Despite shrinking by kr109m in the past week, Saniona (STO:SANION) shareholders are still up 278% over 1 year

It's been a soft week for Saniona AB (publ) (STO:SANION) shares, which are down 11%. But that doesn't detract from the splendid returns of the last year. Indeed, the share price is up an impressive 278% in that time. So it may be that the share price is simply cooling off after a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

View our latest analysis for Saniona

We don't think Saniona's revenue of kr26,662,000 is enough to establish significant demand. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Saniona has the funding to invent a new product before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Saniona has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

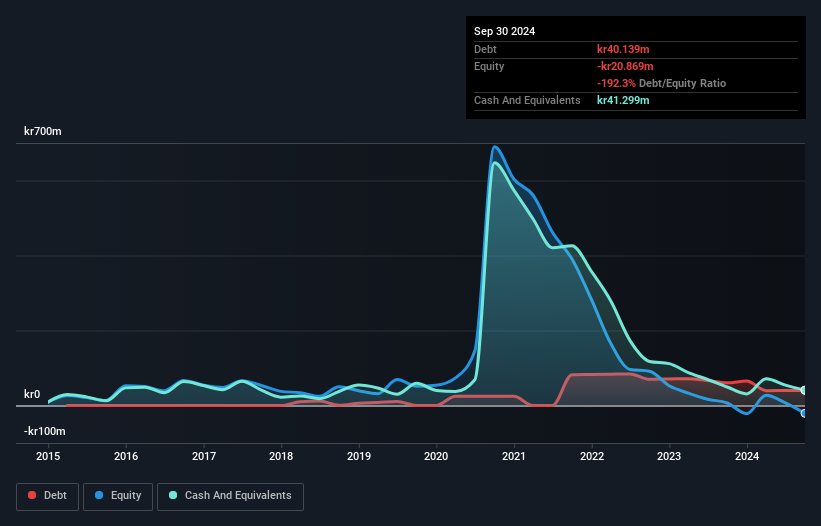

Our data indicates that Saniona had kr61m more in total liabilities than it had cash, when it last reported in September 2024. That puts it in the highest risk category, according to our analysis. So we're surprised to see the stock up 61% in the last year , but we're happy for holders. It's clear more than a few people believe in the potential. You can see in the image below, how Saniona's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's good to see that Saniona has rewarded shareholders with a total shareholder return of 278% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Saniona better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 6 warning signs for Saniona (of which 4 are a bit unpleasant!) you should know about.

We will like Saniona better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

If you're looking to trade Saniona, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SANION

Saniona

A clinical-stage biopharmaceutical company, engages in the research, development, and commercialization of treatments for rare disease patients in Sweden, the United States, Germany, Denmark, and the United Kingdom.

Excellent balance sheet and good value.

Market Insights

Community Narratives