We Think Biovica International (STO:BIOVIC B) Can Easily Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. Indeed, Biovica International (STO:BIOVIC B) stock is up 147% in the last year, providing strong gains for shareholders. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

In light of its strong share price run, we think now is a good time to investigate how risky Biovica International's cash burn is. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Biovica International

How Long Is Biovica International's Cash Runway?

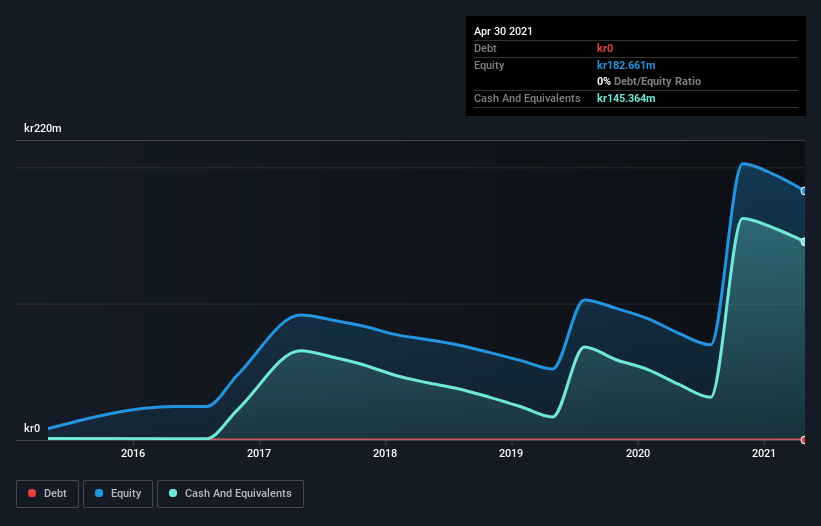

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In April 2021, Biovica International had kr145m in cash, and was debt-free. Looking at the last year, the company burnt through kr38m. Therefore, from April 2021 it had 3.8 years of cash runway. Notably, however, the one analyst we see covering the stock thinks that Biovica International will break even (at a free cash flow level) before then. If that happens, then the length of its cash runway, today, would become a moot point. Depicted below, you can see how its cash holdings have changed over time.

How Is Biovica International's Cash Burn Changing Over Time?

In our view, Biovica International doesn't yet produce significant amounts of operating revenue, since it reported just kr5.6m in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. With the cash burn rate up 19% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Biovica International To Raise More Cash For Growth?

Given its cash burn trajectory, Biovica International shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of kr1.7b, Biovica International's kr38m in cash burn equates to about 2.3% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is Biovica International's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Biovica International is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. One real positive is that at least one analyst is forecasting that the company will reach breakeven. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Biovica International (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you decide to trade Biovica International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Biovica International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BIOVIC B

Biovica International

A biotech company, develops and commercializes novel blood-based biomarker assays that enhance the monitoring and predicting of cancer therapies in the United States of America.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives