- France

- /

- Consumer Durables

- /

- ENXTPA:ALMLB

European Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index continues its upward trajectory, marking its longest streak of weekly gains since August 2012, investors are cautiously optimistic despite mixed economic signals from major economies like Germany and France. For those willing to explore beyond the established market leaders, penny stocks—often representing smaller or newer companies—remain a relevant investment area. While historically seen as speculative, these stocks can offer unique growth opportunities when backed by strong financials and resilience against broader market uncertainties.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.92 | SEK293.94M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.29 | SEK221.95M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.135 | €295.47M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.84 | SEK233.62M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.978 | €32.75M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.69 | €52.84M | ★★★★★★ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.43 | €24.77M | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.065 | SEK1.98B | ★★★★☆☆ |

| Arcure (ENXTPA:ALCUR) | €4.81 | €27.81M | ★★★★☆☆ |

| IMS (WSE:IMS) | PLN3.65 | PLN123.71M | ★★★★☆☆ |

Click here to see the full list of 432 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ForFarmers N.V. operates as a provider of feed solutions for both conventional and organic livestock farming across several countries including the Netherlands, the UK, Germany, Poland, and Belgium, with a market cap of €376.89 million.

Operations: The company generates revenue of €2.75 billion from its food processing segment.

Market Cap: €376.89M

ForFarmers N.V. has recently turned profitable, reporting a net income of €31.4 million for 2024 compared to a loss the previous year. Despite an 8.5% annual decline in earnings over five years, its financial health is supported by short-term assets exceeding liabilities and satisfactory debt coverage with operating cash flow at 65.3%. The stock trades significantly below its estimated fair value, offering potential upside if market conditions improve. However, challenges include an unstable dividend track record and a relatively inexperienced management team with an average tenure of 1.5 years, which may impact strategic execution moving forward.

- Click to explore a detailed breakdown of our findings in ForFarmers' financial health report.

- Review our growth performance report to gain insights into ForFarmers' future.

Miliboo Société anonyme (ENXTPA:ALMLB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Miliboo Société anonyme designs and sells modular and customizable furniture in Paris and internationally, with a market cap of €10.04 million.

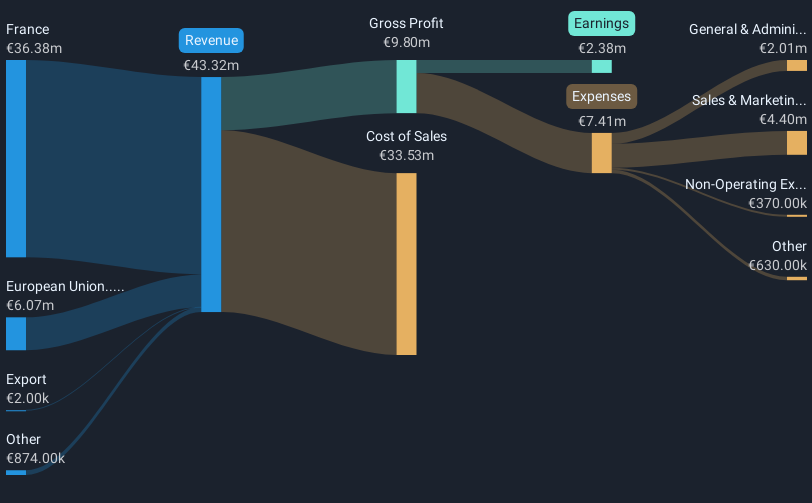

Operations: The company generates revenue primarily through online retailers, amounting to €43.32 million.

Market Cap: €10.04M

Miliboo Société anonyme has transitioned to profitability, with a market cap of €10.04 million and revenue of €43.32 million primarily from online sales. The company’s financial position is robust, with short-term assets of €14.7 million exceeding both its short-term (€8.3M) and long-term liabilities (€3.6M). It maintains more cash than total debt, and its debt-to-equity ratio has significantly improved over five years to 60.4%. Despite high non-cash earnings impacting quality perceptions, the stock's low price-to-earnings ratio (4.2x) suggests potential value compared to the broader French market average (15x).

- Dive into the specifics of Miliboo Société anonyme here with our thorough balance sheet health report.

- Examine Miliboo Société anonyme's earnings growth report to understand how analysts expect it to perform.

Bambuser (OM:BUSER)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bambuser AB (publ) operates a cloud-based video commerce platform in Sweden and internationally, with a market cap of SEK145.75 million.

Operations: The company generates SEK103.02 million in revenue from its Internet Telephone segment.

Market Cap: SEK145.75M

Bambuser AB (publ) recently reported a fourth-quarter sales decline to SEK 23.99 million from SEK 44.13 million the previous year, though its net loss narrowed significantly. The company is debt-free with a stable cash runway exceeding one year, supported by experienced management and board teams. Despite high share price volatility and ongoing unprofitability, Bambuser's strategic expansion into China with Zara highlights its potential in video commerce innovation. Short-term assets of SEK 206.8 million comfortably cover liabilities, yet earnings growth remains elusive as losses have increased over five years at a rate of 24.6% annually.

- Get an in-depth perspective on Bambuser's performance by reading our balance sheet health report here.

- Understand Bambuser's track record by examining our performance history report.

Next Steps

- Discover the full array of 432 European Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALMLB

Miliboo Société anonyme

Engages in the design and sale of modular and customizable furniture in Paris and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives