Even With A 30% Surge, Cautious Investors Are Not Rewarding Xbrane Biopharma AB (publ)'s (STO:XBRANE) Performance Completely

Those holding Xbrane Biopharma AB (publ) (STO:XBRANE) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 99% share price drop in the last twelve months.

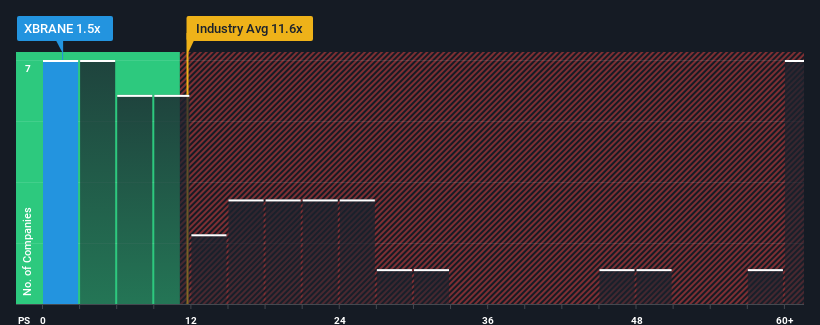

Although its price has surged higher, Xbrane Biopharma may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the Biotechs industry in Sweden have P/S ratios greater than 11.6x and even P/S higher than 27x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Xbrane Biopharma

What Does Xbrane Biopharma's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Xbrane Biopharma has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Xbrane Biopharma will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Xbrane Biopharma?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Xbrane Biopharma's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 109% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 44% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Xbrane Biopharma's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Xbrane Biopharma's P/S Mean For Investors?

Shares in Xbrane Biopharma have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Xbrane Biopharma's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 4 warning signs for Xbrane Biopharma you should be aware of, and 2 of them can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:XBRANE

Xbrane Biopharma

A biotechnology company, engages in the development, manufacture, and sale of biosimilars.

Exceptional growth potential moderate.