The Biovica International (STO:BIOVIC B) Share Price Has Soared 349%, Delighting Many Shareholders

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. But when you hold the right stock for the right time period, the rewards can be truly huge. One such superstar is Biovica International AB (publ) (STO:BIOVIC B), which saw its share price soar 349% in three years. Also pleasing for shareholders was the 34% gain in the last three months.

See our latest analysis for Biovica International

With just kr9,968,000 worth of revenue in twelve months, we don't think the market considers Biovica International to have proven its business plan. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Biovica International comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Biovica International has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

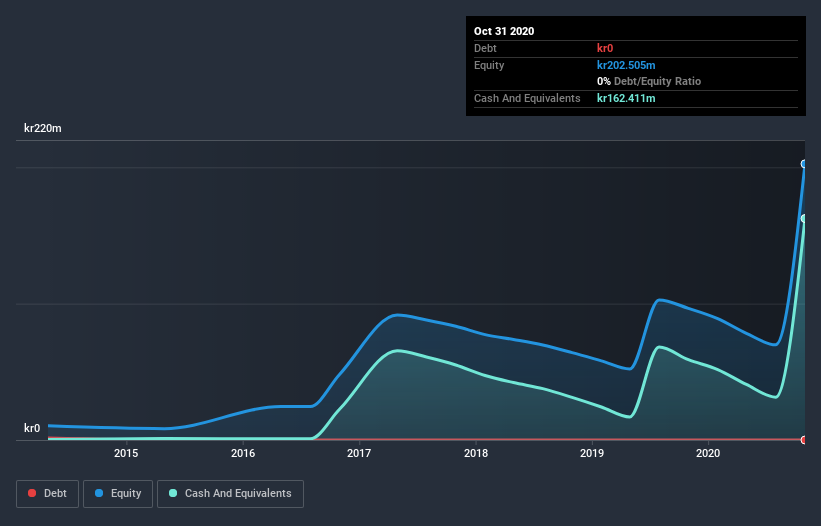

When it last reported its balance sheet in October 2020, Biovica International could boast a strong position, with cash in excess of all liabilities of kr153m. That allows management to focus on growing the business, and not worry too much about raising capital. And with the share price up 54% per year, over 3 years , the market is focussed on that blue sky potential. The image below shows how Biovica International's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. It's often positive if so, assuming the buying is sustained and meaningful. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

Pleasingly, Biovica International's total shareholder return last year was 337%. That's better than the annualized TSR of 65% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for Biovica International you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading Biovica International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Biovica International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Biovica International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BIOVIC B

Biovica International

A biotech company, develops and commercializes novel blood-based biomarker assays that enhance the monitoring and predicting of cancer therapies in the United States of America.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives