Further Upside For InDex Pharmaceuticals Holding AB (publ) (STO:INDEX) Shares Could Introduce Price Risks After 26% Bounce

Despite an already strong run, InDex Pharmaceuticals Holding AB (publ) (STO:INDEX) shares have been powering on, with a gain of 26% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.8% in the last twelve months.

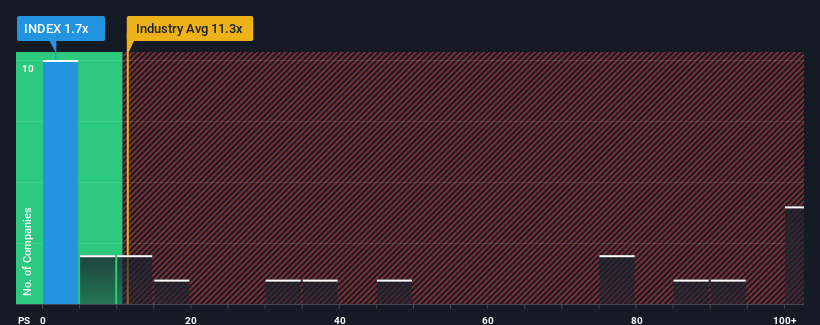

In spite of the firm bounce in price, InDex Pharmaceuticals Holding may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.7x, considering almost half of all companies in the Pharmaceuticals industry in Sweden have P/S ratios greater than 11.3x and even P/S higher than 84x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for InDex Pharmaceuticals Holding

What Does InDex Pharmaceuticals Holding's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, InDex Pharmaceuticals Holding has been doing very well. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for InDex Pharmaceuticals Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is InDex Pharmaceuticals Holding's Revenue Growth Trending?

In order to justify its P/S ratio, InDex Pharmaceuticals Holding would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 21% shows it's noticeably more attractive.

With this information, we find it odd that InDex Pharmaceuticals Holding is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Even after such a strong price move, InDex Pharmaceuticals Holding's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of InDex Pharmaceuticals Holding revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with InDex Pharmaceuticals Holding (including 1 which is significant).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:INDEX

InDex Pharmaceuticals Holding

Engages in the research and development of pharmaceuticals for immunological diseases.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives