- Sweden

- /

- Life Sciences

- /

- OM:GENO

If EPS Growth Is Important To You, Genovis AB (publ.) (STO:GENO) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Genovis AB (publ.) (STO:GENO). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Genovis AB (publ.) with the means to add long-term value to shareholders.

See our latest analysis for Genovis AB (publ.)

Genovis AB (publ.)'s Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that Genovis AB (publ.)'s EPS went from kr0.14 to kr0.56 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

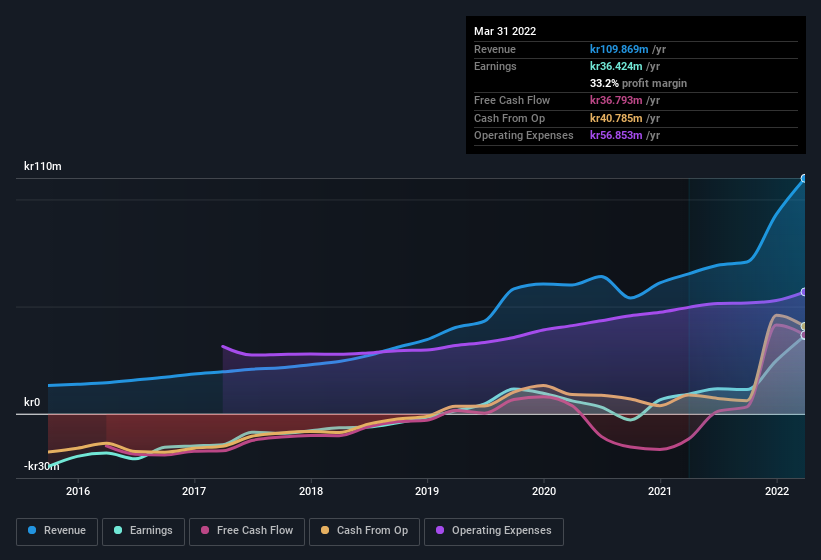

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Genovis AB (publ.) shareholders is that EBIT margins have grown from 13% to 29% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Genovis AB (publ.)?

Are Genovis AB (publ.) Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

A great takeaway for shareholders is that company insiders within Genovis AB (publ.) have collectively spent kr468k acquiring shares in the company. While this investment may be modest, it is great considering the lack of insider selling. We also note that it was the General Counsel, Susanne Ahlberg, who made the biggest single acquisition, paying kr320k for shares at about kr45.75 each.

Along with the insider buying, another encouraging sign for Genovis AB (publ.) is that insiders, as a group, have a considerable shareholding. Indeed, they hold kr499m worth of its stock. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 16% of the shares on issue for the business, an appreciable amount considering the market cap.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Fredrik Olsson, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Genovis AB (publ.) with market caps between kr1.1b and kr4.2b is about kr4.7m.

The Genovis AB (publ.) CEO received kr2.4m in compensation for the year ending December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Genovis AB (publ.) To Your Watchlist?

Genovis AB (publ.)'s earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Genovis AB (publ.) deserves timely attention. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Genovis AB (publ.) shapes up to industry peers, when it comes to ROE.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Genovis AB (publ.), you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GENO

Genovis AB (publ.)

Develops and sells tools for the development of new treatment methods and diagnostics for customers in the pharmaceutical and research industries.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives