Isofol Medical (STO:ISOFOL) Has Gifted Shareholders With A Fantastic 127% Total Return On Their Investment

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. For example, the Isofol Medical AB (publ) (STO:ISOFOL) share price is up 63% in the last year, clearly besting the market return of around 28% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! However, the stock hasn't done so well in the longer term, with the stock only up 10.0% in three years.

View our latest analysis for Isofol Medical

Isofol Medical isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Isofol Medical saw its revenue grow by 221%. That's well above most other pre-profit companies. The solid 63% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. So quite frankly it could be a good time to investigate Isofol Medical in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

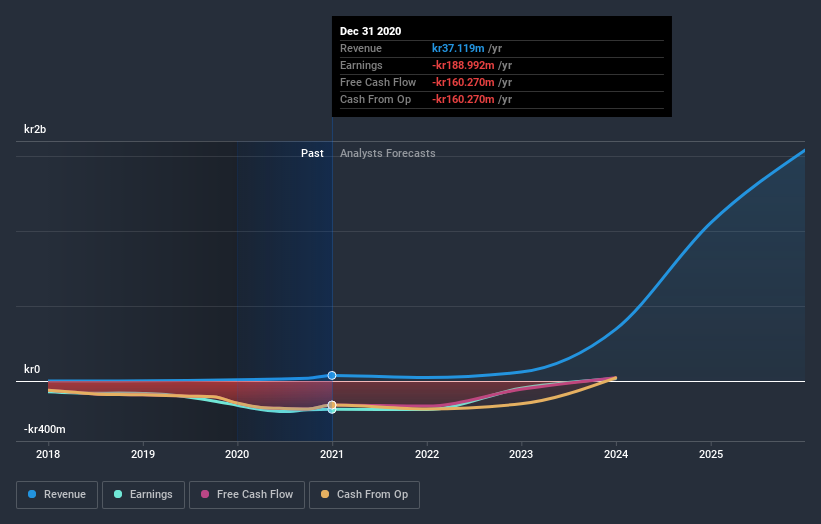

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Isofol Medical's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Isofol Medical's TSR, at 127% is higher than its share price return of 63%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Isofol Medical shareholders have gained 127% (in total) over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 15%. Given the track record of solid returns over varying time frames, it might be worth putting Isofol Medical on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Isofol Medical better, we need to consider many other factors. Even so, be aware that Isofol Medical is showing 4 warning signs in our investment analysis , and 2 of those make us uncomfortable...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading Isofol Medical or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Isofol Medical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:ISOFOL

Flawless balance sheet low.

Market Insights

Community Narratives