How Karnov Group's AI Legal Platform Launch (OM:KAR) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On September 26, 2025, Karnov Group AB (publ) announced the launch of an AI-based legal solution for municipalities in Denmark and Sweden, aimed at making caseworkers more efficient by integrating local regulations and proprietary content into their workflow.

- This cross-border collaboration with Norstedts Juridik leverages a shared AI platform for scalability and combines it with local expertise, marking a step forward in digital innovation for public sector legal services.

- We’ll explore how the rollout of AI-powered legal tools for municipalities could influence Karnov Group’s long-term growth outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Karnov Group Investment Narrative Recap

To be a Karnov Group shareholder, you need to believe in the growing digitization of legal services and the company’s ability to translate AI innovation into sustainable, high-margin recurring revenue. The rollout of the new AI-based solution for municipalities in Denmark and Sweden touches on this catalyst, but by itself it doesn’t materially resolve the immediate challenges in Region South or meaningfully reduce the concentration risk around AI adoption in existing core markets.

The most relevant recent announcement to this AI rollout was the launch of the generative AI legal assistant, K+ Smart Chat, trialed in Spain. This earlier product signals Karnov’s effort to expand premium AI features to underpenetrated regions, a core catalyst, yet structural slowdowns in organic growth and offline revenue in Region South remain hurdles.

Still, if legal sector adoption of AI stalls or pricing power comes under pressure, investors should be aware that…

Read the full narrative on Karnov Group (it's free!)

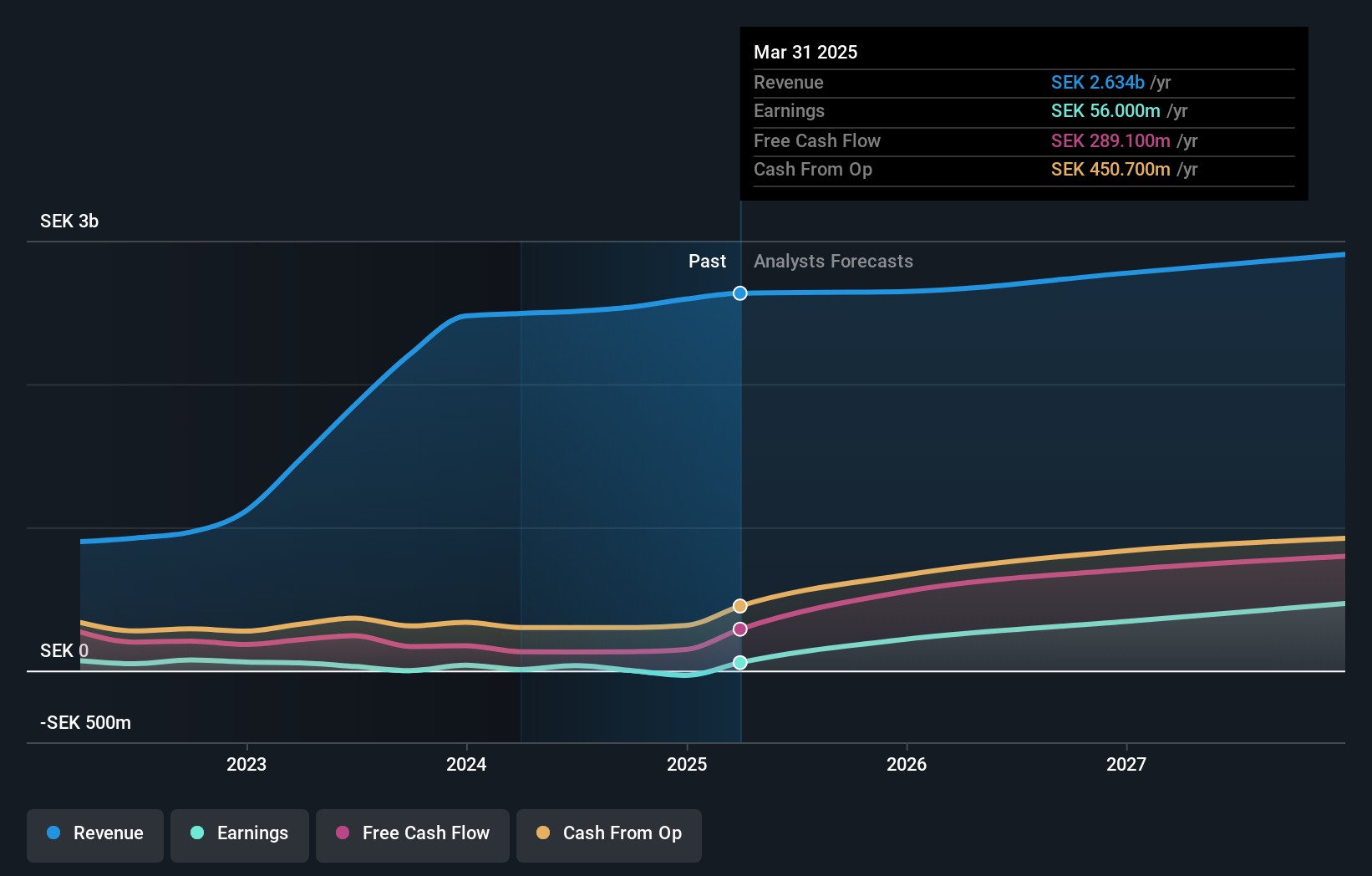

Karnov Group's narrative projects SEK 3.0 billion revenue and SEK 638.9 million earnings by 2028. This requires 3.6% yearly revenue growth and an earnings increase of SEK 575.7 million from current earnings of SEK 63.2 million.

Uncover how Karnov Group's forecasts yield a SEK123.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have estimated Karnov’s fair value between SEK123.67 and SEK147.99, reflecting two unique viewpoints. With AI-driven offerings expanding but revenue growth lagging some peers, explore how various expectations could shape your outlook on KAR’s future.

Explore 2 other fair value estimates on Karnov Group - why the stock might be worth as much as 33% more than the current price!

Build Your Own Karnov Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Karnov Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Karnov Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Karnov Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karnov Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KAR

Karnov Group

Provides online and offline information products and services for professionals in the areas of legal, tax and accounting, environmental, and health and safety in Denmark, Norway, France, Sweden, Portugal, and Spain.

Proven track record and fair value.

Market Insights

Community Narratives