- Sweden

- /

- Entertainment

- /

- OM:PDX

Can Community Content Keep Paradox Interactive’s (OM:PDX) Recurring Revenue Strategy on Track?

Reviewed by Sasha Jovanovic

- Paradox Interactive recently launched new downloadable content for Cities: Skylines, including the Shops of Shibuya and Map Pack 4 Content Creator Packs, as well as a new radio station, Harumi Nights FM, now available on PC, PlayStation 4, Xbox One, and Xbox Series X|S.

- An interesting aspect of this release is the collaboration with community creators, which helps introduce authentic, culturally-inspired assets that continue to expand and energize the game's global player base.

- We’ll explore how the introduction of community-designed content for Cities: Skylines may reinforce Paradox Interactive’s long-term recurring revenue strategy.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

Paradox Interactive Investment Narrative Recap

To be a Paradox Interactive shareholder, you need confidence in the company's ability to sustain and grow its core franchises through regular expansions and community-driven content, a strategy that targets recurring high-margin revenue. The latest Cities: Skylines DLC release further supports this model, but the impact on near-term financial catalysts, such as the upcoming major franchise launches, is likely modest. However, the risk of market saturation and franchise fatigue remains top of mind for investors watching for growth inflection points.

Among recent announcements, the upcoming release of Vampire: The Masquerade – Bloodlines 2 in October is especially relevant, as it may serve as the company's key short-term earnings catalyst and a test of Paradox’s ability to expand beyond its established franchises.

In contrast, investors should also consider the potential impact of established franchise fatigue on future performance, especially as...

Read the full narrative on Paradox Interactive (it's free!)

Paradox Interactive's narrative projects SEK3.0 billion in revenue and SEK1.0 billion in earnings by 2028. This requires 13.0% yearly revenue growth and a SEK335.5 million earnings increase from SEK664.5 million today.

Uncover how Paradox Interactive's forecasts yield a SEK191.25 fair value, a 11% upside to its current price.

Exploring Other Perspectives

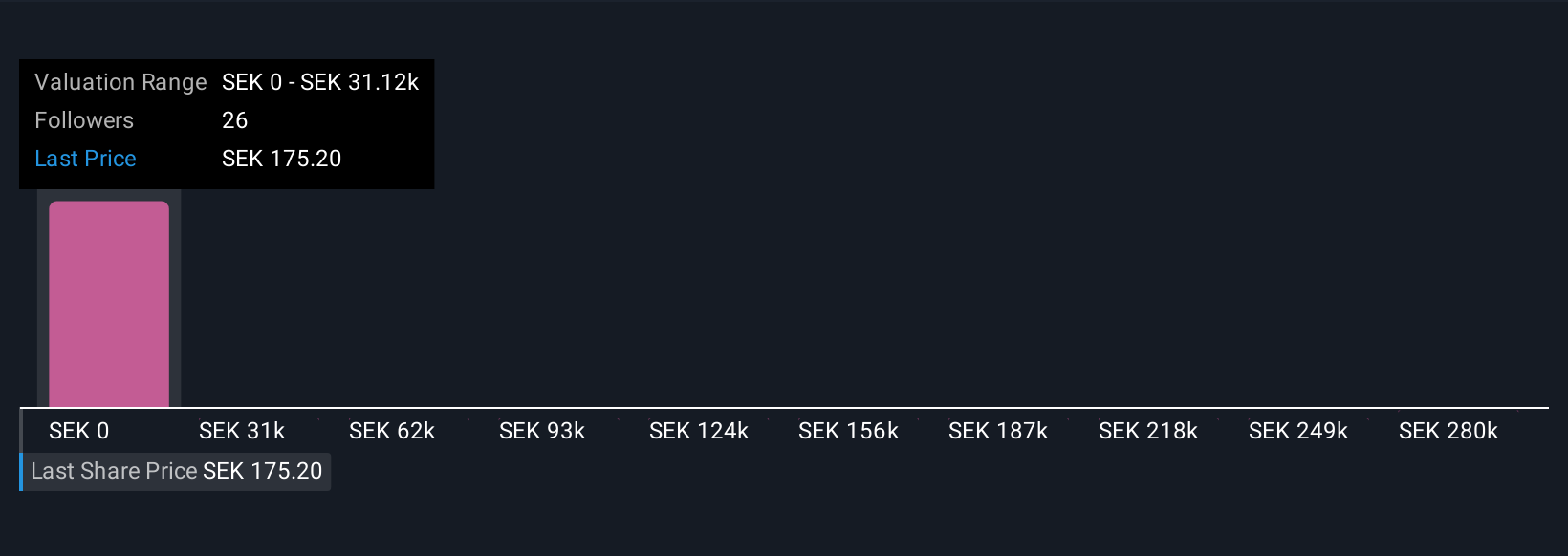

Seven Simply Wall St Community members value Paradox Interactive from SEK31,124 to SEK311,247 per share, revealing wide-ranging confidence and caution. As Paradox's fortunes are closely tied to its major release cycle, your view on franchise longevity may tilt your expectations.

Explore 7 other fair value estimates on Paradox Interactive - why the stock might be worth just SEK31125!

Build Your Own Paradox Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paradox Interactive research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Paradox Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paradox Interactive's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PDX

Paradox Interactive

Develops and publishes strategy and management games on PC and consoles in the United States, Rest of Europe, Sweden, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives