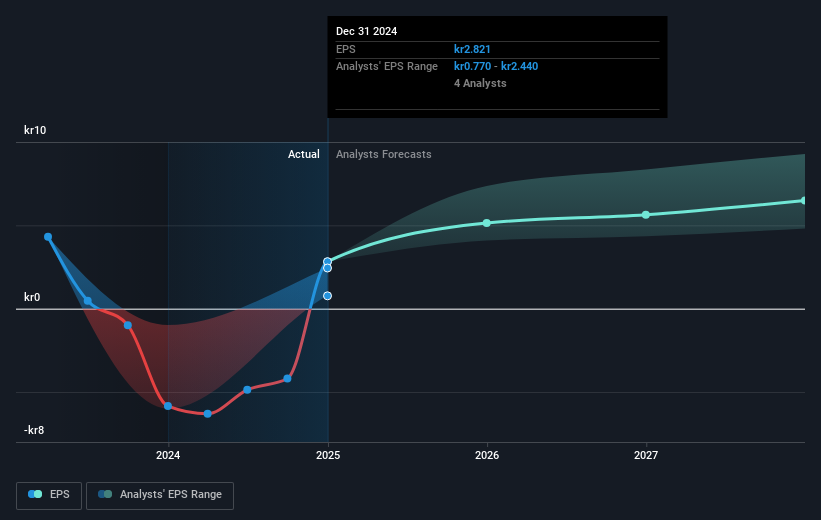

During the five years of share price growth, Fastighets AB Balder moved from a loss to profitability. That would generally be considered a positive, so we'd hope to see the share price to rise.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Fastighets AB Balder has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

While the broader market gained around 0.0005% in the last year, Fastighets AB Balder shareholders lost 2.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Fastighets AB Balder better, we need to consider many other factors. For instance, we've identified 1 warning sign for Fastighets AB Balder that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BALD B

Fastighets AB Balder

Develops, owns, leases, and manages residential and commercial properties in Sweden, Denmark, Finland, Norway, Germany, and the United Kingdom.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives