BioArctic Insiders Sell kr18m Of Stock, Possibly Signalling Caution

Over the past year, many BioArctic AB (publ) (STO:BIOA B) insiders sold a significant stake in the company which may have piqued investors' interest. When evaluating insider transactions, knowing whether insiders are buying versus if they selling is usually more beneficial, as the latter can be open to many interpretations. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for BioArctic

The Last 12 Months Of Insider Transactions At BioArctic

In the last twelve months, the biggest single sale by an insider was when the VP & Head of Research, Johanna Fälting, sold kr6.5m worth of shares at a price of kr295 per share. So what is clear is that an insider saw fit to sell at around the current price of kr277. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

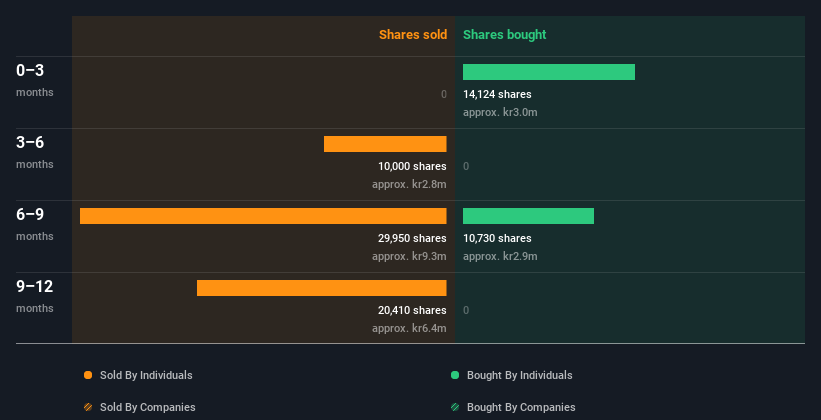

In the last twelve months insiders purchased 24.85k shares for kr6.3m. But insiders sold 60.36k shares worth kr18m. All up, insiders sold more shares in BioArctic than they bought, over the last year. The average sell price was around kr302. It's not particularly great to see insiders were selling shares at below recent prices. But we wouldn't put too much weight on the insider selling. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insiders At BioArctic Have Bought Stock Recently

Over the last quarter, BioArctic insiders have spent a meaningful amount on shares. In total, insiders bought kr3.1m worth of shares in that time, and we didn't record any sales whatsoever. This could be interpreted as suggesting a positive outlook.

Does BioArctic Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. BioArctic insiders own about kr14b worth of shares (which is 57% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The BioArctic Insider Transactions Indicate?

The recent insider purchases are heartening. On the other hand the transaction history, over the last year, isn't so positive. The high levels of insider ownership, and the recent buying by some insiders suggests they are well aligned and optimistic. Therefore, you should definitely take a look at this FREE report showing analyst forecasts for BioArctic.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if BioArctic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BIOA B

BioArctic

Develops biological drugs for patients with central nervous system disorders in Sweden.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026