We Think Abera Bioscience (NGM:ABERA) Can Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Abera Bioscience (NGM:ABERA) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Abera Bioscience

When Might Abera Bioscience Run Out Of Money?

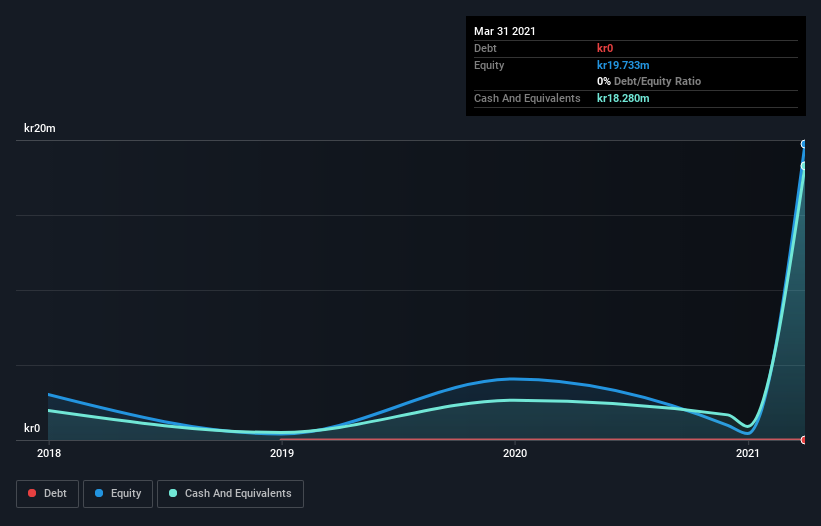

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Abera Bioscience last reported its balance sheet in March 2021, it had zero debt and cash worth kr18m. Looking at the last year, the company burnt through kr6.4m. Therefore, from March 2021 it had 2.9 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. You can see how its cash balance has changed over time in the image below.

How Is Abera Bioscience's Cash Burn Changing Over Time?

While Abera Bioscience did record statutory revenue of kr755k over the last year, it didn't have any revenue from operations. That means we consider it a pre-revenue business, and we will focus our growth analysis on cash burn, for now. The skyrocketing cash burn up 132% year on year certainly tests our nerves. That sort of spending growth rate can't continue for very long before it causes balance sheet weakness, generally speaking. Abera Bioscience makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Easily Can Abera Bioscience Raise Cash?

While Abera Bioscience does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Abera Bioscience has a market capitalisation of kr178m and burnt through kr6.4m last year, which is 3.6% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Abera Bioscience's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Abera Bioscience's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although we do find its increasing cash burn to be a bit of a negative, once we consider the other metrics mentioned in this article together, the overall picture is one we are comfortable with. Looking at all the measures in this article, together, we're not worried about its rate of cash burn, which seems to be under control. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for Abera Bioscience (2 can't be ignored!) that you should be aware of before investing here.

Of course Abera Bioscience may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Abera Bioscience, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:ABERA

Abera Bioscience

A platform and vaccine development company, research, design, and develops vaccines and immunotherapies based on its proprietary vaccine delivery platform in Sweden and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026