3 Swedish Stocks That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets respond to China's robust stimulus measures, European indices, including Sweden's, have shown positive momentum with hopes for interest rate cuts amid slowing business activity. In this context of shifting economic landscapes and monetary policies, identifying stocks that may be trading below their estimated value can offer intriguing opportunities for investors seeking potential growth in the Swedish market.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Concentric (OM:COIC) | SEK218.00 | SEK406.26 | 46.3% |

| Biotage (OM:BIOT) | SEK184.00 | SEK363.47 | 49.4% |

| Lindab International (OM:LIAB) | SEK278.20 | SEK528.19 | 47.3% |

| Nolato (OM:NOLA B) | SEK51.95 | SEK98.81 | 47.4% |

| Litium (OM:LITI) | SEK8.18 | SEK16.33 | 49.9% |

| Mentice (OM:MNTC) | SEK27.00 | SEK50.98 | 47% |

| Tourn International (OM:TOURN) | SEK8.66 | SEK16.48 | 47.5% |

| Nexam Chemical Holding (OM:NEXAM) | SEK4.00 | SEK7.92 | 49.5% |

| MilDef Group (OM:MILDEF) | SEK84.70 | SEK160.39 | 47.2% |

| Lyko Group (OM:LYKO A) | SEK116.60 | SEK217.34 | 46.4% |

Let's dive into some prime choices out of the screener.

Absolent Air Care Group (OM:ABSO)

Overview: Absolent Air Care Group AB (publ) designs, develops, sells, installs, and maintains air filtration units with a market cap of SEK3.75 billion.

Operations: The company generates revenue from its Industrial segment, which amounts to SEK1.14 billion, and its Commercial Kitchen segment, totaling SEK281.66 million.

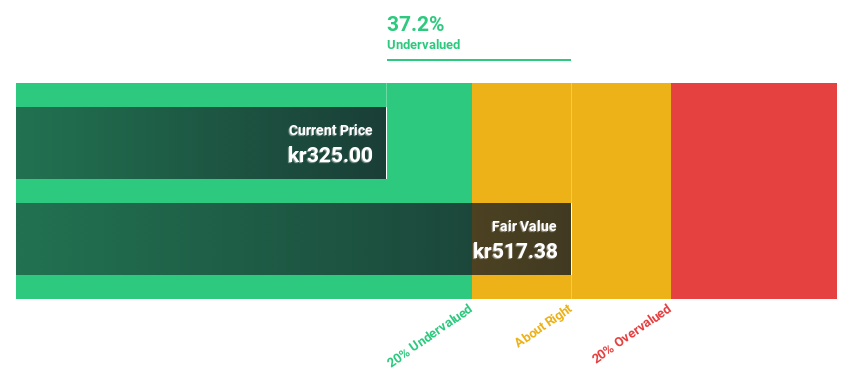

Estimated Discount To Fair Value: 36.1%

Absolent Air Care Group appears undervalued, trading at 36.1% below its estimated fair value of SEK 517.99, with a current price around SEK 331. Despite recent CEO changes and slight declines in quarterly net income, the company shows strong fundamentals with a forecasted return on equity of 20.4% and earnings growth at an annual rate of 18.84%, outpacing the Swedish market's growth rate of 15.2%.

- Insights from our recent growth report point to a promising forecast for Absolent Air Care Group's business outlook.

- Click here to discover the nuances of Absolent Air Care Group with our detailed financial health report.

Humble Group (OM:HUMBLE)

Overview: Humble Group AB (publ) refines, develops, and distributes fast-moving consumer products in Sweden and internationally, with a market cap of approximately SEK5.52 billion.

Operations: The company's revenue segments include Future Snacking at SEK950 million, Sustainable Care at SEK2.30 billion, Quality Nutrition at SEK1.53 billion, and Nordic Distribution at SEK2.67 billion.

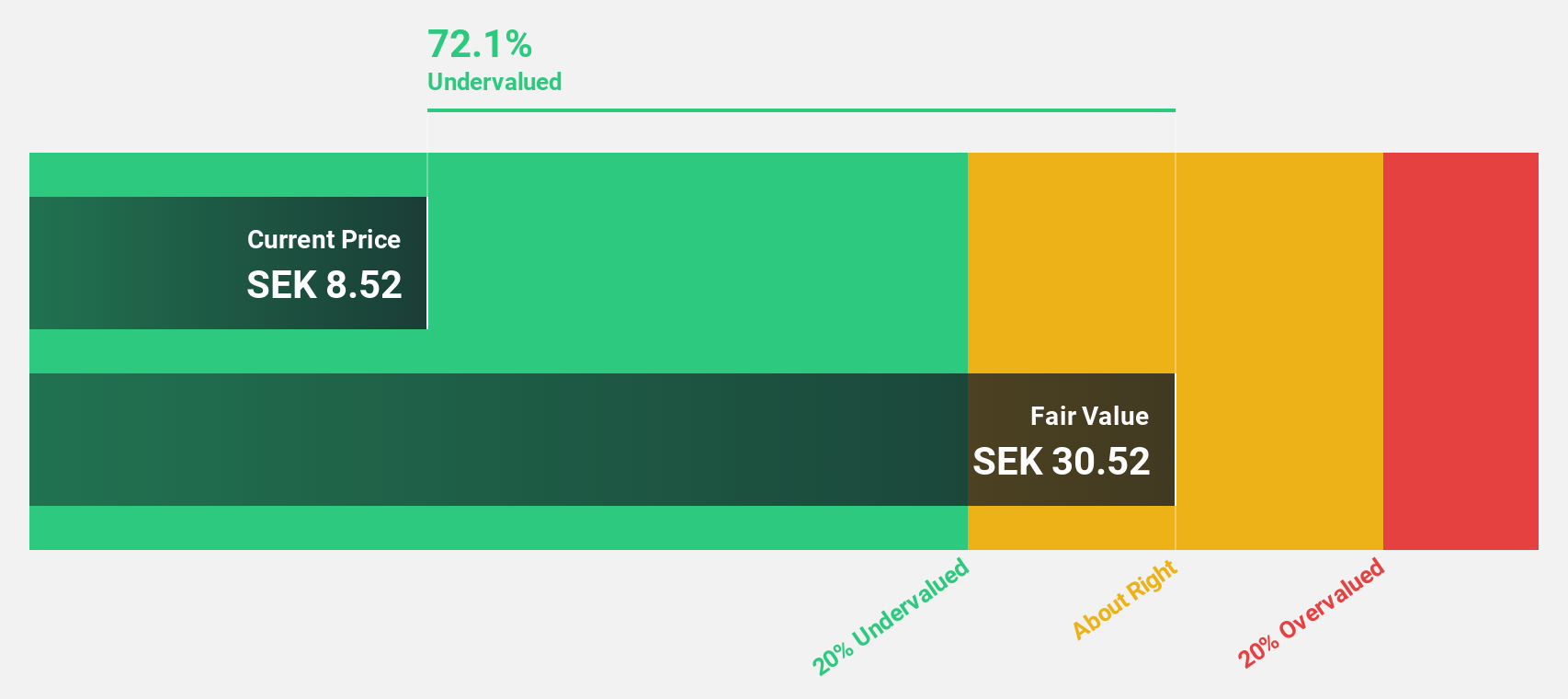

Estimated Discount To Fair Value: 38.1%

Humble Group is trading at SEK 12.35, significantly below its estimated fair value of SEK 19.95, indicating it may be undervalued based on cash flows. Recent earnings show a positive turnaround with net income of SEK 55 million for the first half of 2024 compared to a loss last year. The company's revenue growth forecast outpaces the Swedish market, although return on equity remains modest at a projected 8.7%.

- According our earnings growth report, there's an indication that Humble Group might be ready to expand.

- Get an in-depth perspective on Humble Group's balance sheet by reading our health report here.

Paradox Interactive (OM:PDX)

Overview: Paradox Interactive AB (publ) develops and publishes strategy and management games for PC and consoles across various global regions, with a market cap of SEK19.36 billion.

Operations: The company's revenue segment includes Computer Graphics, generating SEK2.48 billion.

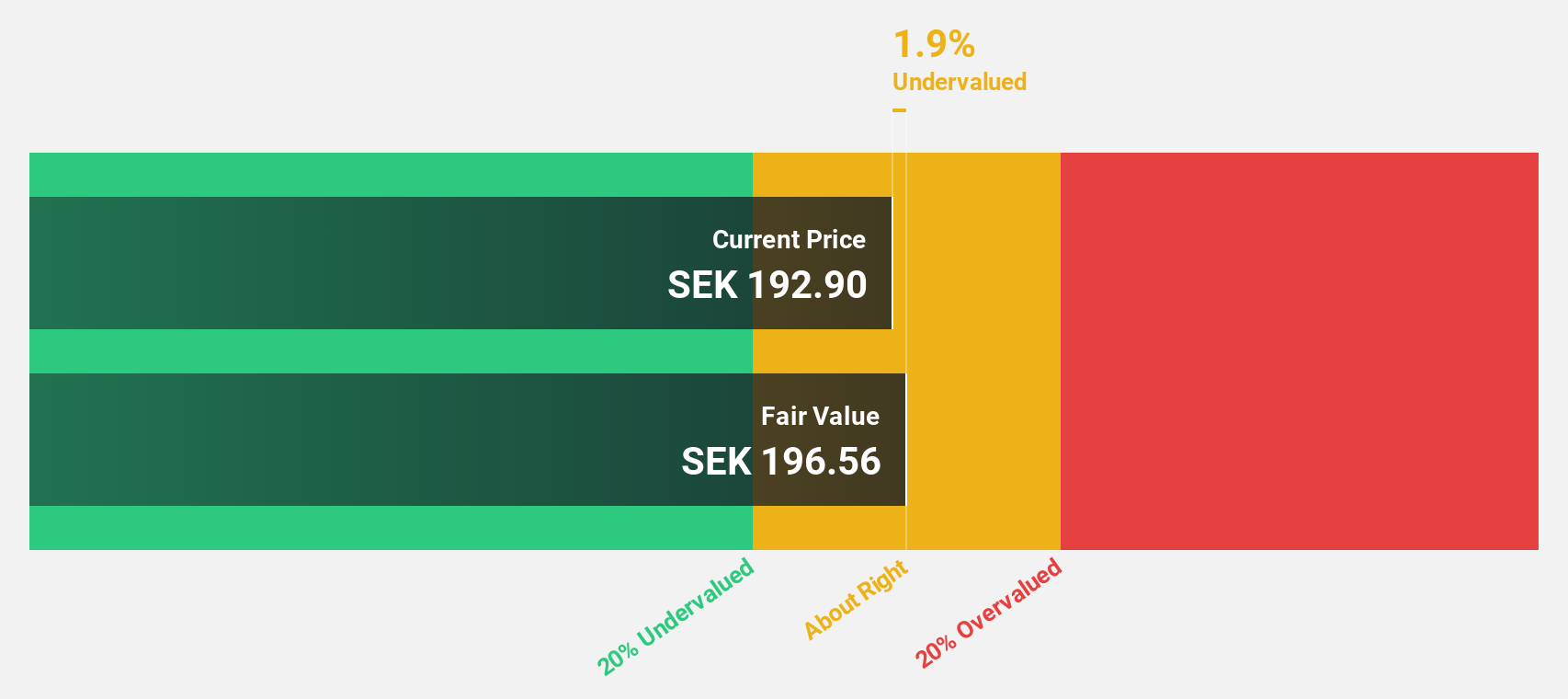

Estimated Discount To Fair Value: 29.9%

Paradox Interactive is trading at SEK 183.3, below its estimated fair value of SEK 261.57, suggesting undervaluation based on cash flows. Despite recent declines in profit margins and net income, earnings are expected to grow significantly over the next three years, outpacing the Swedish market average. The company has announced several new product expansions which could enhance future revenue streams, although current dividend coverage remains weak with a payout of 1.64%.

- The analysis detailed in our Paradox Interactive growth report hints at robust future financial performance.

- Take a closer look at Paradox Interactive's balance sheet health here in our report.

Seize The Opportunity

- Delve into our full catalog of 46 Undervalued Swedish Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ABSO

Absolent Air Care Group

Designs, develops, sells, installs, and maintains air filtration units.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives