Investors in Vitrolife (STO:VITR) from a year ago are still down 38%, even after 6.6% gain this past week

Vitrolife AB (publ) (STO:VITR) shareholders should be happy to see the share price up 12% in the last month. But in truth the last year hasn't been good for the share price. In fact the stock is down 39% in the last year, well below the market return.

The recent uptick of 6.6% could be a positive sign of things to come, so let's take a look at historical fundamentals.

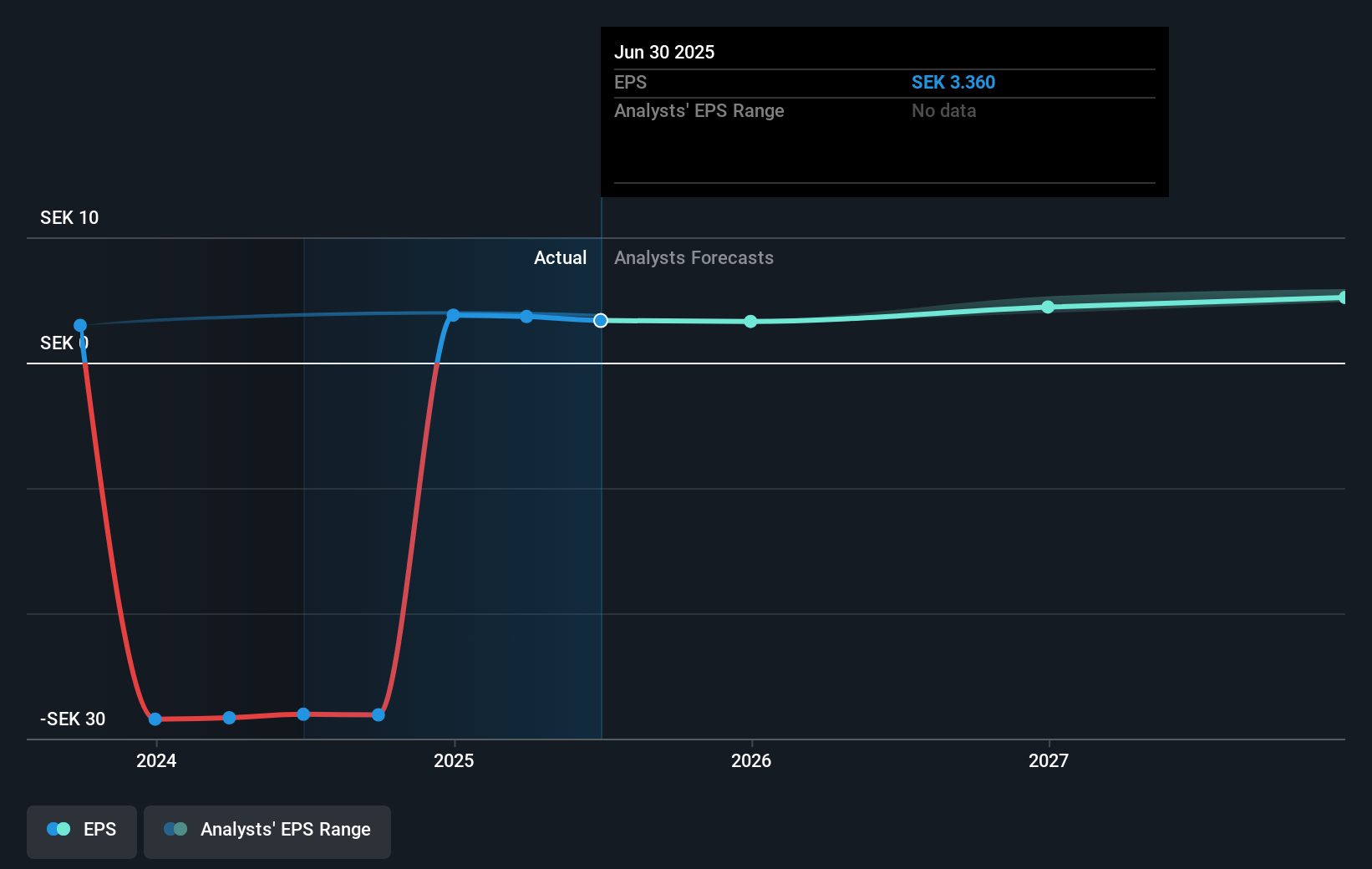

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Vitrolife grew its earnings per share, moving from a loss to a profit.

The result looks like a strong improvement to us, so we're surprised the market has sold down the shares. If the improved profitability is a sign of things to come, then right now may prove the perfect time to pop this stock on your watchlist.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Vitrolife has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

Vitrolife shareholders are down 38% for the year (even including dividends), but the market itself is up 1.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before deciding if you like the current share price, check how Vitrolife scores on these 3 valuation metrics.

Of course Vitrolife may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:VITR

Vitrolife

Provides assisted reproduction products in Europe, the Middle East, Africa, Asia-Pacific, and the Americas.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives