- Sweden

- /

- Entertainment

- /

- OM:NITRO

Positive Sentiment Still Eludes Nitro Games Oyj (STO:NITRO) Following 36% Share Price Slump

The Nitro Games Oyj (STO:NITRO) share price has fared very poorly over the last month, falling by a substantial 36%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

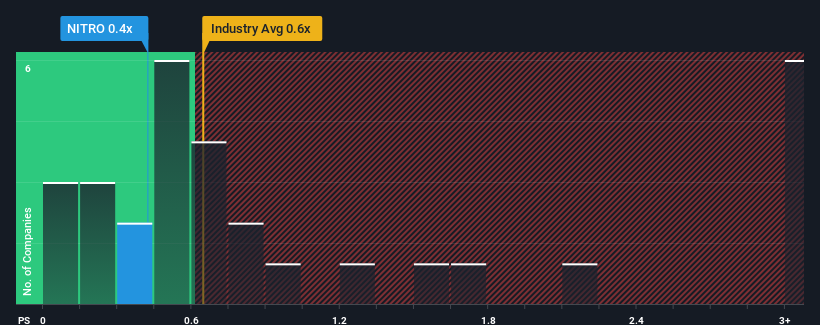

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Nitro Games Oyj's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in Sweden is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Nitro Games Oyj

What Does Nitro Games Oyj's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Nitro Games Oyj has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Nitro Games Oyj's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Nitro Games Oyj would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 6.1% as estimated by the sole analyst watching the company. Meanwhile, the broader industry is forecast to contract by 0.3%, which would indicate the company is doing very well.

In light of this, it's peculiar that Nitro Games Oyj's P/S sits in-line with the majority of other companies. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

Following Nitro Games Oyj's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We note that even though Nitro Games Oyj trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Nitro Games Oyj that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nitro Games Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NITRO

Nitro Games Oyj

Develops and publishes games for mobiles in the European Union, North America, the United Kingdom, and internationally.

Adequate balance sheet and fair value.