- Sweden

- /

- Metals and Mining

- /

- OM:SSAB A

SSAB (OM:SSAB A) Margin Decline Challenges Bullish Narrative Despite Strong Earnings Growth Forecast

Reviewed by Simply Wall St

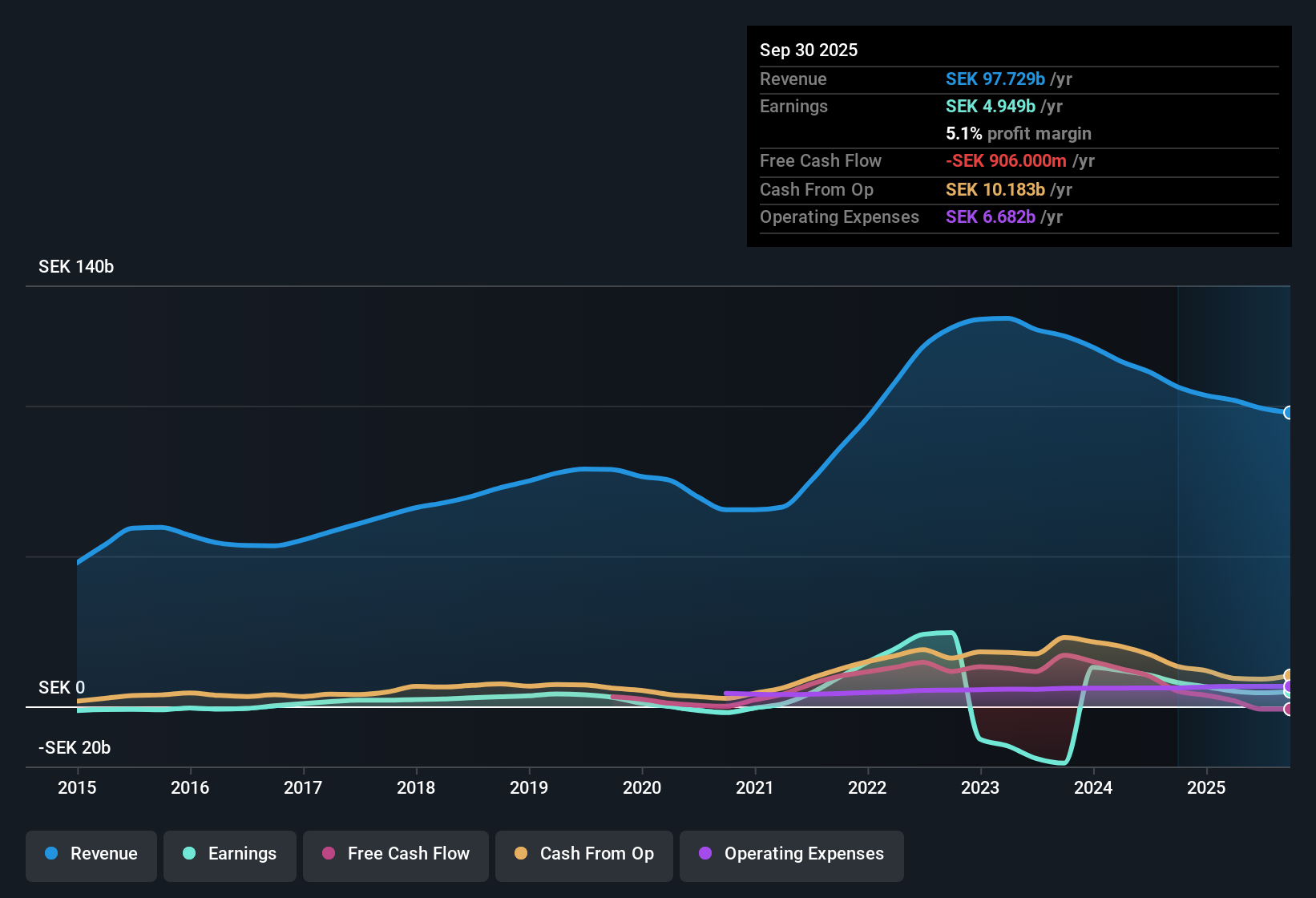

SSAB A (OM:SSAB A) is expected to deliver impressive annual earnings growth of 23.5%, significantly outpacing the broader Swedish market rate of 12.5%. Although net profit margins have contracted from 9.3% last year to 4.5% and earnings growth turned negative over the past year, forecasts for the next three years remain strong, with earnings anticipated to grow above 20% annually. The stock trades at a 13.5x Price-To-Earnings ratio, making it look attractively valued compared to both the European Metals and Mining industry average of 15.6x and its peer group average of 18.9x. Revenue forecasts, however, lag the market at 2.5% annual growth versus the Swedish average of 3.3%, while recent margin trends may temper some investor optimism.

See our full analysis for SSAB.The next section digs into how these earnings results compare with the current market narratives. Some expectations will stand strong, while others could see a reality check.

See what the community is saying about SSAB

Profit Margins Rebound Projected by 2028

- Analyst estimates call for net profit margins to expand from 4.5% now to 6.7% in three years, reversing the decline from 9.3% seen last year.

- According to the analysts' consensus view, the push into fossil-free and specialty steels is expected to drive premium pricing and demand over the next decade.

- Industry decarbonization policies, as well as operational cost reductions and digitalization, are seen as supporting margin expansion and earnings quality for SSAB even as recent margins dipped below prior levels.

- However, persistent overcapacity and project delays in transforming European operations could delay some benefits. The Luleå transformation project notably faces a one-year postponement.

- Consensus narrative gives extra weight to high-margin segment growth and regulatory tailwinds, anticipating that improving margins will buffer earnings volatility for SSAB over the coming years.

- What stands out: The 2.2 percentage-point margin jump expected by 2028 is set against a backdrop of depressed current levels, and hinges on both industry-wide policy momentum and successful execution of cost and product mix initiatives.

- The projected margin recovery is a key test of SSAB's investment case versus the cyclical pressures weighing on European steelmakers.

- See how these dynamics and more shape the full market consensus for SSAB A in the narrative below. 📊 Read the full SSAB Consensus Narrative.

Premium Steel Pivot Reduces Earnings Swings

- Earnings volatility is expected to drop as SSAB grows its portfolio of high-margin, specialty steels like Armox and Hardox. This contrasts with the -1.3% average annual earnings growth over the last five years.

- Analysts' consensus narrative highlights that entering sectors such as mining, energy, defense, and renewables will not only diversify revenue streams but also make SSAB's profitability less dependent on the economic cycle.

- Expanding into these niche, value-added steel products is projected to help insulate margins from the traditional ups and downs of the commodity steel market.

- Diesel costs, geopolitical uncertainty, and slow construction or automotive demand still pose risk, but structural shifts in SSAB’s product mix should dampen the income swings that have dominated recent years.

Valuation: Attractive Discount Versus Industry

- At a current Price-To-Earnings ratio of 13.5x, SSAB trades at a notable discount to European Metals and Mining peers (15.6x) and its direct peer group (18.9x). It is just under the GB sector average (12.6x).

- The consensus view from analysts is that, at a share price of 61.10, SSAB is still below the official price target of 69.38, blending future profit margin improvements and positive demand trends into a forecasted upside.

- For this valuation to hold, investors need to assume net profit margins will rise to 6.7% and revenue will reach SEK105.7 billion by 2028, with steady share counts and progress on the Luleå project.

- Despite the risks from cyclical demand and high fixed costs, SSAB's ongoing transformation and strategic focus on green steel are modeled to drive superior value relative to wage and input cost pressures elsewhere in Europe.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SSAB on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something new in the figures? Share your unique take and craft your personal narrative in just a few minutes: Do it your way

A great starting point for your SSAB research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While SSAB A is forecast to rebound, recent years have seen shrinking margins and volatile earnings resulting from both cyclical and structural pressures on the steel sector.

If you want companies with steadier revenue and profit trends, check out stable growth stocks screener (2094 results) where stable growth leaders consistently outperform through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SSAB A

SSAB

Engages in the production and sale of steel products in Sweden, Finland, the Rest of Europe, the United States, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion